Introduction about the Closed Ended Mutual Funds

Post on: 10 Апрель, 2015 No Comment

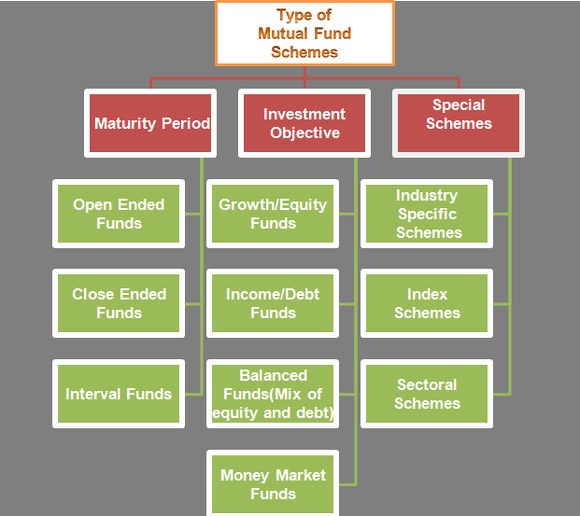

Categories

A closed end mutual fund is a publicly merchandized fellowship that can set up a fixed amount of money through an initial public offering that is, IPO. The fund is then structured, listed and traded in just like another stock on a stock exchange. It can be understood as a collective investment scheme and the numbers of shares are specified. This is the reason why it is called closed as after the launching of the fund, the numbers of shares are not at all redeemable in any case.

Closed Ended Funds versus Open Ended Funds

Unlike open ended funds, in closed ended funds, the investor acquires the shares by buying them on a secondary market from a broker. Also, it is closed to the new capital once its operating has begun. And, most importantly, it is traded on stock exchanges and not directly redeemed by the fund. Unlike open ended funds were trading could be done typically at the end of the market day itself and that too only at the closing price, the shares of a closed ended fund can be traded during any time of the market day. While an open ended fund has no other option than selling at its NAV, a closed ended fund has a premium or discount. Moreover, a closed ended fund has its own specific securities. And the funds need not be placed in advance. There are two factors determining the price of a share in a closed ended fund. The first one is the value of the investments in the fund and the second one is the premium or discount placed on it by the market.

Exclusive Advantages offered by the Closed Ended Funds

The sponsorships for the closed ended funds come from the funds management companies and these companies themselves decide the further investment of money. Investors invest money in an initial offering and it is the initiative step. This may be either public or limited. And the company provides the shares to the investors accordingly that is corresponding to their initial investment. The fund managers may now pool the money and purchase securities and their investment depends directly on the funds charter. Funds may invest in anything according to their convenience stocks, bonds or in very specific things.

Closed ended funds have a distinguishing feature of raising additional investment capital by issuing auction rate securities, preferred stock, long term debt, and reverse repurchase agreements. With this excess capital invested, the fund certainly looks ahead for earning a higher return and therefore, maximum profits.

Types of Stock Shareholders

There can be two types of shareholders. The first kinds are the preferred stock shareholders who can benefit from expenses based on the total managed assets of the fund. And the other kinds are the common stock shareholders who can only benefit from the common assets of the fund and not the total assets. Clearly, the returns of the common stock shareholders are reduced in comparison to the preferred stock shareholders as the expenses for the common stock shareholders are spread among a significantly smaller asset base.

Although the closed ended funds report expense ratios based on the funds common assets only, but the contractual management fees charged to them may be either based on the total managed asset base as well. Now, since the closed ended funds are traded just like stock, a customer trading in them needs to pay a brokerage commission. So we can say that the closed ended funds do not generally have the sales based share classes.

Closed Ended Funds and Exchange Traded Funds

The closed ended funds are very similar in operation to the exchange traded funds. that is, the exchange traded funds, but still there are considerable differences between the two. The factors determining the price of a CEF include valuation of the market whereas the market price of an ETF trades in a narrow range very close to its net asset value. The market price of the closed ended funds is, in general, ten to twenty percent higher or lower than their respective NAVs but the market price of an ETF is compulsorily within one percent of its NAV.