Introduction to Day Trading

Post on: 30 Апрель, 2015 No Comment

Introduction to Day Trading

If you are thinking about the possibility of trying day trading for a living, then youd better fasten your seatbelt for one hell of ride.

Once you enter the world of day trading, you will soon see just how enjoyable, exciting and profitable it all can be.

On the flip side, there are also the losses and frustrations that come on a regular basis. These highs and lows are not for everybody, but if you are truly in it for the long term, then it can be the most rewarding business on the planet.

One of the main benefits of being a day trader in modern times is that there are very little requirements to get up and running. If you have a fairly decent computer in your house, that comes with fast internet access, and you have somewhere to actually tradethen you you are in business!

Dont be fooled into thinking day trading is easy though. At the very core day trading is certainly a simple game, but it is far from easy.

In fact, of all the thousands of people who try their hand at day trading every year, only a small percentage really make it. The vast majority of people struggle to make any significant long term profits at all, and many bankrupt their day trading accounts.

So what is the key ingredient that separates the winners from the losers?

The main answer to that question is knowledge.

You see, the more that you know about day trading, the more likely you are to be successful at it.

Once you really start to understand how to correctly read the markets and quickly identify trends that can make you money, then you are well on your way to being in control of your financial destiny by being an elite day trader.

Sure, there are other important factors involved in day trading as well, but superior knowledge comes out on top every single time.

What is Day Trading?

If you are still unsure of what day trading actually is, then allow us to clarify that for you.

Basically, day trading is the act of buying and selling things such as stocks, currencies and futures. The main goal of every trade that you get involved in is of course to make a profit, and this can be achieved for example, by selling a stock a higher price than which you bought it.

The main difference between day trading and other forms of trading and investing, is that in the world of day trading the vast majority of trades are completed within the course of a single day.

Sometimes, traders buy and sell within a matter of minutes, and things can definitely get crazy as people look to quickly make a profit.

Many years ago, the traders involved in day trading were mainly people that worked for banks. This however has changed drastically in recent years, as everybody now has access to market data, and trades can be made at a low cost.

The Basic Day Trading Tools

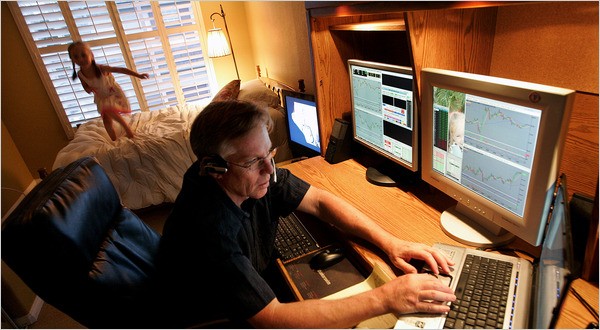

Almost all day trading is done electronically these days, which means that it is possible for you to operate your business from anywhere in the world with only a few basic day trading tools.

Computer

Day traders use a wide variety of computers to make their trades and get valuable information.

For example, some traders use a normal computer, one which you would find at any computer shop, while other traders have custom built computers that are designed to respond quicker, store more data, and having the ability to run many programs at once.

In reality, if you are just beginning your day trading journey, then a normal computer will be able to handle everything for you. Basically, you only need it to perform your trades and run certain day trading software programs.

Internet Access

Another important day trading tool is high speed internet access. Most people already have access to this, but if you dont, then you should contact your internet provider as soon as possible to get it upgraded.

Trying to successfully day trade with a dial-up connection or extremely slow internet access would be a nightmare, and make your day trading business a living hell.

Charting Software

Day traders have a constant need to stay up-to-date with current information and trends. One of the day trading tools that they use to do this is charting software, which usually includes data such as current prices and volume in an easy to understand graphical view.

Once you start day trading on a regular basis then it will become an essential requirement to get charting software of your own. When you sign up with a day trading broker, you normally get access to this kind of software, but sometimes it is not very comprehensive.

Many traders actually invest in many different charting software programs, as they like to get data from multiple sources. Some of the more popular charting software programs available on the market are Esignal, TradeMaven and Sierra Chart.

