Incredible Charts Parabolic SAR

Post on: 16 Март, 2015 No Comment

Parabolic SAR was developed by J. Welles Wilder Jr. and is described in his book New Concepts in Technical Trading Systems. SAR stands for stop and reverse.

3A%2F%2Fwww.incrediblecharts.com%2Findicators%2Fparabolic_sar.php&referer=http%3A%2F%2Fwww.incrediblecharts.com%2F&cb=b17d2c8fb1 /%

Parabolic SAR should only be employed in trending markets — when it provides useful entry and exit points. It is plotted in a rather unorthodox fashion: a stop loss is calculated for each day using the previous days data. The advantage is that the stop level can be calculated in advance of the market opening.

- A stop level below the current price indicates that your position is long. The stop will move up every day until activated (when price falls to the stop level).

- A stop level above the current price indicates that your position is short. The stop moves down every day until triggered (when price rises to the stop level).

Parabolic SAR: Trading Signals

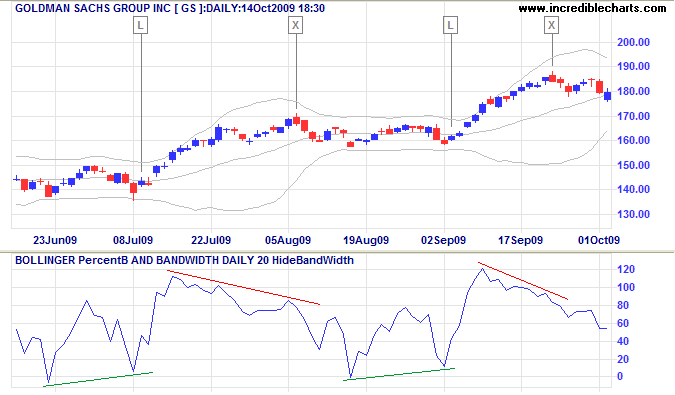

Your first step is to confirm that the market is trending:

- Use a trend indicator, or

- Stop trading with the Parabolic SAR if you are whipsawed twice in a row and re-commence after you observe a breakout from the chart pattern.

A trade is signaled when the price bars and stop levels intersect:

- Go long when price meets the Parabolic SAR stop level, while short.

- Go short when price meets the Parabolic SAR stop level, while long.

3A%2F%2Fwww.incrediblecharts.com%2Findicators%2Fparabolic_sar.php&cb=a2d63756ea /%

Microsoft Corporation plotted with Parabolic SAR and 63-day exponential moving average .

20parabolic.png /%

Mouse over chart captions to display trading signals.

- Ignore signals while price is ranging (identified by the fluctuations around the MA). Go long at [L] after price respects the MA. Price then breaks out of the range, confirming our signal.

- Exit [X] when price activates the Parabolic SAR stop.

Do not go short as the MA slopes upwards.

Do not go short as the MA slopes upwards.

Do not go short as the MA still slopes upwards.

In the original system, short signals are taken at each exit point [X], resulting in unprofitable trades against the trend.

Parabolic SAR: Setup

See Indicator Panel for directions on how to set up Parabolic SAR on the price chart. The default settings are an acceleration factor of 2% and a maximum step of 20%. To alter the default settings — see Edit Indicator Settings .

Parabolic SAR: Evaluation

Parabolic SAR introduces some excellent concepts to technical analysis but leaves two major weaknesses:

- Trend speeds vary over time and between stocks. It is difficult to arrive at one acceleration factor that suits all trends — it will be too slow for some and too fast for others.

- The SAR system assumes that the trend changes every time a stop has been hit. Any trader will tell you that your stops may be hit several times while the trend continues. Price merely retraces through your stop and then resumes the up-trend, leaving you lagging behind.

Join Our Mailing List

Read Colin Twiggs Trading Diary newsletter,

offering fundamental analysis of the economy

and technical analysis of major market

indices, gold, crude oil and forex.