Introduction to Range Trading

Post on: 11 Июнь, 2015 No Comment

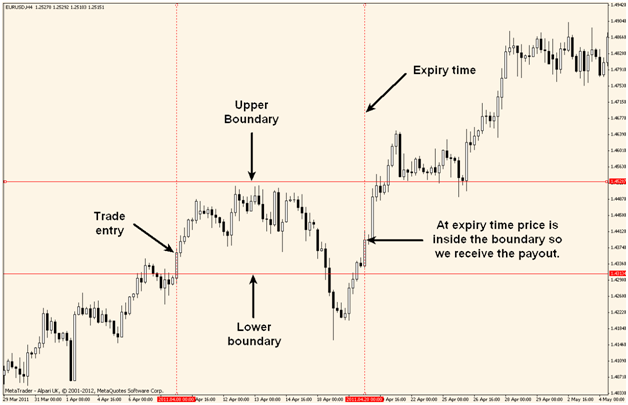

Defining Trading Ranges

A range occurs when the price has bounced off the same support area at least twice, and the same resistance area at least twice. This will create two high points and two low points. The two highs or two lows dont need to stop and reverse at the exact same levelthat is rarebut they should be relatively close to one another. Many traders look for the price to reach resistance and support at least three times before calling it a range.

The two low points are connected by a horizontal line, and same with the highs. This visually defines the range. The more time the price reaches the high and low points, the stronger the range is, and usually the stronger the eventual breakout.

View support and resistance as areas or zones, not a single price. As mentioned, all the highs (or lows) are unlikely to be at the exact same price, so the difference between the highs creates a resistance zone. The same goes for the lows points, creating a support zone .

Charts courtesy of StockCharts.com.

Figure 1. Trading Range on PLAB Daily Chart

This is typical of most ranges some price swings dont reach the prior highs or lows, while other swing will overshoot. When the price breaks well beyond the established range, only to move back into the range, thats called a false breakout.

The range traders goal is to enter short positions near the resistance zone, and enter long positions near the support zone. They are anticipating the range will continue and produce a profit, but also need to guard against false breakouts and actual breakouts.

Trading ranges are also called and channels and rectangles. The term channel should not be confused with trend channel which is when the price is moving between support and resistance (lines) but at an upward or downward angle.

Range Trading Indicators

Traders use indicators to time their entries into range trades. The most commonly used range trading indicators are oscillators, including the Stochastic and Commodity Channel Index (CCI) and RSI .

These indicators are useful for range trading, not only because they show when the price is near the high or low of the price range, but also provide trade signals for entries and exits.

Figure 2. Trading Range with Slow Stochastic and CCI on PLAB Daily Chart

Range Trading Strategy

The indicators are used to form a range trading strategy. There are numerous oscillators, pick one and adapt it to using the following method.

For the CCI, most of the time the indicator is between +100 and -100, so a move above +100 or -100 is noteworthy. In order to get a trade signal, we must consider the stock price and the CCI indicator.

When the price is within, or near, the resistance zone, the CCI will likely also be above +100. If it is, when the CCI falls back below +100, initiate a short position. Place a stop above the most recent swing high in price. Place a target for the trade just above the support zone.

When the price is within, or near, the support zone, the CCI will likely also be below -100. If it is, when the CCI rallies back above -100, initiate a long position. Place a stop below the most recent swing low in price. Place a target just below the resistance zone.

Figure 3 shows three short trades and two long trades. The price must be near the support or resistance zone in order to confirm a CCI trade signal. Price and the CCI (or other oscillator) must be used in conjunction with one another.

Figure 3. Range Trades in PLAB using CCI Signals

Range Trading Pros and Cons

A range that lasts can produce multiple winning trades before it eventually gives way to a breakout. Certain stocks and markets have ranged for years. Even markets and stocks that commonly trend typically range for periods of time, so having a range trading strategy for such times can pay off.

The problem is these long lasting ranges dont come along very often, and when they do you can be assured every other range trader is trading it too, in a similar way. Therefore, long-term ranges can get crowded, resulting in choppier trading with lots of false breakouts, usually resulting in losses.

Not all ranges are worth trading either. While a range may be well defined, if its too narrow the potential profit may not be worth the risk and paying commissions.

Trends are what non-range traders chase. Arguable trends have more profit potential because they can run indefinitelyyour potential is unknown, and can be very large (or not). Range traders are usually only trying to capture the approximate size of the range, so theoretically profit is capped at the width of the range. Ultimately though, it comes down the individual trader, and how they implement their range or trend trading strategy. Some will do better trading ranges, while others will always want to ride trends.

For more insights on trends, consider our guide Trend Trading 101 .

The Bottom Line

Trading ranges occur when the price of an asset is moving between horizontal support and resistance levels. Look to profit from the recurring pattern of the range by shorting when the price is in, or the near, the resistance zone and the CCI drops below +100. Buy when the price is in, or near, the support zone and the CCI rallies above -100. Place a stop just outside the recent swing high or low respectively. Targets go just in front of the opposite zone.

When ranges last, they can provide many great trading opportunities, but profit potential is capped. Also, as the charts show, ranges are prone to choppy trading (not reaching or overshooting your established support/resistance zones) which can result in losses or missed targets. Such things are inevitable; make sure the range is big enough to reward you handsomely for the range trades that do work out.

If you’ve enjoyed this article, sign up for the free TraderHQ newsletter ; we’ll send you similar content weekly.