Before purchasing any day trading charting software, it is highly advisable that you give some programs a trial run. Many of the popular programs offer demo versions, so you can test out the features and decide which one is the best for your current needs.

More About the Different Kinds of Day Trading Charts:

Bar Charts

Day trading bar charts are extremely easy to understand, and have been popular among day traders for many years. The basic information included in a bar chart is the open, high, low, and close prices that have been traded in any set period.

Candlestick Charts

Just like bar charts, candlestick charts have been a popular choice for years, and the data that they give is much the same. Again, you will find the open, high, low and close prices during a set period.

Line Charts

Not as widely used as bar and candlestick charts, line charts are still very useful for interpreting data in day trading. They usually only have one piece of information, which is the close, but when used with certain charting software they can also include the same information as bar and candlestick charts.

The Basic Day Trading Strategies

There are many different day trading strategies that people use to trade in the markets. Here are some of the most common and basic ones.

Scalping

Scalping is a very common day trading strategy as it employs a ìget in and get outî type of mindset towards trading. Basically, day traders who follow the scalping method look to sell once the trade starts to show profitability.

Daily Pivots

Another of the basic day trading strategies is daily pivots, which looks to profit from the daily volatile trends in a particular market. For example, a day trader following this strategy would attempt to buy at the lowest price point during the day, and then sell at the highest price point during the day. These are often referred to as (LOD) low of the day, and (HOD) high of the day.

Fading

Known as a risky strategy, fading is the act of shorting stocks once they start to experience rapid gains. The main theory behind fading is that the stocks are over-purchased and many early traders will be looking to sell. Fading can be very profitable when used at the right times, but also comes with many dangers.

Momentum

If the thought of riding trends interests you, then momentum trading could be the strategy for you. Day traders who employ this method keep a close eye on current news releases, and are always on the lookout for trends which are being supported by a high volume of trades. They will continue to ride these waves until signs of reversal start to become apparent.

More About Day Trading Strategies:

Stop Losses

Day trading is very prone to sharp price movements, which is why the use of stop losses is beneficial in order to avoid huge losses in a short amount of time.

The first type of stop loss is a physical stop loss order, which is set at a price which you are prepared for the trade to drop down to. Basically, this is the amount you are willing to lose on any one trade.

The second type of stop loss is mental stop loss, which is set to come into play if the entry criteria is violated. In simple terms, this means that if your trade were to make a sudden and unforeseen turn, then you will get out of the trade straight away.

Evaluating a Day Trading Strategy

A lot of beginner day traders think that a day trading strategy is going to be the magic wand that makes them rich with a minimum amount of effort. In other words, they falsely believe that a strategy will do the work for them.

Actually, the main secret of successful day traders is that they are constantly evaluating and tweaking their strategies, and also adding elements from other strategies into their plan. This takes work and constant trial and error, and is far from being the easy road to riches.

Many elite day traders end up with their own unique day trading strategy, which they have honed and perfected over years of testing, and has shown consistent profits in a variety of market conditions.

What Makes a Successful Day Trader?

Many people like to imagine that they can make millions as a day trader, working only a couple of hours a day, and living a life of luxury. The harsh reality is that it doesnt work out this way for the majority of traders, and they end up leaving the world of day trading for ever.

Why is this?

Well, one of the reasons is that they just dont have the right kind of personality that is suitable for day trading. Thats not to say that they will never become successful in anything, its just that their personality might be best suited for another type of business.

If you want to become a successful day trader, then there are certain characteristics and traits that you must posses in order to see any real long term profits.

Patience

If you have seen any movies involving day trading, then you may have a vision of guys frantically rushing around, screaming and shouting, and basically being very impatient.

This is probably an accurate portrayal of people that work in the trading pit, but the average successful day trader is usually the exact opposite.

In fact, when you consider that the main activity of a professional day trader involves sitting in front of their computer, and waiting minutes, hours, and even days to identify a profitable trade, then you can definitely appreciate that one of the main traits day traders share is patience.

It also takes patience to stick to a day trading strategy and not be constantly distracted by bright shiny objects.

