International Investing Necessary For Portfolio Diversity

Post on: 4 Май, 2015 No Comment

Gil Armour of SagePoint Financial, Inc. has always felt that international investing needed to be part of a clients portfolio. The first step is determining the percentage of stock appropriate for a clients risk tolerance and age, but once we get that chunk specified, I think roughly a third should be international and the rest U.S.

Armour started as a financial advisor in 1994, and has been including that international flavor to client portfolios from the beginning. If anything, I think its become more important than back then: that everyone should have exposure to all the good investment opportunities around the world. We dont have the market cornered, Armour said.

Its a combination of the risk and reward basis. With any foreign investment, theres always a little more risk and unknown [factors] with currencies and political situations than we have in the U.S. but on the other hand, you can have a little more return if you add a foreign component to a portfolio, he said.

That third portion of client equities devoted to international investing, he adds, could even be thought a bit conservative today: Now, with the U.S. becoming a smaller percentage of the entire global equity picture, just because of emerging and developing economies around the world, you could argue that maybe we should have more like 40% or so. Clients, he said, sometimes get a bit nervous if the allocation gets that high, believing its riskier, which is true to some degree, but not always the case.

Rather than picking individual stocks, Armour uses mutual funds as the primary investment mechanism for most investors because of their professional management and diversification. He adds, And, from day one, since most mutual fund companies have not only U.S. but foreign in their families, Ive always advocated picking from both as we develop our portfolios. He also uses REITs and bond funds, which also provide a similar weighting of about a third in foreign investing components.

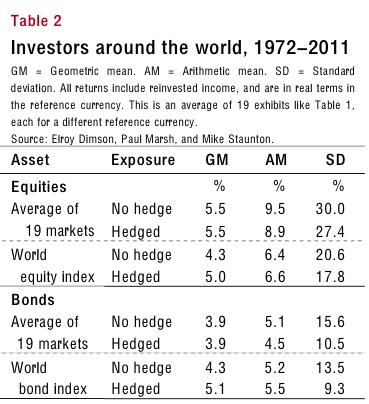

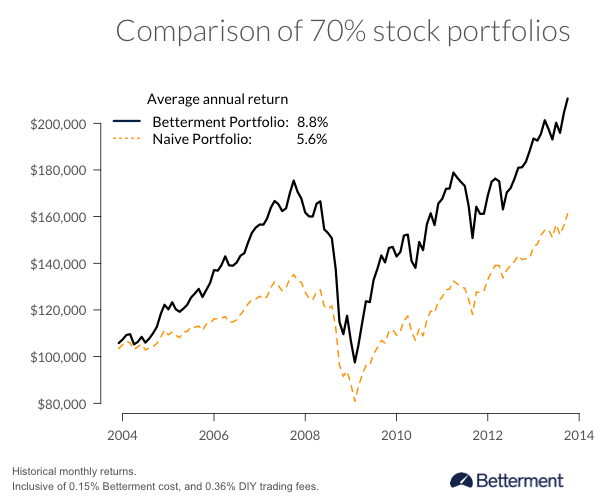

As with other investments, Armour said the return on international investing varies from quarter to quarter and year to year, and depends on weighting. Over the long run, he adds, compared to an all-U.S. portfolio, adding international has provided more return in the form of a higher overall total return and a reduced risk in the form of lower portfolio volatility and fluctuation. That said, he adds, There are years that it works and years that it doesntalso something to be found with other investments.

I try to put most of the burden on the portfolio managers of mutual funds to figure out [which countries or regions to choose]; theyre more tuned in to whats going on than I am, Armour said. Still, he has some thoughts on which countries and regions to seek out or to avoid. Scandinavian countries have been providing some pretty good returns, and over the past decade or so, emerging markets have provided some pretty good returns too, he said.

I think anybody with long-term horizons will agree that emerging or developing economies have a lot more growth potential than the U.S. or Europe: Eastern European [countries], Latin America, emerging Asian, African [countries offer] a lot more potential. Theres a lot more risk there, he concedes; boom one year and collapse the next. You dont want to go too wild with too much. But you should have some exposure to maximize return over the coming decades, he said.

Where does he stay away from? There are some places I avoid now; I wouldnt invest in Greece, but there are a lot of opportunities in Europe that savvy portfolio managers are picking up at bargain basement prices because theyre not appreciated by investors right now. He also avoids investing in foreign currencies.