Insider Alert The

Post on: 16 Март, 2015 No Comment

Posted by M Fish on Jun 29, 2013 @ 12:19 pm

a Great service that delivers.

Posted by Sumflow on Sep 7, 2012 @ 4:00 am

All of the insider stocks show profits now. The longest holding, 164 days the shortest 16 days. The biggest winner 86 days. Some are stocks that have been insider trades in the past, others are new.

We bailed out of one major fast food chain that had previously shown no evidence of insider buying competence, has recently traded below its original, stop out price.

No visual aids or improvements to the text only website. The insider alert has added a forum of its own at the Oxford Club, which is why I have not reported here in a few months.

Posted by Sumflow on Mar 31, 2012 @ 4:00 am

In the beginning I speculated that when building a new portfolio would it be better to put an equal amount of funds into each recommendation right off, or just take each now trade one at a time. Last summer when the US dollar’s creditworthiness was downgraded. We were stopped out of everything simultaneously. The course that naturally evolved getting back in, and has worked well, was to take each trade as it came up one at a time. Investing about 15% of the portfolio in each stock until we had our full position on.

That is to say the size of each position in the portfolio starts out about 1/6 of the whole pie and is left to grow on its own from there.

You can be pretty sure that on your winners you will have the opportunity to make the choice to take a quick 10% gain or to let it ride for more on a trailing stop or get stopped out.

Warren Buffet on diversification

Warren Buffet

Once you are in the position of evaluating businesses, (which is essentially what Alex helps us to do), anyone working with normal capital, who is willing to bring the effort, intensity, and the time necessary to get that job done, six stocks is plenty. Going into more without putting more funds into your best stock has got to be a mistake.

Trading a tight portfolio of income producing insider stocks will cut transactions costs and save time over being spread thin with many stocks and investing theories. The idea is that you have to have a bet on big enough in each company to make a difference or you might as well own an index.

Insider Orphans

When an insider buys they have to report within two days and cannot sell for a year. Insiders often buy before the point of maximum pessimism so prices can go lower after insiders buy. The method that we use can withstand a drawdown of only 20%. When securities go ex dividend prices almost always dip. If this occurs when we are close to our stop we may get kicked out right at the time that we should have been getting in. When we are stopped out after an ex –dividend date, and before the dividend has been paid. When the dividend arrives the corpus is gone. It comes in as an orphan. Three months later this dividend pays dividends, and three months after that they both pay more dividends. Some insider orphans dividends are up 30% and 15%.

Just about all of the insider stocks show profits, most of the time, because when they don’t the stops take us out.

Posted by Sumflow on Mar 13, 2012 @ 8:00 pm

The Insider Alert as it is today is all text. That is to say it totally ignores the right (creative) side of the brain. Many brokerage accounts have evolved to feature charts and diagrams showing the effect on stock prices after Insiders buy. But Alex’s Insider Alert remains mute to the visual recognition side of the human brain. No video’s, charts, graphs, or links. The only enhancement I have seen is a lame attempt at a print view button. Nothing that appeals to the right hemisphere of the brain. It has all of the sophistication necessary for an Apple II, before the Internet. Alex’s current insider alert could have been sent out by fax (which came later). In no way shape or form, is the Insider Alert state of the art in appearance, or even from this Century. You would expect more from a premium product.

They always talk in terms of current open profits, which can be substantial but misleading. I must admit I often find it hard to get in on the same day as the Alert, or at there prices on the winners. There are many reasons for this. It may not come with enough time left to place an order. Price may take off before the email arrives or it is posted to the web site. I do not know what day or time each weeks alert will arrive so I may not be sitting at my machine, with liquid funds and my finger on the trigger ready to buy when the trades taking off the fastest arrive. I could be out driving my sports car, I could still be asleep.

Currently in my own account, one stock (on hold) is up over 41% where it has been before, with another up over 16%, the third winner up over 10%. I have gotten use to seeing double digits in the longer held insider securities, and losses on the new ones. We have five stocks. You don’t see losses on the longer holdings because they get stopped out. We give a lot back with our stops, but that is how trailing stops lets profits run. Last summer we were stopped out of everything at once. Although sequential new trades showed profits almost immediately, it took months to over come the losses from the drawdown, which is never mentioned.

