Intraday Stock Quotes n Charts App for Android (reviewed)

Post on: 16 Март, 2015 No Comment

Must-have tool for investors

Intraday Trend Indicator 2.1 features real-time stock market info and make predictions

Information is the jewel in the crown of stock market. Good investors are also the most-informed. Intraday Trend Indicator is more than app: it’s a must-have tool for investors.

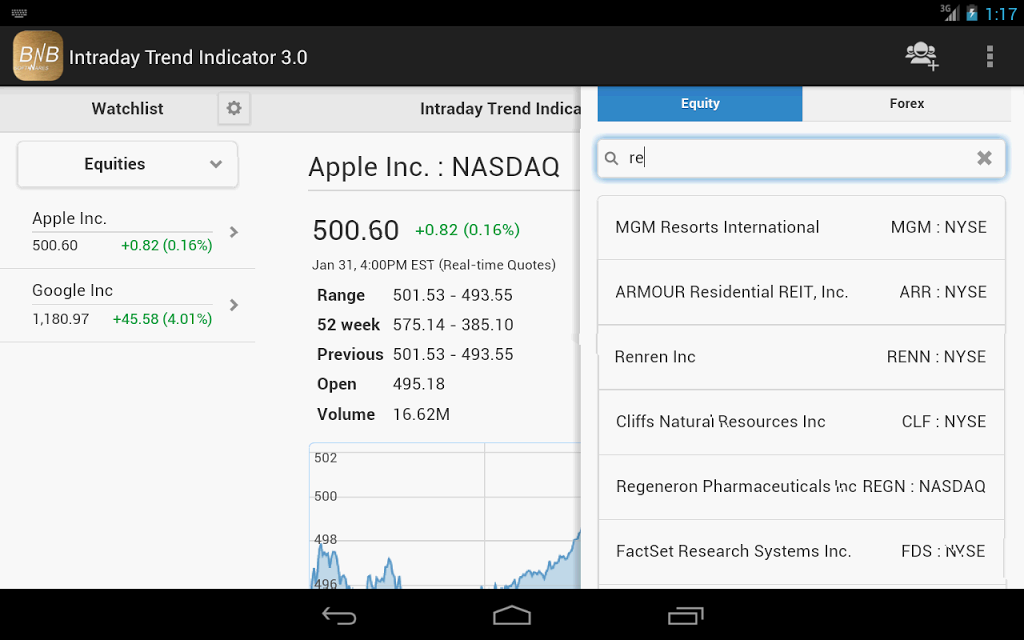

It’s made up by two basic features. First off, real-time info provided by Realtime Live Market & Forex Quotes for major exchanges. Users can add to their favorite source list both global markets (NASDAQ, Dow Jones, BSE SENSEX, IBEX 35, etc.) and specific brands like Apple or Google. Basic quote as range, 52 per week, previous, open and volume, shares, etc. In addition, Track Currency allows users to view pairs between over 90 currencies, including all major Forex pairs.

Intraday Trend Indicator 2.1 by Bulls N’ Bears makes the most of app’s calculated measures like Pivot Point, Resistance Points and Support Points, to facilitate investors making accurate predictions.

The app has been optimized to be run on tablets and smartphones with a low-battery consumption. It’s been set in a simple yet understanding layout, user-friendly. In a few words, a highly useful tool for traders.

Tags: eclipse sample stock quote intraday app open source, intraday trend indicator, stock quotes png, intraday trentindicatore, intraday stock quotes and charts, intraday nifty trading calculator with buy and sell predicating, intraday trend calculator, about www.intradaytrend.com, bullsnbears.in widget, indicator gratis.

Make nearly accurate predictions and take firm decisions using the apps calculated measures (Pivot Point, Resistance Points and Support Points). A must have app for any investor who deals with any Stock market or Equity market or Forex around the world (for example Nasdaq). With this app installed, you dont need intraday tips for trading anymore.

Intraday Stock Quotes n Charts a.k.a. Intraday Trend Indicator 2.3 also features most awaited Realtime Live Market & Forex Quotes for major exchanges.

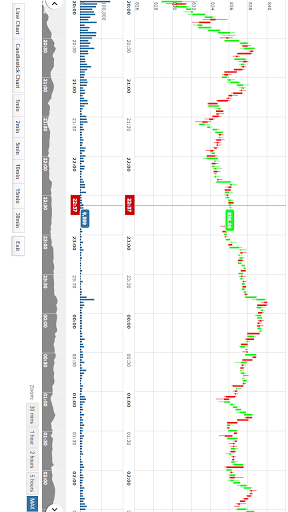

Along with Live Charts including Candlestick charts for Equities, Indices as well as for Forex.

Pan & Zoom throughout the charts while the chart draws live points during active market sessions!

Watch Candles form and slide in realtime for all major exchanges!

Includes Equity information such as EPS, P/E Ratio and much more..

Features :

* Stocks and Indices from 80+ Global Markets.

* Track Currency pairs between 90+ global currencies including all major Forex pairs.

* Sub-Indices from nearly all Global Market Indices.

* Includes Floor Pivots, Tom DeMarks Pivots, Woodies Pivots, Camarilla Pivots as well as Fibonacci Pivots.

* Realtime live quotes for Equities, Indices and Forex

* Company information including EPS, P/E, MarketCap.

* Realtime live charts including candlestick.

* Optimized for Tablets and Wide screens.

* Portrait mode & better UI for small screen devices.

* Very low network usage. (Useful if your Cellphone Carrier charges you for data connection).

* Simple and Sleek design.

* Lightweight — Low memory requirements.

If you dont understand what this App is all about, Read below.

In technical analysis, Pivot Points are used to determine sensitive trading levels at which the price trend is predisposed to change direction — possible support and resistance lines. Pivot Points are trend-predicting indicators (leading indicators) that are based on the average of the previous days High (H), Low (L) and Close (C) prices.

Here, S represents the support levels, R the resistance levels and P the pivot point. High, low and close are represented by the H, L and C”

Pivot points can be used in two ways. The first way is for determining overall market trend: if the pivot point price is broken in an upward movement, then the market is bullish, and vice versa. Keep in mind, however, that pivot points are short-term trend indicators, useful for only one day until they need to be recalculated. The second method is to use pivot point price levels to enter and exit the markets. For example, a trader might put in a limit order to buy 100 shares if the price breaks a resistance level. Alternatively, a trader might set a stop-loss for his active trade if a support level is broken.

A few tips :

Price is bullish when trading above the pivot point.

Price is bearish when trading below the pivot point.

S1, S2 and S3 are important levels of support.

R1, R2 and R3 are important levels of resistance.

Trading Range S1-PP-R1. Normal Position

Trading Range S2- PP — R2. Oversold / Overbought Position

Trading Range S3- PP — R3. Extremely oversold / Extremely overbought Position.