Integrated Pitchfork Analysis by Dr Mircea Dologa MD CTA Traders Log

Post on: 28 Июнь, 2015 No Comment

Posted By: TradersLog

This article was first published by

We firmly believe that a trader’s consistency must pass through a full comprehension of the context of the market. No action can be taken before we know exactly: where are we now, what phase are we in, and especially, where are we going.

We couldn’t agree more with Charles H. Dow, when he said more than 100 years ago “To know values is to comprehend the meaning of the movements of the market”. William P. Hamilton, the illuminator of “The Stock Market Barometer”, and the Charles H. Dow’s faithful successor as editor of “The Wall Street Journal”, enjoyed quoting one of America’s greatest financiers, “If I had 50% of all the knowledge that is reflected in the movements of stocks (securities), I am confident that I would be far better equipped than any other man on Wall Street”.

In order to have a global view of the market, and then act locally, we tried to create a synergy between the features of the pitchfork and “other tools”.

1. Andrews’ Pitchfork

In the beginning of 1960s, Dr Alan H. Andrews created a 60 pages course, based on the work of Roger W. Babson, which mainly followed the Action and Reaction Newtonian Principle.

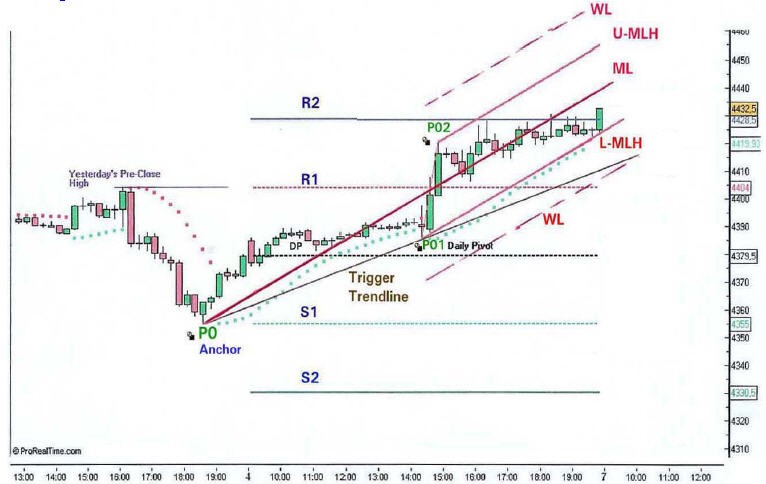

Figure 1 (Click here ) – The pitchfork is a very ergonomic and prolific tool, showing the patterns of directional movements in direct synergy with slant or horizontal trendlines (here shown only daily floor pivots), thus creating, through their intersections, the energy clusters.

If we had to synthesize Dr Alan H. Andrews’ course, in just few lines, we could say:

the median line attracts in a “magnet” like manner the market price.

the nearing of the price towards the median lines, creates, at a time, one of the three movements: reversal, violent piercing or narrow range. The latter, will prepare the next price outburst.

It’s not author’s intention to exhaust here, Dr Alan H. Andrews’ course. We’ll try to expose first, the morphology of the pitchfork, and then later in the article, its indispensable dynamics.

The geometrical structure of the pitchfork is based on three pivots P0, P01 and P02 (ensuing highs or lows), chosen in such a way that the constructed formation, ideally describes the market ( Figure 1). Be aware that the intersections of the median lines and other important trend lines, are creating the energy clusters, which are predominant in projecting the levels where the market price is susceptible to reverse or, on the contrary, to break through, with huge bars, at the high speed of a freight train.

Once we found the optimal three pivots, we draw the median line (ML) from the anchor (P0) through the middle of the P01-P02 swing. The ensuing upper (U-MLH) and lower (L-MLH) median lines are constructed by drawing parallels to median line, from the P01 and P02 pivots. The further parallel lines to U-MLH and L-MLH, are the warning lines, especially needed in high volatile markets. The trend lines drawn from P0 to P01, or from P0 to P02, are named the trigger trend lines and are predominant in the movement of the market price outside of the pitchfork main area. Their breakout engenders low risk high probability trades.

2. Elliot Wave Principle

It’s not really known if Ralph Nelson Elliott, was familiar with Dow’s Theory, which explains the three market movements: the primary trend (tide), secondary reactions (waves) and minor fluctuations (ripples). It can be clearly observed that Elliott Wave Principle has some roots in Dow’s Theory:

market moves in waves are organized in impulsive and corrective patterns.

the five waves of the impulsive pattern are in the direction of the market, where the waves 1, 3, 5 are impulsive, and the waves 2 and 4, correct them.

the three waves, named A, B and C, of the corrective pattern are in the opposite direction of the market. The wave B, corrects the wave A. The wave C, ensues the direction of wave A move.

