Intermarket Analysis_1

Post on: 23 Август, 2015 No Comment

Another reason that chartists have such a big advantage in intermarket work is that they look at so many different markets. Charts make a daunting task much simpler. In addition, it is not necessary to be an expert in any of the markets. All one needs to do is determine if the line on the chart is going up or down.

—John Murphy, Intermarket Analysis. Profiting from Global Market Relationships (Wiley Trading, 2004)

Early last week, Gary Dorsch wrote a timely article titled: Chinese Red-Chips Show Signs of Fatigue . In his article, Gary pointed out the parabolic move in the Shanghai stock market and signs of a possible reversal. I especially liked one of his charts (below) that discussed the psychological underpinnings to the reversal because that’s what charting is—the sum of mass psychology.

www.financialsense.com, 11 August 2009

The 5% down day on July 29th for the Shanghai Stock Index was a warning shot and it caught my attention. Why? Because the Shanghai market bottomed four months before our stock market; now it is showing a top. Credit has taken off at an exponential rate in China during 2009 as Gary points out in his article. News the Chinese central bank recently started to issue some sterilization notes has had its due effect. Deflation is caused by the net withdrawal of credit and money supply. There isn’t a net withdrawal in credit and money supply yet for China, but the rate of increase in credit has fallen (356 billion Yuan in July vs. 1.5 trillion Yuan in June) and perceptions have changed along with it.

Monday’s market events mark some key breakdowns and warnings in the wake of China’s credit change. Some of that starts with the Shanghai Composite Index. A double top has formed and completed in the Index. Two additional red flags have formed since the double top. The first is the reversal at the 38% Fibonacci level. When a bear market rally fails to break above the 38% retracement line, it is a bearish indication that buyers couldn’t take back significant control from the bears. The second red flag is in last night’s break below the 50-day moving average—the first time since breaking above it mid-January. The RSI (Relative Strength Indicator ) is currently just below 40 which is typically bullish support. The first sign of a bearish shift in trend can occur with lows near 20 and highs near 60.

The dollar has been in decline since risk appetites started to improve near March. Since then, the Euro, commodities, stocks, and bonds have been purchased without reservation. Now that the Shanghai Composite Index has reversed, risk appetites are abating. It looks like the dollar is near the completion of a 5-wave (Elliot Wave Theory ) move down. I say near, because there is still the possibility that the bearish trend continues to hold here and that the 5th wave can extend on a move towards 74. However, there are some bullish warnings presented in the chart below that are increasing the probability that the dollar is reversing. The possibility of the 5th wave extending diminishes immensely by a break above the 50-day moving average and the bearish trend channel (red).

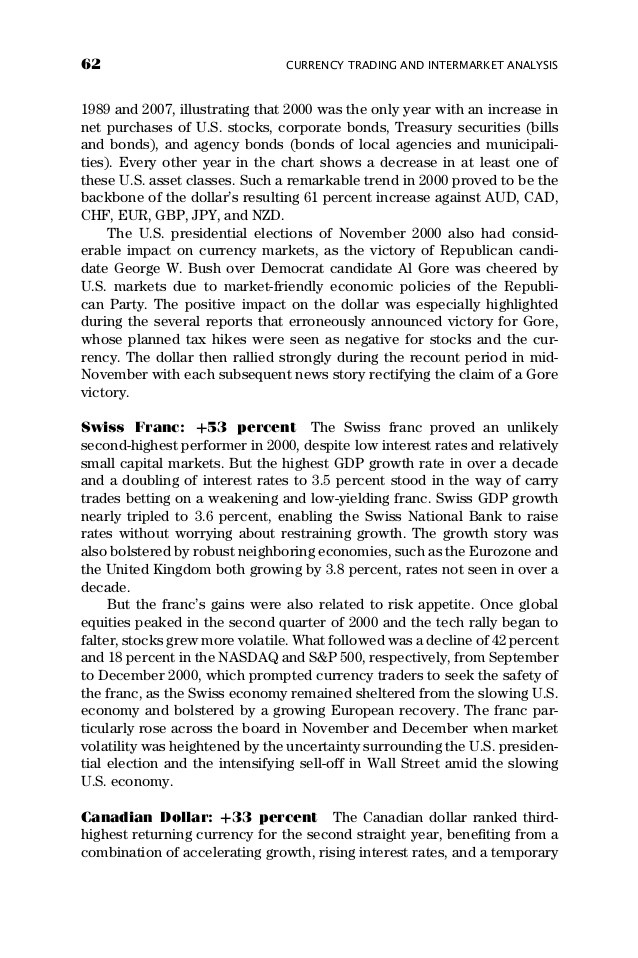

The chart below shows the extremes to which non-commercial traders have gone to bet against the dollar. Just as the dollar experienced a bear market rally in 2005, we have experienced a bear market rally in the dollar from July of 2008 to March of 2009. At the peak in the bear market rally of 2005, large traders went from an extreme position net long and began selling into a break in the rally in 2006 where they became net short the dollar as the dollar free-fell from 88 to 84.

We find ourselves in the same position today: a major bear market rally was broken in the dollar as of May and the dollar bear has resumed its primary trend. Just as happened in 2006, large traders have now become net short the dollar. Is this any reason to be alarmed? Not really. Contract levels are not at bear market bottom extremes yet. At the same point in 2006, we did experience a 5-month consolidation but it was just a small hiccup before the major fall from October 2006 to the bottom in April 2008.

Our S&P 500 has also rallied to a key Fibonacci level of 38%. The difference between the two markets (China’s and ours) lies in the consolidation we’ve already experienced in June/July. Where China’s rally hasn’t released some of its steam until now, the S&P 500 went through a Head & Shoulder consolidation that was formed, but was never completed.

The market internals since that consolidation have been impressive. Volume has picked up, down days have showed little distribution, and new highs have expanded with the market. These are all positive indicators of a healthy rally. Many analysts believe we are in store for a shallow correction due to these market internal indicators and many believe this rally has much more room to go.

Conclusion

The violation of the 50-day average in the Shanghai Composite Index is the first sign we have of a major reversal for intermarket purposes. The Shanghai Composite Index has been a leading trend indicator for global markets since the bottom in the index last October. The break in the 50-day average is a major blow to the bull market recovery story. China’s growth story is earmarked as the demand story for commodities. If China’s market is falling, so can commodities. If the market recovers from this correction, it is likely that commodities may underperform.

The Dollar as well shows warning signs of a reversal, but the sentiment indicators that many deflationist and Dollar bulls are pointing out aren’t nearly at the extremes they would have you believe. Yes, the Dollar is oversold and due for a rally, but risk appetites haven’t been fully satiated in the markets as of yet with a sizeable amount of investors still in cash. Chris Puplava talked about the amount of money market funds sitting on the sidelines in his Financial Sense Market Observation last week titled Balancing Act . In his chart below, he inverted the money market fund series to show a comparison with the market bottom in the first quarter 2009 along with low levels of margin debt. This all shows that we are nowhere near extreme levels for satiated risk appetites. Since the Dollar has been trading with the safety trade story, we can assume that with risk levels still low, there is no need for a major shift back into the safety trade like we saw in July 2008.

Our stock market, as of late, has shown strong market internals since the rally from July 10th. This would suggest that we have a shallow correction ahead—one investors should use to accumulate value. Shanghai led our market recovery by four months. It may be that it’s leading our bear market rally by 3-4 months and that we could see a major top in the U.S. stock market by yearend; maybe on news of a lackluster holiday retail season? I can see it now in which Wall Street’s old adage may apply with a buy the rumor rally (inventory increases and positive GDP) and a sell the news correction (retail disappoints yet again).