ING Groep Poised To Outperform The Market In 2015 ING Groep N V (NYSE ING)

Post on: 7 Июнь, 2015 No Comment

Summary

- Strong operational performance in 2014 will further improve in 2015.

- Competition among mortgage lenders in the Netherlands is declining.

- Strong balance sheet and capital ratio’s support future dividend payments.

- Conclusion: ING Groep is poised to outperform the market in 2015.

The year 2014 was both a turbulent an profitable year for investors. For example, the Dow Jones Index (NYSEARCA:DIA ) and S&P 500 (NYSEARCA:SPY ) closed near all-time highs last week. In Europe, the indexes did not reach new all-time highs yet. Still, European stocks performed well this year as well. With only a few trading sessions left in 2014, it is time to look ahead to the year 2015. In my opinion, stocks are somewhat expensive right now; however, there are still quality stocks trading at attractive valuations. For example, I am quite positive about ING Groep NV ( ING ) and the stock’s ability to outperform the market next year.

ING Groep is a financial institution, headquartered in Amsterdam (the Netherlands), providing all kinds of services for its clients. These services include banking-, investment-, life insurance- and retirement services. The company has an international presence. However, ING Groep runs its main operations in the Netherlands, Belgium and Germany. Further, ING Groep holds two major stakes in Voya Financial (NYSE:VOYA ) and NN Group (OTC:NNGPF ) besides its ongoing operations. Voya Financial is also know as ING U.S. and NN Group is the former insurance business of ING Groep.

2014

In 2014, ING Groep completed the required restructuring of its business and organization. During the latest financial crisis, the company received billions in financial aid from the Dutch government. As a result, ING Groep had to restructure and divest several of its businesses, in accordance with this ruling of the European Commission. For example, the repayment of the financial aid was due within a set repayment term. On November 7, ING Groep managed to repay the last tranche of the financial aid six months earlier than expected.

The repayments of the financial aid to the Dutch government were for the most part financed through the partial divestment of Voya Financial and NN Group. ING Group currently holds a 19% stake in Voya Financial, after selling an additional 30 million shares for the total proceed of $1.2 billion in September and 34.5 million shares for the total proceed of $1.4 billion in November. Further, ING Groep raised 2.0 billion ($2.5 billion) in gross proceeds from the Initial Public Offering of NN Group in July.

According to ING Groep, repayments were also financed through net profits and additional raised share capital. As a result, ING Groep’s balance sheet remained strong despite the full repayment of the financial aid. Not surprisingly, ING Groep managed to comfortably pass the latest Asset Quality Review and stress test; both were part of the mandatory Comprehensive Assessment conducted by the European Central Bank and the European Banking Authority.

2015

Now, why do I believe ING Groep will outperform the market next year? First of all, ING Groep’s underlying performance has been very strong for some time now. During the first nine months of 2014, ING Groep managed to increase its underlying result from its core banking activities by 16.5% to 2,876 billion ($3,523 billion). According to ING Groep’s third quarter earnings report. the strong operational performance was driven by improved margins on savings and lending (banking activities).

ING Groep’s underlying income from banking activities depends strongly on the performance in the Netherlands. For example, the banking activities in the Netherlands contributed for about 40% to the company’s total underlying result in the third quarter of 2014. Due to political developments and new lending criteria for mortgages in the Netherlands, I believe that ING Groep’s margins on savings and lending will improve even further next year.

After the financial crisis, politics in the Netherlands dictated stricter criteria for mortgage lending. Nowadays, mortgage lenders may not lend more than 102% of the value of the property. For sure, this limits the total amount of new mortgages. However, these measures should have a positive effect on margins of existing mortgages in the Netherlands, because these stricter criteria also apply in case existing home owners need to refinance their mortgage.

Existing home owners are free to transfer their mortgage to another lender after their fixed interest term expires. Prior to the stricter criteria for mortgage lending, the other lenders were able to offer a competitive interest rate, based on more than just the value of the underlying property. For example, current and future income potential were important criteria to estimate the risk profile of the possible transaction as well.

Now, there is a very strict requirement that mortgage lenders cannot lend money in case the total mortgage amount exceeds 102% of the value of the property, regardless other qualitative criteria such as current and future income. Even when a client can easily afford the interest and repayments, the mortgage lenders are held to the dictated criteria and cannot accept the new client. Only when the client repays the mortgage to an amount less than 102% of the property value, the mortgage can be refinanced by another lender.