Elliott Wave Principle is governed by strict rules and guides:

wave 3, can never be the shortest wave of the impulsive pattern.

wave 4 never overlaps the wave 1, in stock market. However, it’s allowed a minor spike overlap of approximately 17%, when trading commodities.

wave 2 can never retrace more than 100% of wave 1.

alternation principle is the guardian of the sanctuary, voiding any wave structure which doesn’t comply with the established rules mainly regarding the architecture of corrective waves, and that of the impulsive waves.

in order to control the lengths of the extensions and retracements of all these impulsive and corrective waves, the Fibonacci ratios are the privileged tools.

Once again, our intention is not to exhaust Elliott’s work in a few lines. After this brief synopsis of his waves’ composition and function, we’ll go through further explanations, while we’ll present the specific market movements.

3. Market’s Context

As we have already emphasized, the context comprehension of the current market is one of the vital points in trading life. It will provide a basis for market analysis defining the exact location at a given moment and the market outlook. Moreover, it builds the frame-work of a disciplined thinking. The dual facets of the context, will be revealed by doing the pre-open preparation which begins at the end of day’s market, and it will be concluded by a last check-up, within the 60 minutes of the pre-open. Before studying the multiple time frames charts (first facet), like weekly, daily and the specific operational time frame (60-min, 30-min, 15-min or 5-min, for index trading), the trader will concentrate on inter-market analysis (second facet of the context). The ensuing day’s development will really not only depend on the fundamentals of the “just closed” market, but also on the “contiguous” markets. For instance, if you are trading European indexes like the DAX, FTSE or CAC40, the “contiguous” markets conditions are: how the S&P 500 closed before Nikkei 225 opened; what was Nikkei’s 225 afternoon behaviour and how it closed; is Crude Oil price cruising along or attaining extremes (once again); is the US dollar still battling the Euro; what are the BUND’s (German Bonds) fluctuations.

Like they say … “always trade where the sun rises … while the others sleep”.

Larry Williams, a great trader and teacher said: “…market movement is a combination of trend, which is a function of fundamental values and considerations and the gut-raw human emotions. Simply put, fundamentals are the father-of-trends and emotions the mother-of-daily fluctuations”

The study of the presented weekly, daily and 60-min charts witnesses a trending bias. The pre-close of the 5-min chart, reveals an up-sloping pitchfork (Figure 2) with a wave three in progress. We can say that the marked is in an overall up-sloping trend and the price is continuing the impulsive pattern, toward the termination of its last wave (W5).

4. Preparing for the Morning Trade

Once we got out of the way, the dual facets of the context, let’s concentrate on detecting our morning low risk high probability trades.

Figure 2 (Click here ) – The Integrated Pitchfork Analysis frame-work (see detailed text below).

The synergy between the pitchfork and “other tools” defines the Integrated Pitchfork Analysis, giving a real edge to the trader. It shows a detailed description of how the market behaves and where it is going.

From the multitude of the “other tools” used, we’ll show on this chart: Elliot waves and Fibonacci ratios (primary and minor waves projections & retracements), multiple time frames floor pivots (daily, weekly and monthly), energy clusters and Stochastics.

Observing the pre-close pitchfork on the figure 2, the following corroborating factors instigate the trader for an imminent long entry, after the opening:

a very steep up-sloping median line.

a triple mirror bar pattern at the last reversal zone (4082 level).

a zoom and re-test of the warning line n° 3 (4084.5 level).

the huge up-sloping bar, having the high speed of a freight train, closing in its upper quarter.

a “holy grail” pullback leaning on our weighted moving average.

an overbought Stochastics, just after the inception of wave 3.

the traditional wave three 1.618 of W1 limit, wasn’t yet reached. The pre-close high at 4090, represents only a 1.500 Fib ratio. Judging after the steep slope of the median line, and the steamed momentum, we can expect an up-sloping morning market reaching at least 2.618 of W1 at 4103 level while topping the upper median line, or even the upper warning lines.