Making Decisions

One of the key factors in any trade is knowing when to get in and when to get out. Being able to do this on a regular basis, without the need for hours of procrastination, requires the ability to be able to make decisionsFAST.

Remember, day trading is different to other forms of trading. A profitable situation can sometimes only last for a few minutes, which only gives you a small window of opportunity.

In this short amount of time you have to ask yourself one question, ìam I in or out?î Once you have made the decision then its all about taking action.

You might not get it right, but at least you made the decision. Many beginner day traders hesitate at that vital moment and dont end up following through.

Maintaining Balance

Winning and losing is all part of the day trading life. No matter how great you are, you will experience plenty of both.

The main problem with many traders is not the winning and losing, but rather their reactions to the wins and losses. One day they make a great trade and they are ecstatic and on top of the world. The next day things go wrong and they fall into depression and panic.

If you want to be a successful day trader then understand that the world of day trading is all about maintaining a balance in your way of thinking and with your emotions. Failure to do this will result in an erratic trading style that ultimately loses money.

Whats a Broker Account and What are the Different Types?

In order to start day trading, you will need to register for a broker account with one of the many brokerage firms operating online and offline.

Before choosing which broker to do business with, you should take your time to look at the available options. Like anything in the world, there are brokers that are good and brokers that are not so good. Finding a broker that suits your own personal day trading style is the key to a successful relationship.

Broker Fees and Commissions

Every trade that you make a profit on, you will be subject to broker fees and commissions. With this in mind, it is sensible to look for a day trading broker who offers low fees and competitive commissions.

The commission percentages vary with each brokerage firm. Some brokers offer a flat rate commission structure that stays at the same level no matter what the size of the trade, and can end up working out at only a few dollars for every trade.

Other brokerage firms have a sliding commission structure in place, where the amount you pay depends on how small or large the transaction is.

Two Different Types of Broker Accounts:

Regular Broker Account

A regular broker account is great for beginners to get started with. In these accounts, you are limited to only trading stocks and ETFs, and because you are limited in your position sizing, it greatly reduces the amount of risk you take on with each trade.

Margin Account

If you were to open a margin account with a brokerage firm and then deposit some cash into the account, the firm would then supply you with your own line of credit which would give you a greater buying power. If you are interested in trading FX, commodities or futures, then you will require a margin account.

How to Choose a Broker

One way to find a good day trading broker is to ask around and get some word of mouth recommendations. If a friend or colleague has had a good experience with a particular firm, then they will definitely let you know about it.

Also, check places such as online forums and blogs to read some unbiased reviews about the different brokerage companies.

Another factor to take into consideration is how many years they have been operating and their level of experience in the day trading world. Do they have a proven track record of being reliable and efficient? Is there any testimonials on their website from satisfied clients?

Lastly, you should check to see if they have a good level of customer support.

For example, can you reach them at all times of the day via the telephone, and actually speak to a real person? And is that person knowledgeable about day trading?Also, do they have other lines of communication open such as email and Skype, and are they fast to respond to queries.

Being with a broker who quickly answers your questions and can help you with problems makes a big difference to your day trading business, as you can quickly get issues sorted and turn your attention to more important matterssuch as making money.

Different Day Trading Software

What is the point of day trading software? Well, the main reason is that it gives SPEED in your day trading activities. Instead of spending hours analyzing market data and research, you can get all the information that you are looking for in a few seconds or minutes with the click of a button.

Here are some of the features you can expect to find in day trading software:

Day Trading Platform

You can get all the tools you need to aid you in your day trading career, by using the platform included in many software programs. Tools such as charting trends, watch lists, test trades, and many more.

Market Information

Many of the software programs have all of the latest news, views and data from the marketplace, which is easy to retrieve through a connection to various news feeds and commentary,

Go Mobile

As we step into the mobile age, day trading software is staying right on the cutting edge of technology. Many of the top programs now feature mobile phone apps and SMS alert services that can connect you to the software and keep you right up-to-date with the latest day trading information.

How Much Does Day Trading Software Cost?

The cost varies depending on the software you choose. Some programs charge a monthly subscription to use the software, while others charge a one off fee that gives you lifetime access along with regular updates.

