IBD Archives Chart Your Trad

Post on: 22 Июль, 2015 No Comment

Opening Thoughts

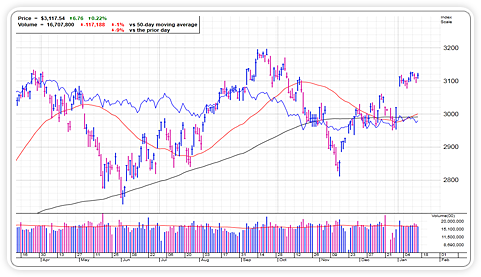

What a month! As youll see in the charts below, the indexes started the month by dropping sharply and testing long term multi-year trend lines. Upon testing them, they immediately found support and proceeded to rally to fresh multi-year and/or all time highs! Its for this reason that I continue to stress the importance of being aware of multiple time frames (daily, weekly, and monthly). When multiple time frames converge, explosive reactions like these often occur. Why? Logically speaking, a greater number of eyeballs are (different types of traders) are now looking at and responding to the same level.

chartyourtrade.com/2014/02/current-market-sector-analysis-february-2014-adam-sarhan/

Daily

The Nasdaq broke through multi-year resistance at 4289 (best seen on the monthly chart further down this post) and closed above it at 4308. This is a significant milestone for the Nasdaq as the next major point of multi-year resistance is potentially around 4500 and then not really until all-time highs of 5132.52 set back in 3/2000. As the index hit this first multi-year level of resistance and finally broke through, we can see volume surge on Friday. To me, I see this as more eyeballs seeing multiple time frames converge.

Friday was an interesting day in itself on the Nasdaq. It counts as a distribution day because it fell more than .2% on heavier volume than the prior day. HOWEVER, it can also be seen as a support day because it closed above 40% of its daily range, did it on higher volume than the prior day, and seemed to have found support at the 10dma.

Weekly

The Nasdaq continues to trade within the channel it created dating back to May of last year. Presently its near the top of the channel so a pullback or a slower rise can be expected should the Nasdaq continue to trade within this channel.

Monthly

The monthly chart of the Nasdaq is showing tremendous strength. Almost each month that has served as an up month has closed near the top of its trading range. This is a very bullish sign. Im not in the prediction business, but given the action of the other indexes (NYSE and S&P 500) both making all time highs, I wouldnt be surprised to see the Nasdaq follow suit.

A trend line can be seen on the monthly chart of the Nasdaq and it has gotten support along this trend line multiple times. In recent months, it has begun to lift off that trend line so a reversion back to it is possible and would actually be healthy for the long term trend.

Daily

www.globalmacroresearch.com/blog/sp-500-breaks-head-shoulders-continuation-pattern/ ) as a reverse head and shoulders pattern. This can be a powerful pattern with a bullish thesis. Supporting the pattern is that the index is now living above the 10, 21, and 50dma for over two weeks, it seems to be receiving support along its 10dma, the 21dma crossed back above the 50dma (when moving averages are stacked in order from shorter term to longer term, its a positive sign), and there is only one distribution day (a stalling day on 2/26).

Weekly

The S&P 500 closed the week on above average volume in the top 73% of its weekly range. It has essentially traded sideways since the year began, digesting last years gains for a full two months. As the index broke out to fresh all-time highs, I see it as a sign of renewed strength.

Monthly

Similar to the Nasdaq, a multi-year trend line can be seen on the S&P 500 dating back to the March 2009 lows. The index has respected this line, dipping below it intra-month but always closing above it. February was no different as it bounced directly off that trend line and into fresh all time highs.

Daily

The NYSE finally hit fresh all time highs to close out the month of February! Again, Id like to call attention to the monthly chart and to highlight a couple of months back when the NYSE started on this run. A comparison was made to its 2005 action prior to breaking out to fresh highs. The NYSE behaved similarly as it stalled, consolidated, and then broke out. History often presents a roadmap for us to follow. The map changes over time but provides a decent framework to follow.

Should the NYSE pull back, it should find strong support near the 50dma as prior resistance at 10230 should now be support, and the 21dma has just crossed above that level.

Weekly

The NYSE continues to trade within its long established channel dating back to 9/2012. As Ive mentioned multiple times, I consider this trend to remain in tact until the NYSE breaks the channel in a powerful and sustained way.

