Intraday Trading Strategy Online Stock Trading Guide

Post on: 29 Март, 2015 No Comment

Trading Stocks, ETF’s and Indices as One Big Asset Class

This is an example of an Intraday Trading Strategy that uses analysis of multiple types of trading classes to help determine future price movements.

The trading classes used in this example are Stocks, ETF’s and Indices. Other trading classes can be used such as individual commodity, currency or Bond Yield charts for instance.

The type of charts to use while making your analysis is determined by research you will have to do to find out which types can be used for your particular trading scenario.

This will take some time, but once you find a few that move relative to each other, you will greatly improve your odds of producing profitable trades.

When trading using multiple asset classes for analysis, it is necessary to have multiple charts open at one time in order to see how each one is moving in relation to the others. Once a pattern is recognized such as one usually lagging the others, or one usually leading the others, a trade can be entered with reduced risk and increased odds of profitability as compared to not using such a method of analysis.

In this Intraday Trading Strategy example we will be interested in trading DIG which is a fund that seeks to closely return twice the daily performance of the Dow Jones U.S. Oil & Gas Index.

For comparisons, we will be using SPY, DIA and XOM for our chart analysis. XOM is being used because of my past analysis. To find an individual stock to use that is part of your ETF, look up the funds top holdings and use one of the largest holdings in the fund. You can see from the information found at Yahoo Finance below that XOM is currently 30.42% of the total assets in DIG as of November 30, 2008.

SPY and DIA are being used to demonstrate how many stocks and funds will sometimes trade in direct relation to Market Indices. XOM is being used to increase our chances of producing a profitable trade by increasing the number of relative price movements to analyze and XOM being a large percentage holding of the fund we are interested in trading.

This relative comparison is most evident during times of extreme optimism and extreme pessimism, which also happens to be times of extreme fear and extreme greed. You still may use this method of analysis during normal, less volatile trading environments, but less false signals will be produced during market extremes.

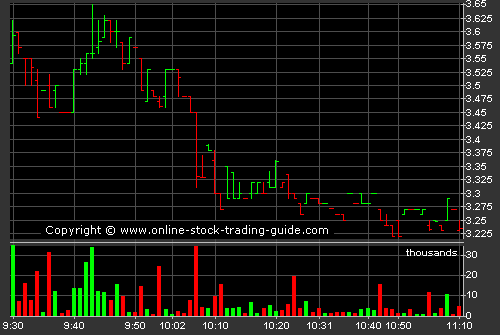

The one day chart image below shows a chart of each of the four symbols we are looking at together so you can see how they move relative to each other. You can click on the image to see a larger version if you would like:

When you glance at the above 4 charts, you can clearly see that shortly after 9:30 a.m. all four charts show a spike higher and then a reversal. There is also a clear reversal shortly after 12:00 and again around 3:30 p.m. If you look closely, these are only some of the common relative price movements that occurred.

The next 4 charts below show only the morning trading hours up through just before 12:30. These closeups will allow you to see a little more clearly how each of the different symbols moved relative to each other.

One way to use these charts to your advantage for an intraday trading strategy is to wait for confirmation of a price movement in 3 of the 4 charts in one direction and then enter a trade for the 4th symbol in the same direction. If the 4 symbols have moved relative to each other in the past, the chances are high that they will move relative to each other again.

While a situation like this does not always occur, you’d be surprised at how often it does. This particular intraday trading strategy has worked very well for me over the years as a scalping and day trading method.

Keep in mind that sometimes energy related stocks and ETF’s move opposite of the market Indices, but as I mentioned earlier, during market extremes if people are panicking and buying or selling, they are very often buying or selling everything at the same time.