Instant Intermarket Money Flow Reaction to Federal Reserve

Post on: 14 Июнь, 2015 No Comment

Instant Intermarket Money Flow Reaction to Federal Reserve

Sep 18, 2013: 3:37 PM CST

We like to study money flow from a cross-market standpoint to pinpoint where money is entering and where money is leaving.

Often, large events such as the Federal Reserve policy announcement no taper (QE3 continues without changes) is a catalyst for rapid money flow shifts across all markets simultaneously.

Lets review the instant reaction, state the typical QE3 Thesis, and view the sudden yet somewhat predictable reversals based on the outcome (no taper) we saw today.

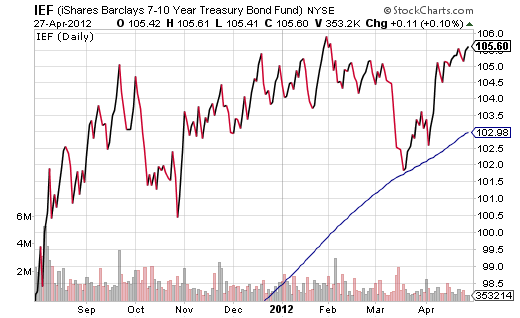

Though weve seen Gold diverge with Stocks and Oil since November 2012. the typical QE or Quantitative Easing Money Flow thesis holds that additional stimulus from the Federal Reserve historically has boosted (elevated) stock prices, gold prices, and oil prices at the expense of a declining US Dollar Index.

Todays sudden No Taper announcement returned the markets to the historical QE Thesis Money Flow or sudden Risk-On Reversal.

After the announcement, we saw a sharp and sustained spike Money Flow into US Equities, Gold, and Crude Oil (just to focus on the four markets not including Treasuries).

At the same time, we saw a breakdown and collapse in the US Dollar Index under the critical 81 support level.

The 30-min Cross-Market Charts above show not just the instant reaction, but the ongoing trends going into todays policy announcement.

Money consistently flowed INTO Stocks but OUT OF Oil and Gold (partially in response to the cooling off of tensions in Syria which helped spike Gold and Oil prices temporarily).

If we stretch the perspective back, we can see a broader picture of short-term Money Flow:

The hourly charts above begin near early August and continue to September 18ths Fed Policy Announcement.

The Syria Trade resulted in money flow out of stocks and into Gold and Oil as tensions escalated, and then reversed course (money flow out of gold and oil and into stocks) as it became clear the United States would not strike Syria (tensions would not escalate).

Now, the shift in money flow resorts back temporarily to the QE or Quantitative Easing historical relationship at least immediately after the announcement where stocks, oil, and gold traded sharply higher together at the expense of the US Dollar Index.

Continue monitoring these sudden reversals in the short-term trends, particularly with the breakout to all-time highs in the SP500.

For prior update posts on this topic, see the following:

Join fellow members to receive daily commentary and detailed analysis each evening by joining our membership services for daily or weekly commentary, education (free education website). and timely analysis.

4 Responses to Instant Intermarket Money Flow Reaction to Federal Reserve

[. ] we saw from yesterdays Instant Intermarket Update after the Federal Reserve Announcement, traders reacted bearishly as would be expected with the announcement that [. ]

[. ] we saw from yesterday’s “Instant Intermarket Update after the Federal Reserve Announcement,” traders reacted bearishly – as would be expected – with the announcement that QE3 will [. ]

[. ] we saw from yesterdays Instant Intermarket Update after the Federal Reserve Announcement, traders reacted bearishly as would be expected with the announcement that [. ]

[. ] actually discuss this surprise retracement up fueled by the Federal Reserve announcement that QE3 will continue indefinitely both from a breakout traders perspective and a trader looking to establish a [. ]