Infographic – Sprott ETFs

Post on: 4 Апрель, 2015 No Comment

GOLD

1 Gold has endured.

Gold is indestructible, possesses a high value-to-weight ratio (which makes it easy to store and transport), is not anyone’s liability, and, most importantly, has provided protection against the destruction of wealth for centuries.

2 Devaluation of currencies.

The U.S. dollar is generally viewed as the world’s reserve currency and thus anchors the world’s monetary system. If you consider the U.S. federal government debt of more than $17 trillion and a sizeable budget deficit, it would appear that this currency may not be as stable as once believed. In addition, the implementation of zero interest rate policies and quantitative easing has been adding to instability concerns.

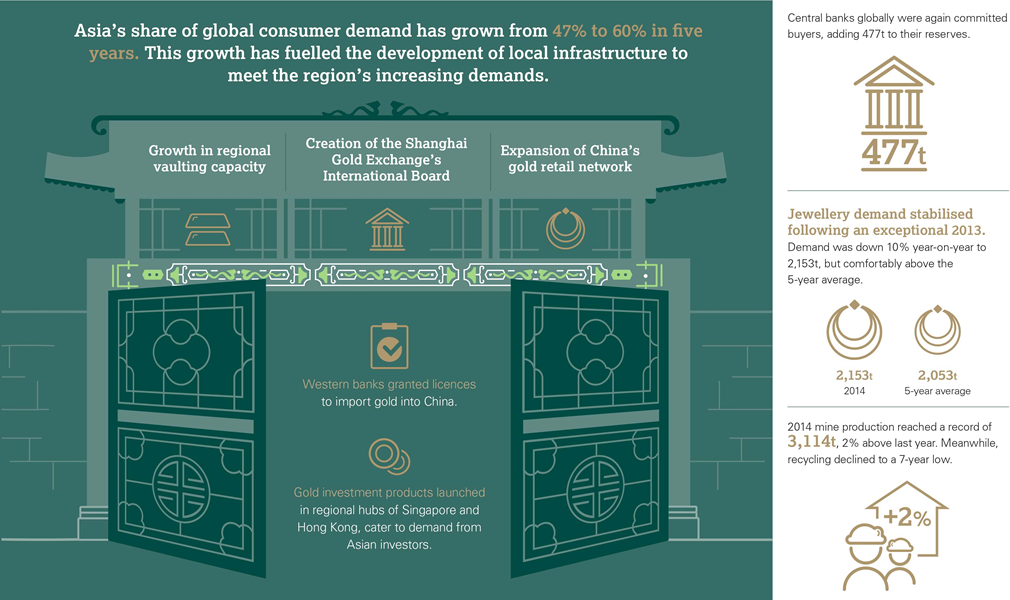

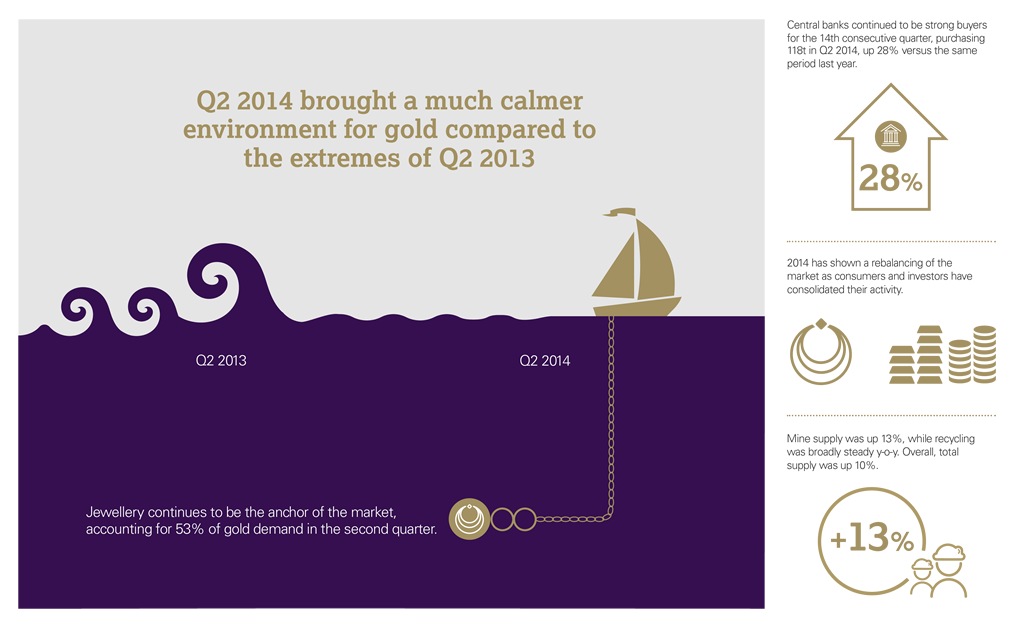

3 Accelerated gold purchasing by Asian central banks.

The enormous concentration of U.S. dollars in the reserves of a number of Asian and Middle Eastern central banks in conjunction with low gold exposure resulted in them becoming major purchasers of gold in recent years.

4 The physical demand charge is being led by China.

This is highly significant because in China, the world’s most heavily populated country, the demand is growing more rapidly than in every other country of significance and the country has a deep cultural affinity for gold. Gold imports into China via Hong Kong have reached an annual rate of well in excess of 1,000 tonnes which represents roughly 50% of world mine production outside China. India, the world’s second most populous country, had been the world’s largest importer of gold until 2013 when onerous taxes have sharply reduced flows into the country.

5 Mine supply growth has been nominal, with few

significant discoveries.

Despite strong demand and a significant increase in the price of gold over the last decade, the mine supply growth has been nominal. Much of the high grade, easily accessible gold in the earth’s crust has already been mined and finding economically-viable, large new deposits is more difficult and increasingly rare.

GOLD MINERS

6 Gold stocks provide exposure to gold price.

The price of gold is a key factor driving the overall profitability of gold mining companies, and their stock prices. When gold rises, gold equities have the potential to provide significant exposure to the increase. Assuming that in the short term mining company’s expenses are constant, an increase in the price of gold contributes directly to company profits.