ICI A Guide to ClosedEnd Funds

Post on: 20 Июль, 2015 No Comment

This guide includes an overview of the types of closed-end funds and how they operate. However, each closed-end fund is different, and investors should learn more about a particular fund before investing. Closed-end funds—like all investments—involve risk, including the possible loss of principal.

What Is a Closed-End Fund?

Closed-end funds are professionally managed investment companies. They generally issue a fixed number of common shares that are listed on a stock exchange. Once issued, a closed-end fund’s common shares typically are not purchased or redeemed directly by the fund, but instead are bought and sold in the open market. The market price of closed-end fund shares fluctuates like that of other publicly traded securities. Closed-end funds invest in a wide variety of domestic and international securities, including common stocks, preferred stocks, high-yield bonds, municipal bonds, and corporate bonds.

Features of Closed-End Funds

A closed-end fund raises cash for investment by selling a fixed number of shares during an initial public offering (IPO), and the manager invests the cash in accordance with the fund’s investment objectives and policies. The fund does not issue redeemable securities and typically does not offer its securities for sale on an ongoing basis.

Because a closed-end fund does not need to maintain cash reserves or sell securities to meet redemptions, the fund has the flexibility to invest in less-liquid portfolio securities. For example, a closed-end fund may invest in securities of very small companies, municipal bonds that are not widely traded, or securities traded in countries that do not have fully developed securities markets. Closed-end funds also have flexibility to borrow against their assets, allowing them to use leverage as part of their investment strategy.

Types of Closed-End Funds

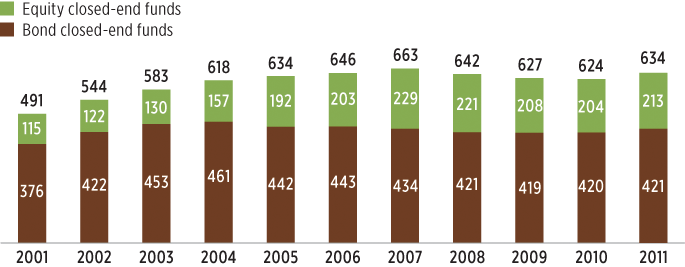

There are two main types of closed-end funds—bond and equity. Bond closed-end funds accounted for more than half of all closed-end fund assets at year-end 2012. Of the total $264 billion invested in closed-end funds at the end of 2012, $163 billion, or 62 percent, was invested in bond funds and $101 billion, or 38 percent, was invested in equity funds. Bond funds were the most common type of closed-end fund, accounting for 65 percent of the total number of funds.

Assets of Closed-End Funds

Billions of dollars, year-end, 2002–2012