International Stock Investing GuidelinesPart 1

Post on: 20 Май, 2015 No Comment

How Much of My Portfolio Should I Invest Internationally?-Part 1

Brian, of the Luke1428 website asks,

What percentage of my stock investments, if any, should I allocate towards international stocks and emerging markets (the latter of which seems to have more volatility)?

Brian asks an important investing question. Theres lots of discussion about the importance of diversification. All but the newest investors know about diversifying within your own country. And most of us understand that its important to diversify internationally .

But how should you divide up your portfolio between developed and emerging or developing nations?

In this 2 part series youll get a good idea about the whys and hows of international investing. Today, learn why to invest internationally, the difference between developing and emerging markets, and a drill down into U.S. developing, and emerging markets 10 year performance.

For years, Ive invested in both a developed and an emerging market international index fund or ETF. And choosing the asset allocation percentages is an art, not a science. Its easy to access historical performance yet impossible to know the future. With that in mind, lets figure out how to go about deciding how to divvy up your international stock allocation.

Before diving into the how of international investing, lets break down the why.

Why Invest Internationally?

We Americans tend to be quite egocentric. We tend to think the world revolves around the United States. That is wrong!

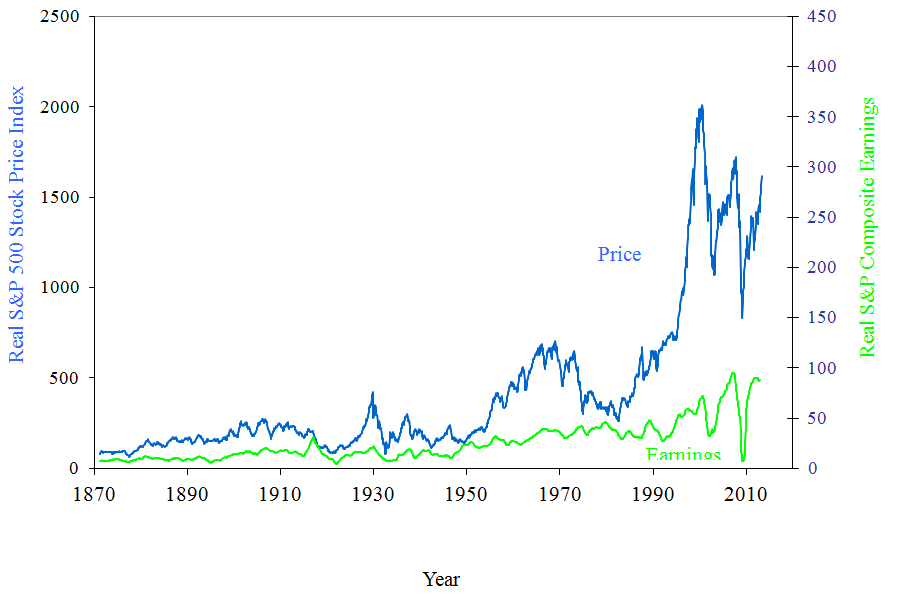

The United States makes up just one third of the entire world stock market capitalization according to Patrick Collins of Greenspring Wealth Blog. And the U.S. is getting a bit long in the tooth. Were not the young upstart country with exploding growth rates. In fact, the countrys 2015 gross domestic product growth, a measure of the U.S. growth rate, is predicted to chug along at about 3% according to the Conference Board.org. According to the International Monetary Fund.org. developing and emerging markets are expected to grow approximately 5.4% in the next year. Thats 2.4% faster growth abroad than in the U.S.

The U.S. is a small component of the larger world investment markets. Naturally, you want your investment portfolio to remain diversified to maximize returns and minimize risk. It would be irrational to ignore the growing international companies.

Whats the Difference Between Developed and Emerging Markets?

So, whats the difference between investing in developed and emerging international markets?

Developed Markets

Developed markets are already established. Think about old European countries such as the U.K. and Germany. Theyve been around a long time with many established businesses. Like older U.S. large companies, these types of firms tend to grow more slowly, have higher dividend payments, and in general, their stock prices are less volatile.

iShares MSCI EAFE (EFA) Exchange Traded Fund

Consider the description of this popular developed market fund, iShares MSCI EAFE (EFA) exchange traded fund by Morningstar analyst, Alex Bryan;

Investors with a high concentration of domestic and Canadian stocks could use iShares MSCI EAFE Index as a core holding. It invests in large- and mid-cap stocks based in developed markets in Europe, Asia, and Australia. This international exposure can help diversify currency, interest-rate, and other local-market risks. Many of its largest holdings are household names, such as Nestle NSRGY. Toyota TM. BP BP. and Bayer AG BAYRY .

In short, developed markets are more stable albeit with lower growth prospects than the emerging markets.

Emerging Markets

Emerging or developing markets are smaller and newer. This asset class is only about 25 years old. Its risk is apparent in the standard deviation of 26%, versus the S & P 500s 18% (higher standard deviation indicates riskier and more volatile price performance). This asset class can be impacted by changes in the value of the dollar versus international currencies (rising dollar hurts emerging markets) as well as international economic events.

India, China, Brazil, and Russia are considered developing markets. Investors in these markets can expect higher growth rates with more volatility.

Comparison of U.S. Developed, and Emerging Market Stock Index Funds

To give you an idea of how the U.S. developing, and emerging markets perform, lets take a look at ten year charts for three index funds which representing U.S. developing and emerging market three asset classes.

- Vanguard Total Stock Market ETF (VTI) is a broad U.S. stock index exchange traded fund (ETF) which is a good proxy for the entire U.S. stock market.

- iShares MSCI EAFE (EFA) is a large and mid cap international developing markets exchange traded fund.

- Vanguard Emerging Markets Stock Index ETF (VWO) is an emerging markets fund.

Notice the spectacular performance of VWO, the emerging markets fund from 2006 through mid-2008 and again between 2009 and 2013. Next, look at how EFA, the developed market proxy underperformed both funds since mid 2011, during the European debt crisis.

The above chart illustrates both the volatility and performance of all three funds. Would you want to invest in just one of those index funds? Of course not. By diversifying the stock portion of your portfolio with U.S. developed, and emerging market funds, youll ensure that you profit from the growth and development of the entire world markets.

In Part 2 of International Stock Investing Guidelines youll receive the allocation steps for the international portion of your portfolio. A one stop international fund will also be presented.

Personal disclosure, I own shares in VTI, EFA, and VWO.

How is your investment portfolio diversified internationally?

image credit for original World Market Cap graph; Greenspring Wealth Blog