Monthly

On the monthly chart, we can see the historical precedent noted earlier and how the NYSE paused at prior resistance, overcame it, traded sideways, and ultimately broke out to fresh highs. I have no idea if the NYSE will continue to rise as it did from 2005-2007, no one does. However, we can look at and interpret the action occurring right now and determine the trend is bullish and until that changes, thats all that really matters.

New Highs vs. New Lows, Leading Stocks, and the Growth 250

New Highs vs. New Lows

Heres a shocker, the number of New Highs continued to dominate the number of New Lows throughout the week, often by a 15:1 margin or better on both the Nasdaq and the NYSE! The number of new highs vs new lows has often served as an early signal of short term trend changes (both bullish and bearish). For now, as an indicator, strength remains.

Leading Stocks

This was an unbelievable week for many leading stocks, though some pulled in a little toward the end of the week. Here are some of the best performing names mentioned recently on ChartYourTrade: FEYE (+17.8%), TSLA (+16.8%), BITA (+14.2%), MEOH (+8.5%), and the list goes on. Check out this weeks Universe List for all the big gainers.

Growth 250

MarketSmith’s Growth 250 list rose to 289 this week up from 277 last week, nearing its upper limit of 300. As a reminder, the Growth 250 is a list of stocks compiled from 30 separate proprietary screens from MarketSmith. The number of stocks in it fluctuates from roughly 150-300 and the greater the number of stocks, the greater the implied strength of the market. The last time this list reached extreme levels was in January just before the sell off. Am I concerned? Not particularly. This is a secondary indicator at best and if anything, I take it to still speak to the depth and breadth to the underlying strength of the market.

Closing Remarks

chartyourtrade.com/2013/11/introduction-psychological-analysis-adam-sarhan/ It serves as a great reminder of the psychological traps we can find ourselves in and how to avoid them. I often re-watch this webinar myself and continue to get something new out of it each time.

Thanks for reading and I wish you all the best in Charting Your Trades!

Mike

HAVE EVERY POST DELIVERED STRAIGHT TO YOUR INBOX!

Charts provided by MarketSmith

MIC = Market in Correction; FTD = Follow Through Day; IBD = Investor’s Business Daily; ”red flags” = distribution days; ”pink flags” = stalling days; “gray flags” = distribution days removed from count due to age and/or price; U.P. = Uptrend Under Pressure

Opening Thoughts

When studying the market, its very important to monitor multiple time frames and identify the various support and resistance levels on each. Doing so will allow you to more easily identify inflection points and the markets potential next move. We never know for sure if the market is going to go up, down, sideways, or in circles. HOWEVER, we can study charts to determine the probability of the next turn and that slight edge can yield a fortune!

chartyourtrade.com/webinars/

Daily

After selling off hard last week and initially finding support at the 50dma, the Nasdaq started the week by crashing through its 50dma and running straight down to the 4,000 level. It hung around there on Tuesday and Wednesday and then proceeded to rally. By Friday, the Nasdaq had impressively worked its way above above the 50dma.

Wednesday counted as what is commonly referred to as a pink rally day. For those that are unfamiliar, a pink rally day refers to an initial rally during a correction when an index closes down on the day but finishes the day in the top half of its trading range. It signals a potential change from correction back into confirmed uptrend.

We are now in pursuit of a follow through day or the market to make a higher high in order for the status to officially change back to confirmed uptrend. To make a higher high typically that would mean getting back above the nearest marked high of 4246.56. However, Id personally consider the uptrend resumed on a move back above 4136 taking out the high made on 1/30. On 1/30 the Nasdaq had a feeble bounce off the 50dma and immediately found resistance at 4135.84 which corresponded closely with both the 10 and 21dmas at the time. The Nasdaq has already moved back above each of those 3 moving averages and now needs to get back above resistance at 4136. Once it does, Id consider the uptrend officially resumed.

Weekly

The weekly chart of the Nasdaq below emphasizes why its so important to consider multiple time frames when studying the market. We can see that the Nasdaq ran straight to the lower trend line of its up trending channel and bounced off of it with gusto! The rebound occurred directly off trend line support, with strong volume, and closed the week at the top of its range and back above the 10wk line.