Since home prices fall sharply over the past years, most of the existing mortgages for whose fixed interest term will expire in the next couple of years cannot be refinanced by another bank, because the value of the property is below 102% and the home owners has not enough savings to repay the difference between mortgage and value of the property. As a result, home owners are required to stay with their current lender. In other words, there is almost no competition in this particular part of the market and banks are not triggered to offer a competitive interest rate to existing clients. In my opinion, the lack of competition will have a positive effect on mortgage lending margins.

My expectation regarding the margin on ING Groep’s savings and lending business is also based on the assumption that interest rates on saving accountants remain historically low (see graph below). The graph below shows ING Groep’s interest rate on condition free saving accounts (orange line) compared to the average interest rate on comparable accounts in the Netherlands.

Finally, ING Groep should start paying dividends as of next year. ING Groep’s strong capital ratio’s provide support for paying dividends out of the company’s income from continued operations. My expectation regarding a potential dividend is supported by Seeking Alpha contributor The Investment Doctor see this article ). Since the company repaid all financial aid to the Dutch government,shareholders should (in)directly benefit from any additional income from the sale of the remaining stakes in Voya Financial and NN Group as well.

ING Groep confirms it commitment to pay a dividend in its latest conference call :

So we’re on track in terms of most of these elements. And therefore, we remain with the policy to pay a minimum dividend of 40% of profits over the financial year 2015, comprising both an interim and a final dividend in cash.

Let’s assume ING Groep to earn $1.40 per share next year (source: FT.com ). The dividend payment for the year 2015 will be $0.56 per share, a healthy yield of 4.17%.

Sanity checks

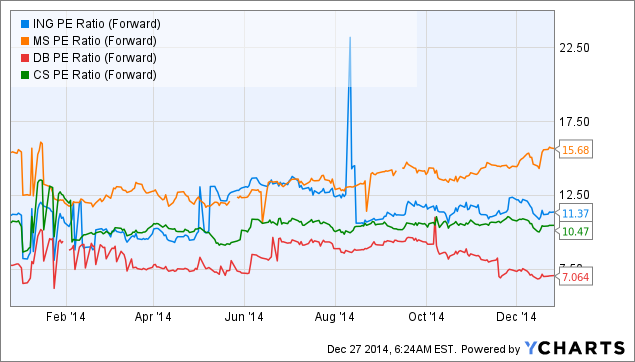

To place ING Groep’s current valuation into perspective, I provide two ‘sanity checks’ (price to book value and forward PE ratio). My peer group exists of Morgan Stanley (NYSE:MS ), Deutsche Bank (NYSE:DB ) and Credit Suisse (NYSE:CS ). I choose these three foreign banks based on their comparable market capitalization and because no comparable Dutch banks are listed or actively traded.

My first sanity check shows that ING Groep trades at an average price to book value ratio of 0.853 (see graph above), compared to Morgan Stanley at 1.113, Credit Suisse at 0.902 and Deutsche Bank at 0.508. The reason for Deutsche Bank’s lower price to book value might be the fear among investors for the required additional capital. I conclude that ING is not overvalued compared to the peer group, based on its current price to book value.

My second sanity check shows that ING Groep trades at an average forward PE ratio of 11.37 (see graph above), compared to Morgan Stanley at 15.68, Credit Suisse at 10.47 and Deutsche Bank at 7.06. Please note that I believe ING Groep should be able to beat the assumed net earnings of $1.18 per share. Net earnings of $1.40 to $1.60 should be more realistic. Therefore, I believe ING Groep trades at a discount compared to the peer group based on its forward PE ratio.

Conclusion

In my opinion, ING Groep will outperform the market next year. The company will continue to improve its strong operational performance, especially in the Netherlands were competition for mortgages with an expiring fixed interest term is limited and saving rates are likely to remain at the current low levels. This should have a positive effect on ING Groep’s savings and lending margin and improve the operational performance. Further, ING Groep has a strong balance sheet and should start paying dividends next year. Based on my sanity checks, I find that ING Groep is attractively valued compared to its peer group as well.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.