Intraday Trading in India

Post on: 30 Апрель, 2015 No Comment

Categories

People enter into the stock market to win and earn lots of money. But earning money in the stock market is not that easy. It is not a place where you can easily fulfill your dreams. It is a risky business in the sense that investing in the stock market is a type of gamble which everyone wants to play. The real day trader is one who earns profit out of this gamble. India is one of the emerging markets in the world and to invest in Indian stocks, you need to be very wise and careful. You should read the earnings reports of the major companies and other financial news. You have to keep yourself updated and well informed about the latest trends in the Indian stock market.

For the purpose of trading, there are only two stock exchanges in India: one is National Stock Exchange (NSE) and the other is Bombay Stock Exchange (BSE ). 90% of the trading is done in NSE. NSE NIFTY has 50 companies in it. Though BSE started long time back in 1927, it is less popular in India. The number of companies listed in BSE SENSEX is 30.

Different Types of Share Trading in India

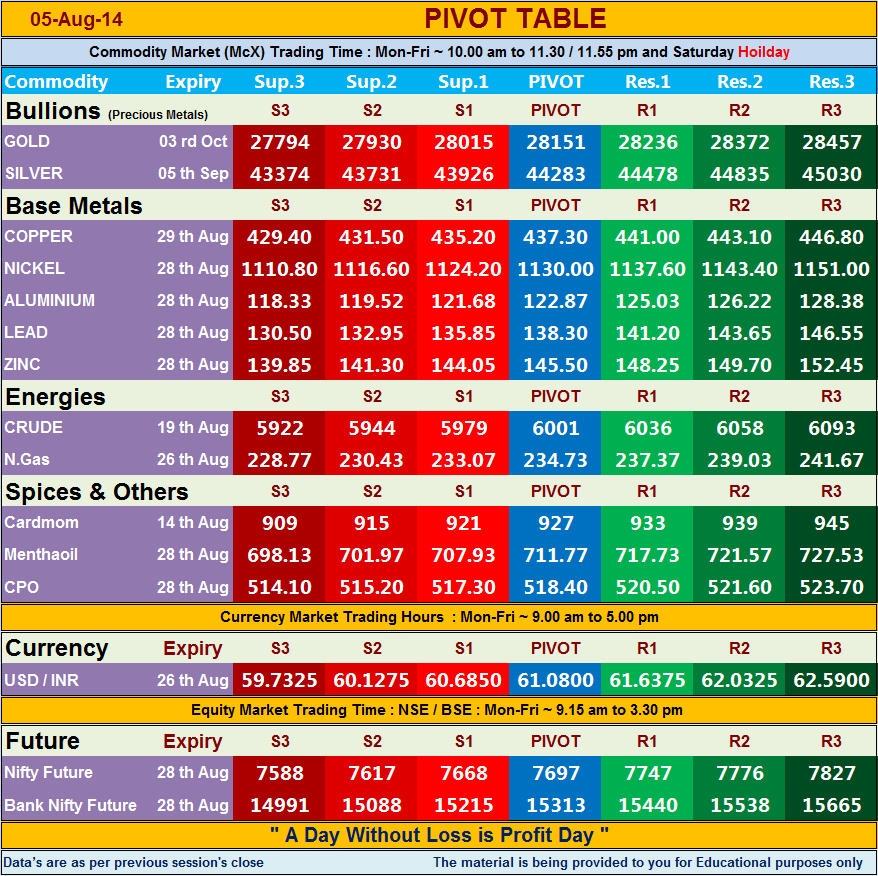

There are different types of share trading done such as intraday trading. commodity trading. swing trading, etc. When trading is done on commodities it is called commodity trading. Commodities such as silver, nickel, gold. lead, crude, etc. are traded. This market of commodity trading opens at 9:55 am and closes at 11:30 pm. In this market, commodities are bought and sold in a lot or individually. Most of the large players of this market are the jewellers. Any change in the price of the commodities in the international commodities market influences the commodity trading. Most of the parties involved in this market go for margin money and if the value of their security falls down they are forced not to hold it for longer period of time as they are short of funds.

In Swing trading the instrument is bought or sold at the end of volatility in price. This type of trading makes use of the volatility of the share price for one week.

Intraday trading involves buying and selling of securities in a span of one day. The securities are bought and sold on the same day. People indulge in intraday trading to earn quick money. They cannot be considered as real investors. While intraday trading gives quick profits, it also involves larger risk of losses. Intraday traders find it exciting and profitable to buy and sell stocks on daily basis. But they do not understand that it is risky too. The intraday traders should be very attentive and careful while buying and selling of stocks or commodities or else it can lead to great financial loss. Also, intraday trading requires quick and wise decision-making process.

Tips for Beginners Involved in Intraday Trading

The first step involves opening a Demat account. This account can be opened either in stock broking houses, banks or financial institutions. This account holds your shares in electronic form.

Intraday traders should follow some strategies and tips in order to avoid losses and gain huge profits.

• First, it is very important to know all types of stocks of major companies you want to invest in.

• In order to do money management, you should fix your amount of investment capital well in time.

• Initially, you should start with low investments because you are new in the stock market. It is very important to understand the functioning of the stock market before making huge investments.

• Indulge in Margin trading as it is considered to be always profitable.

• It is best to buy shares of many companies across different sectors.

• To protect your investment from heavy loss always keep open the option of Stop Loss.

• Be attentive and careful about financial news and stock market movements.

• The best is to trade in high volume index based stocks.

• Liquid stocks should be preferred because they have very high volume and entry and exit in such stocks is very easy and fast.

• If it is not going good in the stock market, exit as soon as possible. Don’t stick in there with an average status.

To trade in stock market, you require deep knowledge, strict discipline, enthusiasm and lot of research of domestic stock market. Not only domestic stock market but the knowledge of world market is also important as any movement in any stock market influences the stock market all over the world. For beginners, intraday trading is best it does not require huge investment. But for successful intraday trading, it is very important to follow strategies and tips.