Index Funds vs Actively Managed Funds Who outperforms

Post on: 7 Апрель, 2015 No Comment

Ive been doing a lot of reading on the topic of modern portfolio theory and its relation to the argument on index funds vs actively managed funds.

Its pretty fascinating stuff actually. Almost all of the research and evidence points in one direction, but the financial services industry has been headed in the opposite direction for quite some time.

At the heart of the subject is the question about efficient markets. Are securities priced fairly at all times? Do they reflect the true value of a company while accounting for all of the current information available to investors?

Or are markets inefficient? Do they directly reflect behavioral flaws of the underlying investors? Are price movement irrational and random, unsupported by fundamentals or valuations?

In reality, its a spectrum. There are arguments for both sides and I believe the true answer falls somewhere inside of both extremes. But Im interested in the practical outcome of theoretical debates.

If markets are efficient and pricing is reflective of the true value of stocks, broad index funds should outperform actively managed funds, right?

If youre new to the subject, index funds are a type of passive management. They dont have a fund manager sitting at the helm trying to buy underpriced stocks and sell overpriced ones. They just track an index, sometimes even the whole stock market, while keeping fees extremely low.

Active management on the other hand, believes in inefficient markets. In fact, there would be no reason to consider active management if all markets were perfectly efficient and stocks were priced correctly. You have to believe that some stocks are priced too low, and others too high, if you want to try to outperform the market or a related index.

Why It Matters

Your eyes might be glazing over from the finance lingo. Not to worry, Ill bring it home. The reason it matters, is money . Thats the only reason anything in finance is worth debating.

Actively managed funds charge high fees. They must pay all of the management team and the worker bees making the trades. They have higher overhead, and the CFAs running the statistics also seem to demand a hefty salary.

In addition, because of all the trading the continual buying and selling, they generate more taxable events. Those taxes are paid by you, the investor.

Passive management on the other hand, including index funds and ETFs, usually have very low fees. Not much is needed to track an index, and trades are usually not very frequent, usually resulting in tax efficiency.

So whats left is a decision. Does market inefficiency warrant actively managed funds? In other words, are the high fees warranted? Can active managers exploit the market inefficiencies enough to overcome the added fees and still make you money?

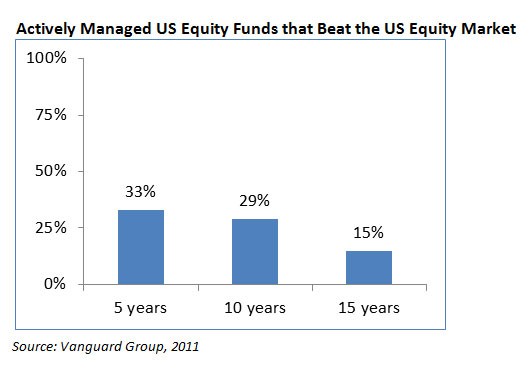

In a word, no. There is very little evidence to support that notion. Here is a little infographic provided by Businessprofiles that shows a few shocking stats.

Index Funds vs Actively Managed Funds Summary

Right now, active management is having a difficult time showing any added value when compared to low cost index investing. In fact, most actively managed funds under-perform their passive benchmarks by roughly the amount of added fees that are charged.

For example, Vanguard index funds often have a 0.05-0.35% Expense ratio. Actively managed funds will typically be anywhere from 1-3% in ongoing expenses. If the index returns 10% this year, the actively managed fund will likely underperform by roughly the fees charged, or 1-3%.

This leaves your with a smaller retirement account, or a big delay during your journey toward financial freedom .

Unless you think you can outperform the professionals, who clearly underperform the broader market after considering fees, stick to index funds and passive ETFs.

Whats your take on index funds vs actively managed funds?