IHUB Most Posted And Most Read Stocks Do Not Perform Well

Post on: 16 Март, 2015 No Comment

Summary

- I have often wondered if the metrics available on the Investor’s Hub stock chat message board could guide me to generate abnormally high returns.

- Clearly, the Seeking Alpha and Investor’s Hub boards cater to different segments of the investing community, where micro-caps and sub-penny stocks dominate the latter.

- This article examines some data captured on Sunday, and examines the returns generated by the Monday and Tuesday close – friction or commissions excluded.

- Assuming that the Friday’s closing price was revisited on Monday, a value-weighted portfolio, excluding commissions, generated a 1.9% (1 day) and 1.7% (2 day) return.

- There were 3 losers and 7 winners, from N=15 unique stock tickers, the net returns from which would be likely to be more than consumed by commissions.

Stock Message Board Volume and Sentiment

Sentiment or stock chat board posts are rarely studied, though one academic study is available here and another one, here. Of course, the University of Michigan and MIT are well-known research institutions, so it is interesting to note that stock message board volume has attracted some attention in the academic literature. Some are, now, studying Facebook (NASDAQ:FB ) posts and Twitter (NYSE:TWTR ) tweets.

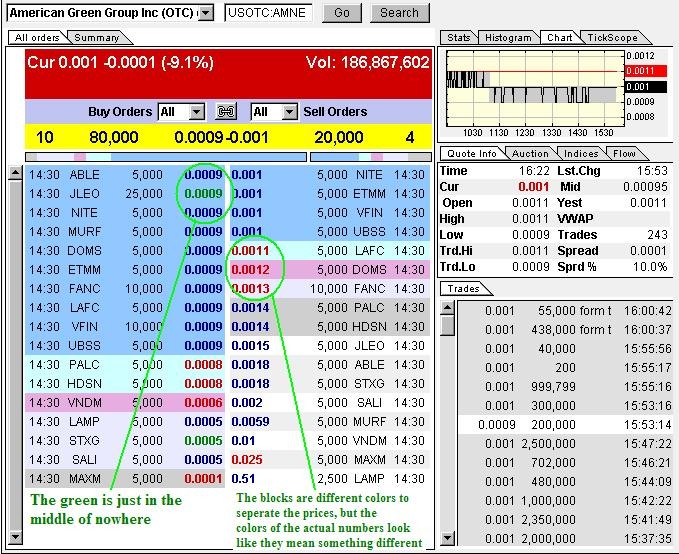

I have often wondered if using the Investor’s Hub (IHUB) diagnostics might assist me in quickly and efficiently identifying stocks likely to generate abnormally high returns. In this article, I captured screen shots of the stock chat boards with (1) the most reads and (2) the most posts.

The Needle in the Haystack

I scanned a few posts, but did not read all of them. Those posts containing useful information or information content are difficult to find, and are, effectively, the needle in the haystack.

The most efficient means of identifying the reason for the stock chat volume is to simply Google the ticker for headlines and press releases. Then, if your interest is peaked, scan Seeking Alpha for articles based on discussions of the relevant fundamentals and the IHUB board for any useful content. Frequently, you will find that the IHUB boards post links to Seeking Alpha and Yahoo!Finance articles and posts, respectively.

The IHUB boards have too many noisy posts with no information content. Some say nothing more than lol, and it consumes quite a bit of time to click through these. An example from the MINE board follows:

Focusing only on the top ten, I ranked these boards by reads and posts, respectively. The 2 non-ticker boards were not investigated. The results are not favorable, where a general rule of thumb is to assume 4% round-trip commission or friction and the return fell below this measure, at 1.9% (Monday) and 1.7% (Tuesday).

The Rankings

Below are screen shots of the most read and most posted IHUB boards from Sunday, February 8, 2015, at 9A:

Most Read as of February 8, 2015, 9A (>174,000 reads in 24 hours):

Most Posted as of February 8, 2015, 9A (>1,700 posts in 24 hours):