Institutional Investors And Fundamentals What s The Link Yahoo She Philippines

Post on: 8 Июль, 2015 No Comment

Many investors quickly learn to appreciate the significance of institutional shareholders — the mutual funds, pension funds, banks and other big financial institutions. These types of investing entities are often referred to as smart money and are estimated to account for as much as 70% of all trading activity. This professional stock buying is called institutional sponsorship and is believed by many stock watchers to send a strong message about a companys health and financial future.

However, investors with a fundamental approach need to understand the connection between a companys fundamentals and the interest the company attracts from large institutions. Institutional sponsorship, often driven by factors other than fundamentals, is not always a good gauge of stock quality.

The Dependability of Institutions

The argument that institutional sponsorship signals strong fundamentals makes a lot of sense. Big institutions make their living buying and selling stocks. Working hard to buy stocks that are undervalued and offer good prospects, institutional investors employ analysts, researchers and other specialists to get the best information about companies. The institutions meet regularly with CEOs, evaluate industry conditions and study the outlook for every company in which they plan to invest.

Besides, the institutions with large stakes have a stake in increasing the value of their shareholdings. Big institutional investors can exercise significant voting power and impact strategic decision making. These shareholders tend to promote value-driven decisions and create shareholder wealth by ensuring that management maximizes the stream of earnings. Broadly speaking, research shows that high ownership concentration generally leads to better monitoring of management, leading to higher stock valuation.

Academic research suggests that institutional holdings pay off. In their study Does Smart Money Move Markets?, which was published in the Spring 2003 edition of Institutional Investor Journals. Scott Gibson of the University of Minnesota and Assem Safieddine of Michigan State University compared changes in total institutional ownership to stock returns over the each quarter from 1980 to 1994. During the 15-year period, stocks with the largest quarterly increase in institutional ownership (about 20% of all stocks) consistently posted positive returns.

William J. ONeill, founder of Investors Business Daily and creator of the CANSLIM stock selection methodology, argues in his book How to Make Money in Stocks (1988) that it is important to know how many institutions hold positions in a companys stock and if the number of institutions purchasing the stock now and in recent quarters is increasing. If a stock has no sponsorship, the odds are good that some looked at the stocks fundamentals and rejected it.

When the Dependability Becomes Instability

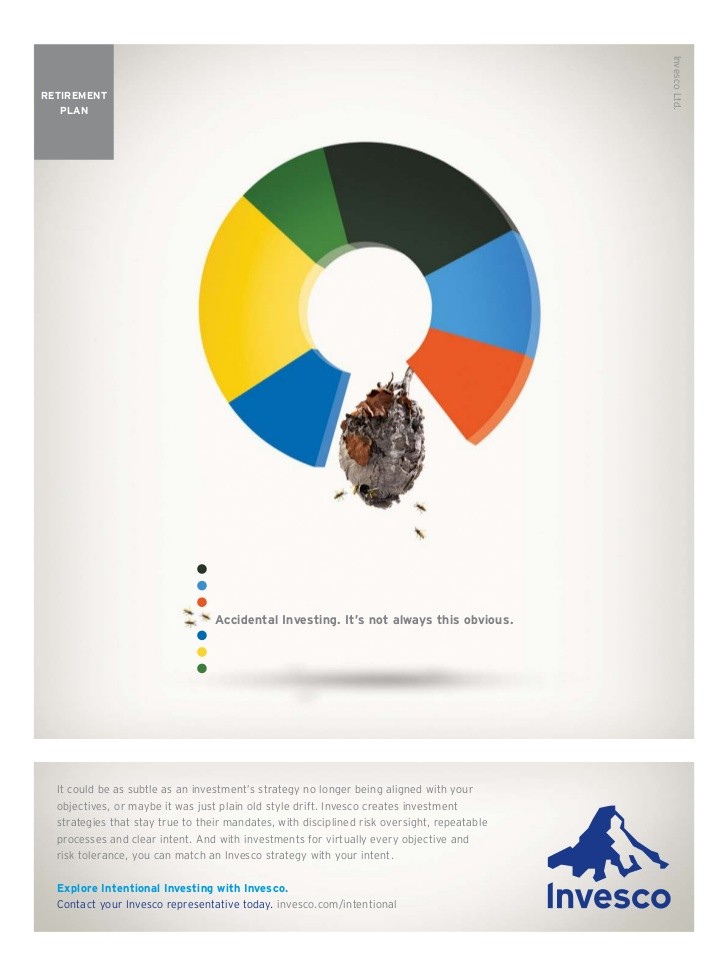

Of course, you can have too much of a good thing. ONeil is careful to point out that while institutional sponsorship is attractive, a lot of institutional ownership can be a sign of danger. If something goes wrong with a company and all the institutions holding it sell en masse. the stocks valuation can tank — regardless of fundamentals.

Think of a stock as a swimming pool. The water level is analogous to the stock price, and elephants represent institutional investors. If the elephants suddenly start stepping into the pool (buy the stock), the water level (the price of the stock) will rise very quickly. However, if the elephants get spooked and leap out of that pool (or sell the stock), then the water level (price of the stock) will fall rapidly.

Remember, institutions are not only investors but also traders. In principle, they will put money into stocks only after lots of fundamental analysis, identifying where the stock price should be and compare that to where it is. In practice, however, they often forego fundamental analysis for the signals emitted by technical indicators. Because their main worry is whether the stock price is going up or down, institutions will often concentrate on whether the price direction has any momentum.

A stock with a lot of institutional support may be close to the peak of its valuation, or full of elephants. When every mutual and pension fund in the land owns a chunk of a particular stock, it may have nowhere to go but down. Look at the meltdown of technology stocks in 2000 and 2001. Companies like Cisco, Intel, Amazon and others had an unprecedented amount of institutional sponsorship, but as the subsequent collapse of their share price demonstrated, they also had unattractive fundamentals.

The legendary investor, Peter Lynch, thinks institutional investors make poor role models for individual investors. In his best-selling book One Up on Wall Street, he lists thirteen characteristics of the perfect stock. Heres one of them: Institutions Dont Own It and the Analysts Dont Follow It. Lynch brushes aside the notion that companies without institutional support carry the risk never being discovered: he argues that the market eventually finds undervalued companies with solid fundamentals. These companies are never out of sight for long. By the time institutional investors discover these hidden gems, the companies will no longer be hidden but fairly valued, if not overvalued.

Finding Out Who Holds the Institutional Sponsorship

It all comes down to the quality of institutional sponsorship. With a little extra research, investors can find out which institutions own the stock. For spotting companies with good fundamentals, you can determine if the stock is owned by funds with good track records.

One way to see if a stock has some institutional support is by checking its trading activity for block trades. A block trade, which is a single trade of a large number of shares, typically has a value of at least $100,000. Normally only an institutional investor has the money to buy such blocks.

Otherwise, visit Multex Investor, which provides a list of links to research reports online, some of which may identify institutional holdings. Many of the Multex reports are free.

Of course, the easiest way to find out if a company has some institutional sponsorship is simply to ask it. Often the companys investor-relations web page will provide a listing. Otherwise, ask the companys representative if any of its shares are held by mutual funds, pension funds or other institutional investors. He or she should be able to tell you which institutions are shareholders.

Although logic and statistics show that institutional sponsorship is a good indicator of a good company, investors should be aware that institutional investing is not always driven by quality fundamentals. Before you depend on the assumption that smart money is the leader in judging fundamentals, make sure you determine whether the institutions are investing for the same reason you are.

More From Investopedia