Indexed Annuities Vs Mutual Funds

Post on: 15 Апрель, 2015 No Comment

At first glance, it may seem that indexed annuities and mutual funds are the same, but they do have differences that need to be considered before any investment is made. Mutual funds are professionally managed pools of money that are taken from other investors. The mutual fund manager has the ability to use those funds and buy stocks or other investments that grow the funds. Mutual funds are strictly regulated by the Securities and Exchange Commission.

Anyone is able to invest or purchase stock in a mutual fund. That growth, depending on how it is invested can be taxes immediately. An investor might be able to secure a dividend payment every month or elect to have the dividend reinvested in the mutual fund. An investor would be able to purchase those funds through a retirement-like account such as a Roth IRA or IRA where that investment would be deferred until the withdrawal is made.

When investors enter into a contract for purchasing an indexed annuity in exchange for a future payment amount, they agree to future distribution that is yet to be determined by the market’s performance. After the “accumulation” period occurs the “distribution phase” begins. This is where the insurance company who issued the annuity will make installment payments or a “lump sum” payment to the investor. Gains during the accumulations period are protected from taxation on a yearly basis up until the investor makes his first withdrawal, making this an exceptional favorite among many investors.

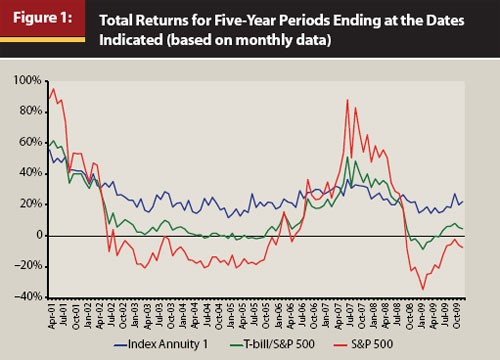

Since the rate of return for the investor relies on the performance of the index market, it is possible for the purchaser of the annuity to get less in return than what he may have paid into the annuity. In addition, index annuities are cashed out before maturity or a specified date then significant fees and penalties will apply. A mutual fund, purchased on its own as a standard investment would not be penalized the standard 10% early withdraw penalty. The investor is still obligated to pay taxes on the growth of that mutual fund investment.

When it comes to annuities, certain contract features of the indexed annuity may determine that the investment may or may not be registered with the SEC. Generally, for SEC registered securities, for example, the insurance company must provide a minimum rate of return for the investor. Of course this may not always be guaranteed due to the built in nature of predictable market fluctuations and the type of investment. To be sure most mutual funds with equity stock vested in them are regulated by the SEC. Nevertheless, index annuities provide a great option for investors who would like to diversify their portfolio and peg their earning directly to the performance of the market with a particular investment vehicle. In addition, with index annuities, there may also be ceilings, or the maximum rate of interest which can be earned by the investor.

Though both mutual funds and fixed annuities provide stable ways to grow their money, they may be used for different purposes. Index annuities are a great option for the long-term investor who would hedge a percentage of their future retirement income stream based on the market’s historical trend for increased growth. In either case, the investor should read the prospectus and investigate the health of the fund or the company issuing the annuity.