Introduction to CFD Trading CFD Brokers

Post on: 10 Апрель, 2015 No Comment

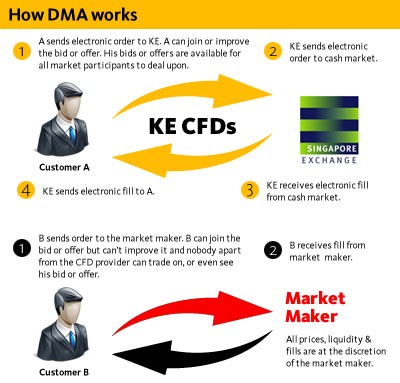

Contract For Differences, or CFDs for short enable the investor to trade on the price action of stocks and indices. CFD’s are high risk derivatives and can be traded without physically owning the underlying assets that are being traded.

CFD trading makes for an ideal investment option for traders looking for flexibility in terms of maximizing their profits whilst allowing them to hedge their risks. Trading CFDs can be efficient due to the market that they are market participants, thus allowing the investor to keep their costs low and be able to trade during market volatility. However irrespective of the flexibility offered by CFD’s they are not suitable for all kinds of investors.

CFD trading is nothing but a contract between the buyer and the seller which dictates that the buyer will be paid the difference between the current value and the value of the asset at the time of ‘buying’ the contract. Likewise, if the difference is negative, then the converse comes into play where the buyer will have to pay the seller the difference amount. Trading CFD’s during market volatility enables the CFD trader to take advantage of the fluctuating market prices and can therefore either take a long or a short position on their trades.

Of the many advantages that work in favor of CFD trading, Leverage ranks the highest. CFD traders can be exposed to a bigger position that what is available in your capital. Making use of leverage CFD traders can profit from the markets without having to put up the entire amount upfront. Leverage, while offering its benefits is also risky as it magnifies the risk as well and any losses incurred could go well beyond the invested capital. Most CFD brokers offer margin trading, where the CFD trader needs to maintain a certain amount of margin in order to trade on leverage. The margin typically ranges between 5 – 10% for most of the commonly traded stocks.

To illustrate Leverage in CFD’s, a 10:1 leverage offers the trader the capital of $10,000 for an investment of $1000.

CFD Trading Tips

CFD trading offers a great potential to profit from the markets. However without following a trading plan it is easy to lose money as well. One of the main factors towards a successful CFD trading requires a robust trading strategy and a discipline. While there are no hard and fast CFD trading strategies that can offer profits, the trading tips mentioned below could at the very least reduce the risks involved in CFD trading.

- Following a trading plan

- Take Losses in your stride

- Have a money management plan in place

- Take profits even on trades that do not make any sense

- Practice risk management such as stop losses and limit orders

- Do not overtrade or make use of too much leverage

- Let go of losing stocks

- Be comfortable with both long as well as short positions

Basic CFD Trading Strategies

Pairs Trading. A popular CFD trading strategy, pairs trading tends to balance a long trade against a short. In other words, traders can buy one financial instrument while simultaneously sell another trade. Anticipating the divergence or convergence between the two instruments pairs trading allows you to adjust your risk tolerance for the trade. Pairs trading can also be used within the same sector as well. For example you could trade with RBS and Deutsche Bank in the banking sector.

The assumption being that your basically trading RBS against Deutsche Bank and the price of one will rise or fall, relative to the other. Pairs trading can help reduce exposure to any big market jumps in an index. For example in the event of a market crash, the exposure is significantly reduced by exposing the trader to only the convergence and divergence between the stocks.

Pairs trading in CFD can also be used to trade shares across different sectors or different market caps and so on.

Hedging. With CFD trading, an investors long term share holdings can be protected against the varying market conditions. For example, if there was a stock that you feel will decline in the near future but you want to hold on to it then you could go short and make money from the falling prices for that stock.

By doing so, even if the price of the instrument stays low the investor would have covered their losses by shorting in. CFD trading essentially saves the investor against any associated costs involved in selling the physical shares.