Introduction to Stock Valuation The PriceEarnings Ratio

Post on: 19 Июль, 2015 No Comment

by Joe Lan, CFA

Value investing is one of the most popular forms of long-term investing, trumpeted by such famous investors as Benjamin Graham and Warren Buffett (not to mention countless others).

The premise of value investing is to find stocks that are trading at a discount to their intrinsic value, which, admittedly, is far more difficult than it sounds. Valuation ratios are intended to help investors with this task, providing a metric to gauge the valuation of a company compared to an underlying fundamental data element. In this article, we examine the price-earnings (P/E) ratio, which is the most commonly used measure of valuation.

Throughout the course of our Financial Statement Analysis series, we looked closely at financial statements and ratios to gauge the financial strength of companies. However, no matter how financially strong or fast-growing a firm is, if the stock is not a good value, investors should think twice before purchasing shares. The price-earnings ratio helps investors assess the valuation of a firm. The ratio is calculated by dividing a companys current stock price by its current earnings per share. It represents the number of times earnings the stock is trading at. Put another way, it shows how much investors are paying for each dollar of earnings per share. The formula is presented as:

Price-earnings ratio = current stock price current earnings per share

Analyzing the Price-Earnings Ratio

Though the price-earnings ratio is very simple to calculate, analyzing the figure is a completely different story. The price-earnings ratio is driven by both changes in share price and earnings per share. Every quarter when companies report earnings, a large change in earnings per share can increase or decrease the price-earnings ratio. The more powerful driver, however, is a change in investor expectations and perception of the firm, which is represented in its share price.

There are several variations on the price-earnings ratio, each with its own strengths and weaknesses. The two most common are trailing 12-month price-earnings ratio and forward price-earnings ratio: The first is calculated by dividing the current price by the earnings per share for the trailing 12 months (TTM P/E), the second by dividing the current price by the estimated earnings per share for the coming current fiscal year (forward P/E).

A high or low absolute price-earnings ratio does not necessarily mean that the stock is pricey or a bargain. A low price-earnings ratio generally means that most investors perceive the company to be facing an uncertain future. They are only willing to pay a small amount for a given level of earnings. On the other hand, companies trading with relatively high price-earnings ratios generally signify that investors believe the company has strong future earnings growth potential. Investors are willing to pay a larger amount per dollar of earnings, believing that profits will grow fast enough to continuing pushing share prices higher. The goal of a value investor should not necessarily be to search for companies with the lowest price-earnings ratios, but rather to search for companies that are improperly valued (in contrast to growth investors, who rely heavily on growth rates and earnings momentum). A simple screen for companies with the lowest price-earnings ratios may lead to a bevy of companies with little or no growth prospects, while companies trading at price-earnings ratios above their industry medians may not necessarily be poor values. The concept can be examined by looking at a few detailed examples.

Table 1 shows the price-earnings ratio for all the stocks in the Dow Jones industrial average (DJIA). using data from AAIIs stock screening and fundamental database, Stock Investor Pro, as of August 9, 2013. Stocks are sorted by their trailing 12-month price-earnings ratios in ascending order (lowest to highest). One of the weaknesses of the price-earnings ratio is that it cannot be used if a company has negative earnings, which can be seen in the case of Hewlett-Packard Co. (HPQ). Since the Dow components are larger and more-established companies, they typically, but not always, are profitable. However, earnings for smaller or fast-growing companies can be negative for several consecutive quarters.

For stocks that do have positive earnings, price-earnings ratios vary drastically. For example, the trailing 12-month price-earnings ratios for Dow components range from a low of 9.1 for JPMorgan Chase & Co. (JPM) to a high of 91.3 for Verizon Communications Inc. (VZ), though the vast majority are below 30.