Bear in mind that you may also have to pay additional costs to use a data service provider, that connects to the day trading software and supplies the required information to things such as day trading charts.

Here are Some of the Top Day Trading Software Programs Currently on the Market:

eSignal

Used by many day traders, eSignal is a market leader and has been around for many years.

The software comes complete with various tools and features, such as charts, scanning and analyzing. There is also a data feed included in the package, so you can quickly and easily get real time market information to help you with making decisions.

MultiCharts

Available as a one-time payment, MultiCharts is a well known day trading software program that offers a variety of charts, automatic trading options, and customized scenario technology.

The program also works with multiple data feeds, meaning all the information you need is only a click away.

NinjaTrading

With a range of market data feeds to choose from, and a host of different tools available, NinjaTrading is always a popular choice.

One of the main downsides to NinjaTrading is that they dont currently offer any telephone or live chat support, which means it can take some time to get your questions answered.

Also, they dont yet offer any mobile services such as SMS or Apps, which are widely available with other software programs.

Different Day Trading Books

There are many different kinds of day trading books available to buy online and from bookshops.

If you want to improve your day trading skills and improve your knowledge in areas of the industry, then it is highly recommended that you pick a few up.

Please note, that no matter how great a book is, it will never be a magic pill for day trading success.

Sure, there are many books that include great information and tips, but no book can hand you the keys to day trading riches on a silver platter. You have to put the information that you learn into daily consistent action, and commit yourself to lifelong learning.

Also, books are not the only place to get information from. For example, there are many beginner and intermediate day traders who seek help from a mentor, so they can get first hand advice from somebody with years of knowledge and experience.

With that being said, here are a few day trading books to get you started on your journey:

Trade Your Way to Financial Freedom

This is one of the most popular day trading books currently on the market. In it, there are many different day trading methods covered, as well as some in-depth information on topics such as risk management and position sizing.

Trading to Win: The Psychology of Mastering the Markets

Written by Ari Kiev, this book gives you an over the shoulder look of what makes a day trader successful and the habits and mindset you must develop to get there. Ari is somebody that has many years of experience in the day trading world, so you can be sure that the advice in this day trading book is solid.

The Encyclopedia of Trading Strategies

A must have for any aspiring day trader. This book is a great point of reference for all of the different day trading strategies currently employed by millions of traders around the world. Its a good starting point for beginner day traders who want to get an overview of the day trading world as a whole.

Financial Publications

Day trading books are not the only things that make essential reading, as there are also dozens of different financial publications that are published on a daily, weekly and monthly basis.

These publications are an excellent way to get insider tips and general ideas that can form the basis of your own day trading strategies.

Here are a few of the more popular financial publications:

The Wall Street Journal

One of the biggest business newspapers in the world, the Wall Street Journal is published by Dow Jones and Company, and is read daily by more than 2 million people.

They also print an edition of the newspaper in Spanish, which is called The Wall Street Journal Americas, and can be found as a supplement in many of the top Latin American newspapers.

Forbes Magazine

Released every two weeks, Forbes magazine is for anybody and everybody who is involved in business. Each issue contains all of the latest news and stories on companies, markets, trends and investments, and can excellent source for day traders to stay in tune with what is happening in the world of business.

Investors Business Daily

Founded in 1984, Investors Business Daily is an essential read for day traders who want up to the minutes news and views on financial topics.

One of the main benefits of reading this newspaper is its in-depth section on information related to the stock market.

Qualities of a Day Trader

Hopefully, you now have a better understanding of the day trading world and are in a better position to decide whether or not day trading is for you?

Before you make that decision, there are a few more factors to consider:

Temperament

One of the biggest qualities of a day trader is their ability to keep an even temperament and control their emotions the majority of the time.

As mentioned earlier, day trading is not for everyone and if the thought of having real money involved in the ups and downs of a particular market freaks you out, then there is a very high chance that day trading will not be a good match for you.

The quality of keeping an even temperament is essential to success. If you dont currently posses this trait then it is possible to work on it and try and improve your state of mind while trading.

One good way to do this is to just paper trade at first. This will give you a better idea of the swings involved in day trading, so you are better prepared to keep your emotions in check.

Do You Have the Time?

