Interactive Brokers Review 2015

Post on: 6 Май, 2015 No Comment

A fter using Interactive Brokers for a number of years, I feel that its a good a time to write a review on the popular online discount brokerage . In late 2014, IB finally delivered on their promise to offer RRSPs and TFSAs to Canadians. Although it comes with a $50/year maintenance fee, the low trading fees will be attractive to many investors.

Trading Platform(s):

- The TWS software trading platform is extremely powerful, but a bit tricky to use. Once you get accustomed to the GUI, you will wonder how you ever traded without it. They have demo software on their site so that you can give it a test run before you commit.

- They also have a web based trading platform which is not as powerful but extremely user friendly. The web based platform is convenient when away from your main computer.

Low Trading Commissions

- $1USD/200 shares (US), $0.005 / share > 200 shares (0.05% max)

- $1CAD/100 shares (CAD), $0.01/share > 100 shares (0.05% max)

- Example: 400 CAD shares @ $5/share, commissions cost: 400 x 0.01 = $4, or $5 x 400 = $2000 x 0.05% = $10, whichever is less.

- Commissions can get expensive if trading penny stocks.

Low Margin Rates

- Prime 0.23 on balances < = $115,000

- Prime 0.73 on balances > $115,000

- Prime 1.23 on balances >= $1,150,000 (big wigs)

Low Foreign Exchange Rates:

- Where the big banks will charge up to a 1.25% premium (each way) on top of the exchange rate, Interactive Brokers charges the going exchange rate x 1 basis point.

- 1 basis point = 0.0001 (0.01%) with a min. commission of $2.50USD.

Real time Quotes

- NASDAQ quotes are free providing that you trade at least $30USD/mo worth of commissions. Otherwise they are $10/mo, level II quotes are $20/month

- TSX I quotes are $10/mo, level II quotes are $14.50/mo.

- You can find the rest of the data fees here .

- I personally use my bank brokerage and Questrade for my real time quotes.

- Min commissions are $10USD/mo. If you dont trade at least this amount per month, they will take the difference from your account.

- EFT deposits are FREE, along with the first monthly withdrawal. Fees apply after first withdrawal.

- $50/year maintenance fee for RRSP/TFSA.

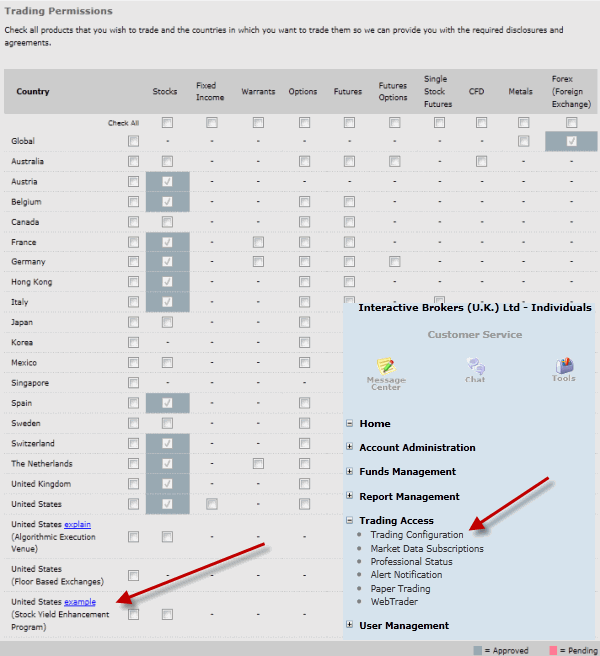

Opening an Account

- Requires $10,000 initial deposit.

- Fairly lengthy initial paper work.

- Deposits take 5 days to get approved (through EFT).

Who is this brokerage suited for?

- Active traders looking to reduce their trading commissions.

- Not suited for penny stock traders as there are cheaper alternatives than Interactive brokers. For example, 8000 shares of a stock @ $0.50/share will cost 8000 x $0.50 = $4000 x 0.05% = $20 in commission + ECN fee on venture exchange.

- You could make the same trade above with E-Trade or CIBC for $9.95 or $6.95 respectively.

- Suited for investors who pay more than $120USD / year in commissions which works out to be around 4 trades / year with the big banks.

- I personally use and recommend Interactive Brokers for active traders as it will save most traders a bundle of money in commissions. The powerful interface along with fast execution times make it an extremely competitive brokerage for traders.

- This platform is not only for traders, long term investors who spend more than $120USD/year in commissions should also consider this brokerage.

- If you are interested in stock trading, check out some of the free stock trading tools that I use .