We used the primary W1, the minor wave w1 and w5 of W3 and the prior trend correction Fibonacci ratios, to better pinpoint the termination level of wave 3.

a strict pitchfork observance will imply that the price projection of the ongoing steep slope market move, will have enough saved energy to reach the upper warning lines (WL-01 or WL-02). If it fails to attain these levels, it will be a great proof of market up-sloping failure, and an excellent opportunity for a low risk high probability short trade.

5. Execution of the Morning Trade

The ideal pre-arranged entry for the morning trade (Figure 3) is at 4090.5 level, one tick above the high of the day’s huge last bar (close) level with a stop loss two ticks under the day’s close (4087 level). We will try to play with market’s money, as soon as possible. We will enter a break-even stop with an ensuing cancellation of the already existing stop loss. Its value is one Average True Range bar ATR(21) – having a size of 4-6 points, on this particular time frame. This value will only guide us, in the process of hiding behind an ongoing bar’s low. Its location will probably be around 4095 level (4090.5 +5 points).

The market opens through a “Oops phenomenon” – an opening below the prior day’s close, followed by a market counter move filling of the just opened gap.

For aggressive traders, there is a possible long trade opportunity of entering at 4088.5 level (one tick above previous day’s close) with a stop loss at 4087 level (opening bar’s low). We have rather chosen a more conservative trade.

Figure 3 (Click here ) – The “three pawns technique” is the basement of consistent trading. It consists of a progressive order of entering the market, as soon as it is propitious, with three types of orders: trade entry (long here), stop loss order and profit target order.

The first target of two trading units (out of three), is chosen at the multi-level cluster around 4100 level, due to: floor pivot cluster (daily R1, weekly and monthly), W3 extension of 2.618*W1 and because 4100 level is a whole, easily mmorized value. Once the exit level is defined, the trader will enter immediately a pre-arranged order. There is no second target. We’ll let the market come to us and be trailed out, for the remaining one trading unit.

Figure 4 (Click here ) – The market shoots straight up, right through the opening. In only fifteen minutes (out of 11 hours daily trading time), it already travelled more than 20% of the daily trading range.

As we have expected, the pre-open steamed momentum catapulted the price, in only 15 minutes, right through the target n° 1. We were exited with the two trading units at the 4100 level. The remaining one unit is waiting to be trailed out.

Figure 5 (Click here ) – The high steamed market is continuing its move behind the W3 extension of 2.618 of W1.

Figure 6 (Click here ) – The role of Integrated Pitchfork Analysis is clearly stated here; the market’s high steamed momentum was suddenly stopped at the energy cluster formed by: pitchfork’s warning line n° 2 and the multi-levels Elliott waves extensions.

This high momentum market (Figure 6), was halted at the 4108.50 level, which coincides with a multi-levels cluster: the W3 extension of 3.00 of W1, the correction of the prior trend of a 1.382 Fib ratio and an elongated w5 minor wave of W3 ( 9.00 of w5). We can clearly see here that the use of the pitchfork is predominant in establishing an energy clusters. The advance of wave three stopped exactly at the warning line n°2

Before stopping completely, ensuing a reversal, the market formed a trading range (not seen here), with a “last gasp” move to 4110.5. The upper median line served again, as a strong overhead resistance, causing the reversal of the over-extended wave three (3.25 of W1).

6. Money and Risk Management

Let’s talk a moment about money and risk management. We have expressly chosen a very tight stop loss of 3.5 points (75 euros), instead of the usual six to eight points, because of the omnipresent risk of the high steamed market momentum. The reward will come to 9.5 points per trading unit, against a risk of 3.5 points, giving a reward / risk (R/R) ratio of 2.7. One should never trade this volatile futures market using a R/R ratio below 2, because of the omnipresent risk due to the high leverage. Why should you take a high risk ? There is always another trade !

Concerning the P&L statement, the total number of trade points is 29.5: 19 points for the first two trading units, and 10.5 points for the third trailed out unit, an overall amount of 737.50 euros, around 870 of nowadays US dollars.

Every trader should have only one “credo”: in this business you only make money if you don’t consistently lose money. This can only be accomplished through the use of risk control and money management. Most of the novices can hardly understand, that the business of trading is the only business where the losses are planned and it is quite normal to lose money, as long as you have and you master the most adequate tool(s) to your kind of market. For today’s trade the tool was the Integrated Pitchfork Analysis.

Dr Mircea Dologa is a commodity trading advisor who founded a new teaching concept, for young and experienced traders at www.pitchforktrader.com. He can be contacted, for any questions at this Email: mircdologa@yahoo.com