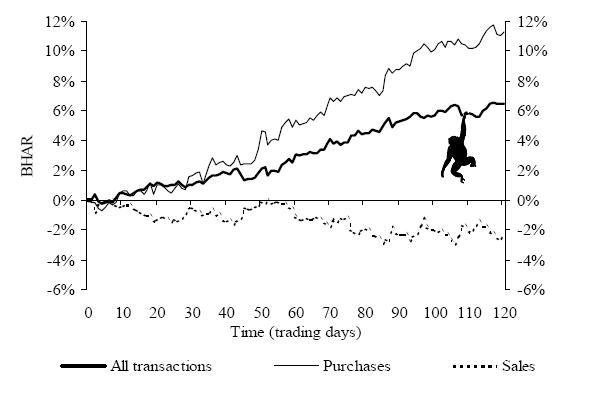

Probably because of the popularity created by Peter Lynch, you can now easily find out what insiders are buying, and a Google search on the company and form 4, will show you the companies filing. Of course you need to know which companies to watch and which insiders in those companies. To help you some sites list the effects on price after specific insiders buy. They will give you the Predictive Insiders and the results they have achieved before. Many have easy to see charts with variables chosen by the chartist. The main thing you want to see is buying without exercised options. You want to know when they go out with there own cash and buy stocks because they think they are going to go up soon. No one knows better than the insiders, unless it’s the government about to do some big deal.

The Insider Alert has some old advertising running around about speculating with $1,000.00 in each recommendation and ending up with a ton of money. But that is with $1,000.00 in each stock, as well as $1,000.00 in each option, for many specifically chosen years. Whenever you hear these outrageous claims do the math. If there was one new recommendation every two weeks, in three years alone you might need over a hundred and fifty thousand dollars to try this $1,000.00 bet. You might need twice that in six years.

Many times because I get in at a higher price than on the day of the alert. The published trade will show a gain when stopped out where I will actually show a loss. Running a twenty percent stop you can report a trade up 10% unrealized for weeks and realize a 10% loss on the stop out. You can also lose 20% at the beginning. It takes to 10% winners to cover that one loss. The stop has to stay back if we are going to be in for the big moves. The Insiders feel and act on the turns in there business, who knows how long before the market reacts?

I was told that when Insiders buy they cannot sell for a year. I do not know if they cannot sell the shares that they just bought (last in, first out), or if they cannot sell any of there previous holdings (first in, first out). But many of the Insider Alerts stocks may get recommended again after being stopped out, depending on further insider buying, and what it is up against that week. So you might want to watch these after getting out. There is only one reason insiders buy, but that does not say much about insiders timing. It does not say why they bought, when they bought. The visual charts not used by the insider alert, show what has happened before when insiders buy stock.

Insiders unrealized gains do not well reflect realized returns. But they are consistent and you could get double-digit gains in almost all winners if you do not wait to be stopped out, but get out earlier. But of course if you jump out every time a stock trades up ten percent you will be sitting around in cash most of the time, and miss out on the many that go twenty, thirty, or as the case with our current summer holding 40%. And if you sell out at 10% to buy the next new pick, there is no telling it will out perform what you just sold. That is it may take longer to get to 10% than the proven winner that you just sold gets to 20% or beyond.

The Oxford Insider Alert support email contact is pretty much non-responsive. Tech phone support doe not use the product. In all the time that we have been following this, despite what phone support says. We have not had any sell orders. Alex has not told us to sell anything that we owned. The Insider Alert uses trailing stops, and this is the only way that we close out positions. When an Insider Alert says to sell something we are already stopped out of it.

Posted by Sumflow on Dec 10, 2011 @ 8:00 pm

www.cbsnews.com/video/watch/?id=7388130n

www.c-spanvideo.org/program/InsiderTra .

The loophole in which members of congress and legislative staffers are immune from enforcement of insider-trading laws, is because the delayed reporting of securities transactions by congress, defeats, obstructs, and impairs its use as timely evidence. Insider-trading cases are hard to prove, because the trades must be tightly linked to the events or information on which they are allegedly based. Trades need to be disclosed in real time or near real time, so that the memories of potential witnesses are fresh and suspects do not have time to cover up their actions. The SEC, which conducts most insider-trading investigations, urged faster disclosure of stock trades by members of Congress on electronic, searchable forms. This is why no Congress people were investigated under the current laws.

The media and congress consider the same group of insiders that we monitor, the benchmark of excellent trading in the stock market. If they succeed in getting congress insiders to report promptly, just as corporate insiders do now, this will just be one more tool we can use to continue to out perform the insiders ourselves.

Coming into this week my leading insider stock is up almost 17%, another 11%, almost 6% on the third, 2% and our last purchase is down 5% with a bullet. Two options, which I did not take, were half cashed out up over 100%. My experience is that a few options come in, but they do not make enough to cover the expense of buying them all as recommended.