Stocks with abnormally high or low price-earnings ratios, such as Alcoa Inc. (AA) and Verizon, are worth examining closer to determine if there is a reason they are trading at extreme valuations. Alcoas high price-earnings ratio can be attributed to its low earnings figure of $0.10 per share for the trailing 12-month period, which was caused by the company reporting negative earnings during two of its past four quarters. The companys earnings releases show that during the second quarter of 2013 and the third quarter of 2012, Alcoa took charges for environmental remediation, legal settlements and restructuring. Verizon Communications earnings were also affected by non-operational items. The company reported non-cash expenses related to pension charges, for the early retirement of debt and for other restructuring activities. These charges led to a loss of $1.48 per share in the fourth quarter of 2012, which in turn reduced total trailing 12-month earnings.

However, investors seem to be looking past the current 12-month earnings period for both companies, as their forward price-earnings ratios are much more in line with other Dow components. Alcoas price-earnings ratio using the current fiscal-year (2013) estimate is 26.8 and using the 2014 estimate, the price-earnings ratio is 15.6. Verizons price-earnings ratio using expected earnings for 2013 is 17.6 and its price-earnings ratio using expected earnings for 2014 is 15.4.

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days

The forward price-earnings ratio is impacted by share price and earnings forecasts, which are provided by analysts that track the firm. When actual earnings, which are released when a company announces earnings, differ from the consensus earnings estimate, the share price is often affected, moving up or down depending on whether the difference was positive or negative.

It is also important to keep in mind that many data sources adjust earnings. Adjusted earnings generally exclude income or expenses that are non-recurring, meaning they are not typical of normal income and expenses and are unlikely to occur period after period. Different data sources and even different analysts may adjust earnings differently, so it is prudent to note how earnings are being adjusted so that you can avoid making decisions based on faulty or inconsistent information.

Making Sense of the Price-Earnings Ratio

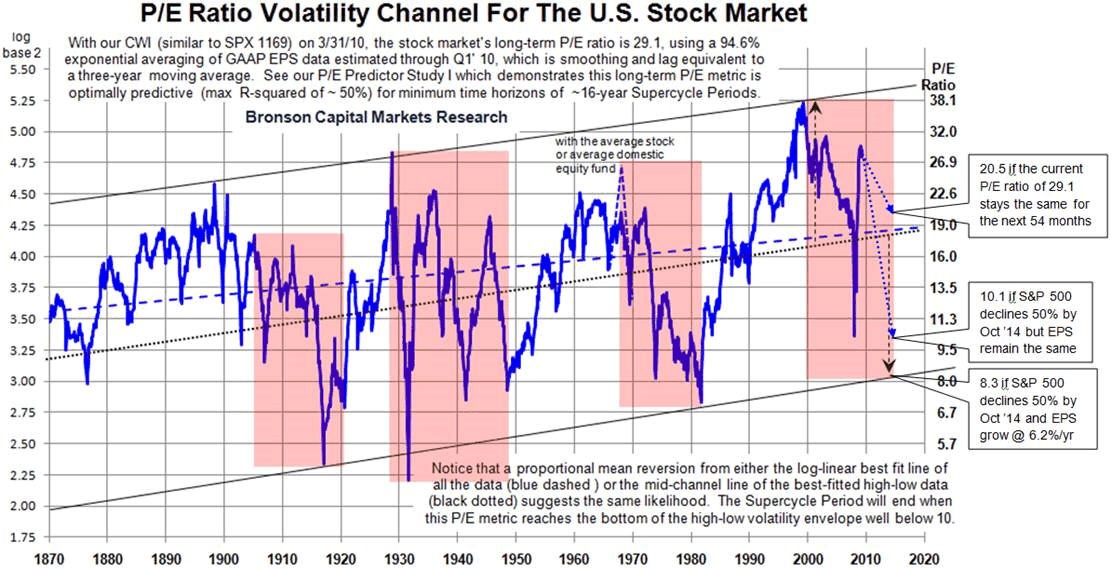

As I stated earlier, simply looking at the price-earnings ratio as an absolute figure makes it difficult to ascertain whether a stock is overvalued or undervalued. Stocks with strong growth prospects tend to trade at higher valuations than stocks with weaker growth prospects. One way to determine if a stock is fairly valued, overvalued or undervalued is to compare the current price-earnings ratio to historical norms.