For several months weve highlighted that until these longer term trends are broken in a significant and sustained way, the broader uptrend remains in tact. For now, the broader long term uptrend remains well in tact.

S&P 500

Daily

The S&P 500 approached and bounced off prior resistance near 1730. Like the Nasdaq, it too had a pink rally day on Wednesday 2/5 which means that the first opportunity for a follow through day will be on Monday. Ill personally be looking for 1 of 3 things to happen in order to consider the market back in a confirmed uptrend:

- A follow through day

- The S&P makes a higher high taking out 1850.84

- The S&P makes a strong move back above the 50dma

From the way the broader uptrend has gone over the past year, scenario 3 seems the most likely. Often follow through days have come late if at all and a waiting for a higher high is still over 50 points away. In this case, Id rather see if the 50dma acts as resistance or were able to rally strongly through it like the Nasdaq did on Friday.

Weekly

The S&P 500 started the week by diving further below its long term uptrend line. HOWEVER, as we highlighted in last weeks post (click here to view) from November 2012 through the beginning of January 2013 prices actually traded below this trend line but still moved higher. The trend line acted like a magnet for prices particularly when they have fallen below the line. That’s exactly what happened this week and why its so important to identify key trend lines! Look for that trend to continue in the coming weeks. When it changes (which it inevitably will), that is when the broader uptrend will have changed.

chartyourtrade.com/webinars/

NYSE

Daily

The NYSE was able to find support at and rally off the 200dma which corresponds to the prior resistance levels around 9695 highlighted last week (click here to view post). Similar to the S&P 500 and Nasdaq, the NYSE had a pink rally day on 2/5 as well. Additionally, for all intents and purposes it too is under the same 3 scenarios as the S&P 500. It will be interesting to see how the index behaves near the 50dma. If it is able to rally above it with gusto, it will be a definite sign of the market strengthening again. If it gets back above the 50dma but lacks volume, it could be a sign of a lack of conviction. Its for this reason that we dont determine the State of the Market based off any one factor, index or otherwise. Everything is taken into account including the New Highs vs New Lows and Leading Stocks to be discussed momentarily.

Weekly

Again we must emphasize the use of weekly charts in our analysis. The NYSE bounced perfectly off the lower trend line in the up trending channel seen below. It did this on increased weekly volume which shows added conviction. As mentioned earlier, and in prior posts over the past several months, well consider the broader uptrend to remain in tact until the channel is broken in a meaningful and sustained way.

New Highs vs. New Lows, Leading Stocks, and the Growth 250

New Highs vs New Lows

Over the past couple of weeks weve seen the number of New Lows begin to outpace the number of New Highs. That was the trend for most of the week. On Friday, however, the number of New Highs on the NYSE was 68 vs only 10 New Lows. On the Nasdaq there were 55 New Highs vs 29 New Lows. This certainly isnt the robust 30:1 high to low ratio we saw throughout most of the uptrend but it is a slight improvement. Should the uptrend resume, look for these numbers to continue improving.

Leading Stocks

The majority of leading stocks either found support or continued rallying last week which is a good sign for the market. Stocks like KORS, GMCR, UA, NFLX, PCLN and others which have all been profiled in the various watch lists posted here every week took off mightily! This obviously bodes well for the broader uptrend and plays a large part in my slightly aggressive approach to call a resumed on the indexes before a follow through day as noted earlier.

Growth 250

MarketSmith’s Growth 250 list rose slightly to 248 this week up from 244 last week. 248 is still moderately strong as 300 is about the upper limit. As a reminder, the Growth 250 is a list of stocks compiled from 30 separate proprietary screens from MarketSmith. The number of stocks in it fluctuates from roughly 150-300 and the greater the number of stocks, the greater the implied strength of the market. The midpoint of the range is 225 and we’re still above that.

As far as this screen is concerned, despite the sell off, the implied internals of market are moderately strong. That said, I consider this just one piece of a very large puzzle.

Closing Remarks

chartyourtrade.com/2014/01/advanced-entry-exit-points-part-1-adam-sarhan/

I wish you all the best in Charting Your Trades!

Mike

HAVE EVERY POST DELIVERED STRAIGHT TO YOUR INBOX!

Charts provided by MarketSmith