Intrinsic Value what s the best way to evaluate a company

Post on: 16 Март, 2015 No Comment

on 8/21/13 at 7:27am

This is my first post here in WSO and I would like to share with you a work I did last semester for an investment course, in which I had to create a portfolio of stocks. After searching for several methods I used a DCF and based my decisions in some Buffett ‘s theory.

I chose 6 companies that from 15th of April are beating Dow Jones by 8%. The purpose of this post is to get some feedback from you guys!

Valuation methodology:

Financial stability:

It is the stability of a company’s business that determines our ability to predict its future earnings. If a company’s revenues and costs vary widely, it is not possible to accurately predict growth. We have to take into account that if a company has a stable 10% increase in revenues but loses 20% in one year, in the next year it will need a 50% growth approximately to maintain the same revenue it would have in case the loss did not happen. So we cannot trust in growth averages as a precise value but as instead an estimation and only for stable companies. The gross margin plays here an important role too since if it is too narrow, when the economy contracts, costs rise, or revenues decrease for any reason, this company will shrink it even more having even in some cases negative gross margins. Another figure we must take into account is the level of debt. Highly leveraged firms are too dependent on the debt markets and if a debt crunch happens, which also deteriorates the economy substantially; it would not be possible for them to refinance themselves in those hard times.

Intrinsic Value (IV):

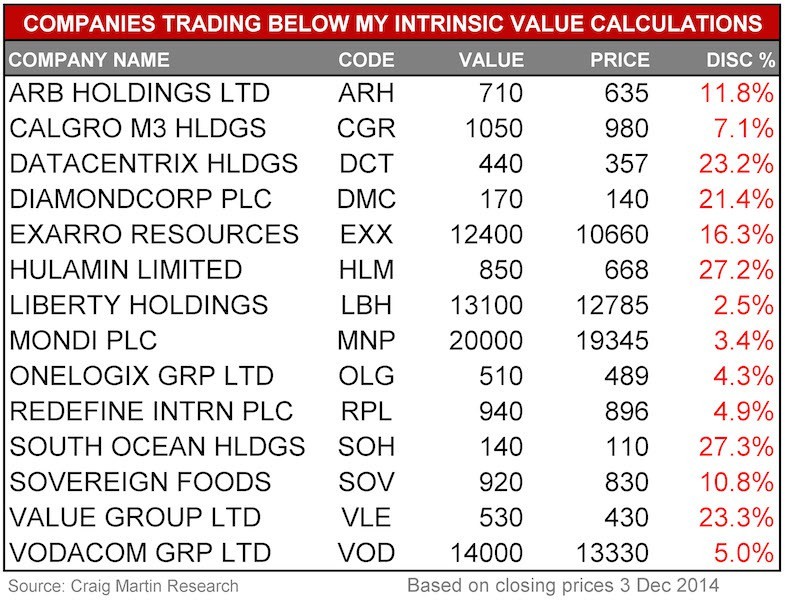

By knowing the financial parameters that a stable company has, it is possible to do a sort in NASDAQ website for example. After the sort we just have to choose the ones which present the more stable and higher returns. By developing an excel sheet that extracts data from Reuters and calculates almost automatically (it needs a few manual adjustments), the intrinsic value of each company it is easy to find which companies are undervalued at the current market price.

For the calculations of the intrinsic value, the operating income, depreciation and amortization, capital expenditures, number of shares, current price, total debt (D) and cash and short term investments (C) are needed (these values are the ones we download automatically for our excel sheet from Reuters).

The owner’s earnings (OE) are found by adding the depreciation and subtracting the capital expenditures to the operating income. These earnings represent the amount of money the owner of the business has in “his pockets” at the end of each year. The growth rate (g) from these earnings must be stable so that it is possible to make a prediction of future growth rates. After applying the growth rate to the owner’s earnings after several years, there is the need to discount this result to the Present Value. For the discount rate (r) we use 10%, Even though current interest rates are so low that we cannot invest our money at this rate in a risk free instrument (in the best scenario we would get 4%) we use 10% because it gives us an extra safety margin.

Our temporal choice for our investments are 10 years so in these 10 years the stock value will get the returns created by the business, so by summing the PV of these returns we have our first part of the intrinsic value.

The capitalization rate is the returns divided by the market capitalization of the company (M). This way it is possible to calculate given the future returns, what will be the market price 11 years from now. This will be the residual value of the business which is then discounted until the present.

The intrinsic value will be then the sum of the PV of the 10 year returns and the PV of the residual value in the 11th year with the Cash and Short-term investments minus the Total Debt. As recommended by Benjamin Graham. a 25% margin must be discounted from this intrinsic value.

If we wanted to buy the whole business we would need to be worried about the shares dilution, however as we intend to have small stakes of each of these companies in our portfolio we need to take in account this variable. By analyzing the number of shares in the past 10 years of the company’s activity it is possible to make a prediction, with the respective safety margin, of the future dilution rate. So when we calculate the intrinsic value per share we can already take into account this factor and thus arrive at a more precise value.

The conclusion is simple, if the current price of a stock is lower than its intrinsic value per share then we consider it as undervalued.

Fundamentals:

It is not enough for a stock to be undervalued. It is imperative that the firm has some kind of competitive advantage that its competitors do not have and cannot obtain at least on short term. This competitive advantage can be a way of reducing costs by for example having a better bargaining power with the suppliers or increasing sales by producing goods with an extraordinary quality. A firm which belongs to a competitive industry must have some factor that differentiates from the others because otherwise it would be affected by price competition and narrow margins. The management quality is another aspect to take into account, which can be evaluated by the precision of their estimates and the transparent financial results and accounting practices. Customers and suppliers are also extremely important since a company that relies in a small number of suppliers and customers is dependent on their stability.

The companies inside my portfolio are: SNX, CHRW, JW-A, WMT, KSS, MNST.

Please feel free to give me some advice regarding the calculations and methods used to find the Intrinsic Value.