Another quality that day traders should have is the ability to properly manage their time, so that they have enough hours available to put the required work into making themselves successful.

Day trading has many different elements to it. You have to study about a range of topics, be constantly keeping your eyes on news and market trends, as well as the actual trading itself while sitting in front of the computer.

All of these things take time, and it can be months or years before you find yourself at a level where you really understand what you are doing and can make profitable trades on a regular basis.

Before you start, you should come to a realistic conclusion of just how much time you can devote to day trading. Many people have fallen in the past because they thought everything could be done in just a couple of hours a day.

Sure, it is possible to day trade on a part-time basis, just as long as you realize that the time frame in which you will see positive results would be greatly increased.

How Much Risk?

Everybody is different, and one of the main qualities of a day trader is their ability to accurately assess how much risk they are willing to accept.

Because of the many different methods of trading in the market, there are certain strategies that require a high amount of risk, while others that are much lower. You must be honest with yourself from the beginning about how much risk you are willing to take, so you can begin trading within your comfort levels from the start.

Risk management is a popular topic within the day trading community, and there have been many books and articles published on the topic.

As you gain more experience, you will learn more about money management and trade size and how it all relates to the level of risk that you accept in your day to day trading actives.

The Ability to Work Alone

If you have been employed in a job for the majority of your life, then becoming a day trader who works all day on his own can pose unforeseen challenges.

At the end of the day, not everybody is cut out to be on their own so much, and after a few months they can feel very alone and start to crave the company of co-workers.

Think about it, in your current job isnt the daily office banter one of the highlights of the day, speaking with your colleagues about last nights football game or organizing a night out at the weekend?

Of course, there are also many benefits to working on your own, but you should just be aware that the solitude of being a day trader is not for everyone, and you may end up finding out down the line that its something you dont cope well with.

Conclusion

If you really want to find out whether or not day trading is for you, then the best way to go about this is to try it out for a short while to see what happens

Take the time to learn the basic fundamentals and then test out a few markets with paper trading. Once you do this, you will form a better idea of which markets are better suited to your style.

During this time you can also trial some day trading software and even open up an account with a day trading broker to get a better feel for how things work.

If after a while you decide that its not for you, then you can simply move on with your life without having invested a large amount of effort. However, if you decide that day trading is the way forward and your path to a large income, then there are a few additional things to consider

Get a Business Plan

Once you decide that day trading is for you, then you should aim to get a business plan written out as soon as possible.

Day trading is a business, even if you only do it in your spare time, and so it should be treated as such right from the beginning. If you dont have a business plan in place, then you may struggle to make profits in the long term, as well running the risk of facing tax problems in the future.

When writing your business plan, you should consider what both your short term and long term goals are, so that you can be positive that the action you take on a daily basis will lead to the business becoming a profitable venture.

You should also have a pretty accurate idea about the sort of expenses your business will incur, because if you dont know this, then it is hard to judge exactly how much profit you are likely to make.

The expenses of books, publications, broker fees, software, computing costs, electricity, internet, furniture, and much more, are all things you need to consider in order to get a well rounded business plan in place.

Where is Your Office?

Its very important to decide where you main place of work will be. Many new traders never really figure this out, and simply end up working where ever is convenient. One day its at the kitchen table, and the next its in the living room.

The main problem with this is that your home life and work life soon becomes a blur, and it can be hard to get day trading thoughts out of your head while you are trying to relax or concentrate on other activities.

Having a dedicated office solves this problem, because once you leave the office you can leave the work behind and relax your mind.

You can easily set-up an office in a spare room in your house, or if this is not possible, then renting small office space in your local town or city is usually an affordable option.

Getting an Accountant

Once your day trading business starts to take off, and the profits are coming in on a regular basis, then you will find it very beneficial to enlist the help of a professional accountant to deal with your tax issues.

In fact, you may find that this is something you want to do from the start, especially if the thought of filling in tax forms and keeping financial records is something that makes you nervous.

A good accountant is worth their weight in gold, and they can end up saving you a lot of money. So take the time to choose the right one for your day trading business, and you should have a relationship that will last for many years to come.

Good luck with your day trading business!