Inverse VIX ETNs Free Money

Post on: 14 Июнь, 2015 No Comment

As the ETF industry has expanded in recent years ongoing innovation has given investors more precise tools for accessing various corners of the stock and bond markets, as well as securities that deliver exposure to previously hard-to-reach asset classes and investment strategies. Many of the exchange-traded products to debut over the last several years utilize futures contracts and derivatives to achieve their objectives, introducing additional complexity and risk factors. When used correctly, these products can be powerful tools to hedge exposure, speculate on short term price swings, or implement advanced strategies. But they also introduce the potential to get burned when used incorrectly.

The volatility ETP space has exploded over the last year or so, as investors have embraced the exchange-traded structure as an efficient way to access an asset class that has the potential to deliver valuable diversification benefits but that can be hard to access and maintain for many investors. Because the VIX (and other volatility indexes, such as the one linked to CVOL ) tend to spike when equity markets are falling the correlation between the VIX and stocks is generally close to -1.0, giving the products in the Volatility ETFdb Category appeal for investors looking to smooth overall volatility or install a partial equity market hedge.

But the various VIX ETPs are similar to many commodity products in that they dont offer exposure to the spot VIX, but rather achieve exposure to this asset through futures contracts. Because the market for VIX futures is generally in steep contangoespecially in the short-term, the impact of contango on returns can be significant when positions are held open for multiple trading sessions. Since debuting in early 2009, the iPath Short-Term VIX Futures ETN (VXX ) has lost more than 90% of its valuea considerably bigger drop than the 60% decline in the spot VIX over the same period.

Volatility ETPs can perhaps be best thought of insurance policies; when equity markets encounter turmoil, they can be expected to perform well and will be one of the best ways to cushion the blow felt by many portfolios. But in return for the unparalleled protection during crises, investors pay a hefty premium in the form of a steep roll yield to maintain exposure to futures contracts.

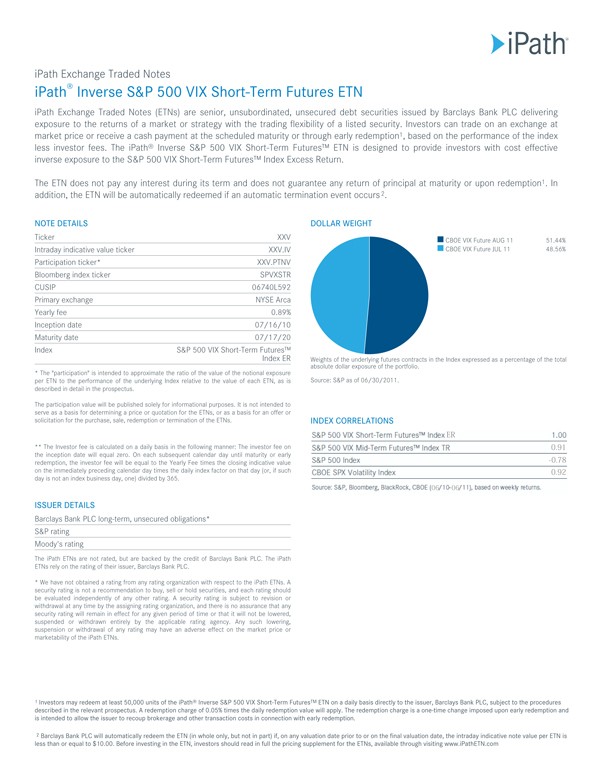

Recent innovation in the ETF space has produced products that essentially allow investors to play the role of the insurance company, essentially exploiting the steepness at the short end of the VIX futures curve. The VelocityShares Daily Inverse VIX Short-Term ETN (XIV ), for example, will deliver returns equal to the inverse of the S&P 500 VIX Short-Term Futures Index, a benchmark that offers exposure to a daily rolling long position in the first and second month VIX futures contracts and reflects the implied volatility of the S&P 500 Index .

An inverse VIX ETN may seem like an odd concept; because the VIX and equity markets generally move in opposite directions, a bet that volatility will drop might seem like another way of betting that equity markets will risein which case establishing exposure to stocks might seem like a more logical play. But because XIV seeks to deliver results that correspond to the inverse of a futures-based index, it has the potential to perform well in markets where stocks and the VIX are flat. Thats because the steep contango in VIX futures markets that creates headwinds for investors in a long volatility fund like VXX generates tailwinds at the back of those invested in XIV.

A look at January performances shows some pretty interesting returns. The spot VIX rose by about 10% last month, but VXX was down by about 15% on the monthillustrating just how significant the impact of contango can be on a futures-based fund. But the more intriguing performance is that of XIV; the inverse VIX ETN was up 15% during a month when the spot VIX increased 10%.

That jump came after XIV surged by about 25% in December, a month that saw both the spot VIX and VXX tumble as global equity markets staged a year-end rally. During the two month stretch, XIV climbed a whopping 51%; the VIX and VXX dropped by 27% and 38%, respectively, during the same period. And XIVs impressive gains blew out SPY. which added a relatively meager 11%:

XIVs track record is obviously limited, but the ETNs ability to generate gains in periods of both rising and falling volatility should be intriguing to various types of investors.

XIV does, of course, come with some risks. Because the exposure to the underlying index resets on a daily basis, oscillating marketswhere gains are followed by losses and vice versacan potentially result in return erosion (similar to the manner in which leveraged ETFs functioned during 2008). And while XIV managed to gain ground when the VIX jumped in January, it likely wouldnt move higher if volatility markets staged a repeat of 2008. The VIX closed at an all time high of 80.86 in November 2008, jumping by nearly 300% over a three month stretch.

Many investors have expressed frustration over the nuances of futures-based products, lamenting the return lag that such a strategy often produces. But XIV gives investors to jump over to the other side of the table and exploit the upward sloping futures curve. The ETF boom has made various alternatives more accessible than ever, and XIV is one alternative ETF that is worth a closer look.

Disclosure: No positions at time of writing.