If Warren Buffett Is So Popular Why Don’t More People Invest Like Him

Post on: 16 Май, 2015 No Comment

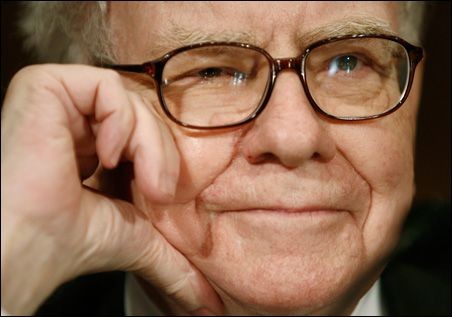

Warren Buffett, the chairman and chief executive officer of Berkshire Hathaway. is the world’s best-known and most successful investor. He’s also open and honest about how he plies his trade. Yet, and here’s where things get interesting, the data is clear that few individual investors choose to follow his approach.

This is generally reconciled by assuming that the typical investor has neither the discipline nor the temperament to do so. Not only is Buffett diligent about his research, but he’s also a textbook contrarian, living and breathing his own advice to be fearful when others are greedy and greedy when others are fearful.

But is this answer too clever by half? Could something else be at work here? I think so. The issue has less to do with our behaviors and more to do with a convenient and, from the perspective of the financial services industry. profitable misunderstanding of what Buffett actually stands for.

Buffett’s reputation precedes him

To say that Buffett is the world’s best-known investor is an understatement. Take the following chart as an example, which plots the Google keyword search volume for 20 of the most prominent investors in America against their respective fortunes.

George Soros, the second richest investor with a net worth of $26.1 billion, had a search volume of 90,500. Carl Icahn came in third with a net worth of $23.8 billion and a search volume of 60,500. And the rest of the list — which includes billionaire investors like Steve Cohen, Bill Ackman, and David Einhorn — generated individual search volumes of no greater than 30,000.

By these measures, Buffett is in a league of his own. Not only is he the wealthiest investor — and the third richest person in the world overall — but he’s also the most commonly queried financier on Google by a long shot. The search volume for the keyword Warren Buffett was 368,000. That’s more than four times the runner-up George Soros and 22 times greater than the group average. Even compared to more general keywords related to investing, the only one I found with a larger search volume was stock market.

Just as significant for our purposes, moreover, is the fact that Buffett is forthcoming about his investment strategy. Every year since taking control of Berkshire in 1965, he’s published an annual letter to shareholders that documents what stocks the company bought and sold in the preceding year and also details Buffett’s philosophy on business and investing. Ask anyone who’s read them and they’ll tell you that the letters are a treasure trove of invaluable insights, all of which are available free of charge on Berkshire’s website .

The keys to Buffett’s success

Buffett’s approach to investing takes the form of a three-part framework. First, he prefers outstanding companies run by outstanding managers. Second, he generally buys stocks when everyone else is selling them and thereby driving down the price. Finally, he holds investments for long periods of time, which allows the law of compounding returns to work its magic while also avoiding a drag on returns from trading commissions and taxes on capital gains.

This approach has served Buffett and his investors well. Since 1965, Berkshire’s shares have beaten the S&P 500 on an annual basis by 9.9%. In total over this time period, they’re up by 693,518% compared to a total return on the S&P 500 with dividends included of 9,841%. In a chart comparing the two, the difference is so big that the S&P 500’s performance is almost indistinguishable from the horizontal axis — and, mind you, these five decades capture the most extraordinary bull market in American history.

But despite Buffett’s well-publicized success and investment philosophy, few individual investors have chosen to follow his lead. There’s even reason to believe that the behavior of most investors may be going in the opposite direction. Since the 1960s, it’s estimated that the average holding period of stocks has fallen from more than eight years down to less than two — and some studies peg the current figure at a handful of days thanks to the proliferation of online and high-frequency trading.

Additionally, not only are investors buying and selling stocks more frequently, they’re also doing so at precisely the wrong time. When the market peaked between 2005 and 2007, investors poured $241 billion into stock funds. After stocks plummeted in 2008 and 2009, they pulled $230 billion out. And as the market has recently soared again to all-time highs, $239 billion flowed back in.

Trends like these show the typical investor’s knack for buying high and selling low, which weighs heavily on returns. Over the last two decades, the S&P 500 returned an average of 9.22% on annualized basis. By contrast, the average equity fund investor returned only 5.02%. This difference might not sound like a lot in any given year, but over 20 years it means that the average investor returned 278% compared to the 637% return generated by the S&P 500.

Why most investors don’t follow Buffett’s lead

This gaping divide between the performance of the typical investor and the broader market brings us to our central question: If Buffett’s approach to investing is so superior and easily accessible, then why aren’t more people using it to their advantage? To put it another way, why are investors content with inferior returns when a road map to producing superior results is lying in plain sight?

The conventional answer, as I noted at the outset, is that most people aren’t temperamentally capable of investing like Buffett. We’re innately impatient and overconfident, the reasoning goes, which causes us to frenetically trade in and out of stocks in a self-defeating attempt to beat the market. And because our actions are dictated by fear and greed, we can’t help but buy stocks when the market is peaking and then frantically sell them after the market plummets.

But the problem with this perspective is that there are tangible examples of people becoming demonstrably better investors by studying Buffett’s philosophy. Mohnish Pabrai, a California-based fund manager with nearly $500 million in assets under management, serves as a case in point. If there wasn’t a Warren Buffett, there wouldn’t be a Pabrai Funds, he wrote in the introduction to The Dhandho Investor: The Low-Risk Value Method to High Returns . It is hard for me to overstate the influence Warren Buffett and Charlie Munger have had on my thinking.

There are other examples as well, including Todd Combs and Ted Weschler, the money managers hired by Buffett in 2010 and 2011, respectively, to oversee investment portfolios at Berkshire. And for what it’s worth, which may or may not be much, reading Buffett’s writings has made me a better investor, and I’m confident that many of my colleagues at The Motley Fool would say the same thing about Buffett’s influence on their own approach.

Consequently, in my opinion, the answer to our quandary is less about innate ability and more about a simple misunderstanding of the precedent that Buffett’s success sets. Buffett proves that it is indeed possible to beat the market systematically — that is, not as a result of sheer luck. This encourages people to actively invest. But they do so without taking the critical next step of figuring out exactly how Buffett achieves extraordinary returns. And it’s this oversight that leaves investors particularly vulnerable to the legions of decision-making biases identified by the proponents of behavioral finance.

Using Buffett responsibly

Buffett was once asked how to become an exceptional investor. Read 500 pages like this every day, he said, holding up a stack of paper. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will.

The point here is that Buffett does indeed prove that it’s possible to systematically beat the market. This is encouraging; it should give you hope. At the same time, however, you’ll never be able to do so unless you take the time to figure out how he goes about doing so. In investing, as in most other aspects of life, there are no shortcuts to success.

John Maxfield has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .