Index funds easy but be careful

Post on: 15 Июнь, 2015 No Comment

Some things are meant to be simple. The world really doesn’t need purple ketchup, blueberry vodka or talking toasters.

But if you’re an index investor a wonderfully simple investment strategy it might be time to add new types of index funds to your portfolio. We’re not talking about funds that track Andorran utilities or large-cap binocular manufacturers. But some index funds measure the market in more subtle ways than traditional index funds do, and they’re worth looking at.

Index funds simply track a market index, such as the Standard & Poor’s 500 (SPX). The advantage is clear: The average managed stock fund rarely beats a broad-based market index, such as the Standard & Poor’s 500, over long periods.

There are two main reasons. For one thing, index funds don’t need a manager or troops of analysts, so they cost much less to run than actively managed funds do. Low costs are a tremendous advantage. An average stock fund will match the market’s average returns over time, minus expenses. And an index fund that charges 0.2% a year will usually beat the average stock fund, which charges 1.5% a year.

The second reason: Efficient market theory holds that stock prices generally reflect all that’s known about a company. If that’s true, you’re better off buying a fund that tracks the entire market, rather than one that tries to find, say, undiscovered growth stocks.

Over time, though, problems have emerged with indexing. The destruction of technology stocks in the 2000-02 bear market led some to wonder whether the words efficient and market can be used in the same sentence.

And a few investment strategies have produced above-average returns over long periods, which indicates that the market might not be entirely efficient. Value investing, which involves looking for cheap, out-of-favor stocks, has had long stretches of outperformance, particularly with small-company stocks.

Furthermore, most index funds (and stock indexes) are weighted by a company’s market capitalization the current value of all its outstanding shares. For example, ExxonMobil (XOM). the largest company by market cap, is 3.2% of the index.

Weighting by market cap poses problems. As a stock rises in price, it becomes a larger part of the index. The index can then become larded with overpriced stocks. At the same time, it underweights undervalued stocks.

Jeremy Siegel, a finance professor at the University of Pennsylvania’s Wharton School, has proposed fundamentally weighted indexes, which weigh stocks by some factor other than market cap. For example, an index could be weighted by the total amount a company pays in dividends. This would reflect the companies’ earnings and financial strength.

A dividend-weighted index has outperformed the S&P 500 over the past 10 years by about 2 percentage points a year. The index has a higher dividend yield than the S&P 500, as well as a slightly lower price-earnings ratio, both of which appeal to value investors.

(Dividend yield is a stock’s 12-month dividend payout per share, divided by price. A P-E ratio is a stock’s price, divided by the past 12 months’ earnings; the lower the P-E, the cheaper the stock relative to earnings.)

Another type of index is an equal-weighted index, such as the Rydex S&P Equal Weight exchange-traded fund (RSP). Rather than weighting stocks by size or dividends, this index simply gives the same weight to each stock. The approach works best when small and midsize companies are faring better than large-cap companies.

Siegel’s fundamental indexing approach doesn’t sit well with some indexing experts. Gus Sauter, chief investment officer at the Vanguard Group, says a dividend-weighted index is tantamount to active investing, not indexing. I’d ask the question, ‘Is active management that easy?’ Sauter says.

If so, Sauter wonders how such a simple solution could have eluded so many investors for so long.

Siegel doesn’t advocate an all-or-nothing approach. I’m not saying to move 100% into fundamentally weighted indexes, he says. I’m saying that these can be a good supplement. WisdomTree (WSDT). an investment management company where Siegel is a director, has just rolled out several fundamentally weighted exchange-traded funds. You can find out more about them at www.wisdomtree.com .

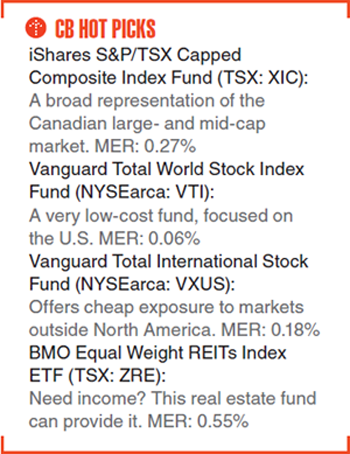

If your main goal is to achieve broad exposure to the stock market at very low cost, then owning a few index funds is an excellent strategy. The Vanguard Total Stock Market Index fund (VTI). for example, would give you good exposure to virtually all U.S. stocks at very low cost. If you want even more diversification with a value or small-cap tilt these new types of index funds might not be a bad idea.

John Waggoner is a personal finance columnist for USA TODAY. His Investing column appears Fridays. Click here for an index of Investing columns. His e-mail is jwaggoner@usatoday.com

Posted 8/3/2006 9:15 PM ET