HowtoInvestOnline Borrowing to Invest When & How to Do It

Post on: 23 Июль, 2015 No Comment

Borrowing to Invest: When & How to Do It

The basic idea and attraction of borrowing money to invest is simple — if the cost of the loan is less than the return on the investment then there is a profit. You have used money you don’t own to earn. That’s why the operation is also called leverage — you use the borrowed money as a lever to gain a profit. However, as usual, there is a downside, since it is possible to lose money too. If things go awry, the leverage makes you lose faster, which is why there are many dark warnings e.g. What are the dangers of borrowing to invest? on the GetSmarterAboutMoney.ca site sponsored by the Ontario Securities Commission, or Wealthy Boomer Jonathan Chevreau’s Financial Post column When does it pay to borrow to invest?

A few months ago, we looked at various ways to carry out leveraged investing. Today we will drill down to see under what circumstances it can work, to examine the risks, to look at tax and book-keeping implementation do’s and don’ts. That should give you a better idea if borrowing to invest is worthwhile for you.

Favourable Conditions

A beneficial combination of factors specific to you and of conditions in markets and the economy will increase the chance of success.

Investor’s Personal Situation :

- Able to sustain the loan payments — Whether it be an interest-only or an interest plus principal repayment, you must be able to keep up payments, otherwise you may be forced to liquidate the investments, which as bad luck could have it, might be at a time when the investments have declined in value. There should be some leeway for higher payments since some forms of loans have floating interest rates that will rise with general interest rates. In addition, when the investing is within a non-registered taxable account, there is income tax to pay each year on the investing income. Thus, the following conditions give you an advantage.

Markets & Economy :

- Low interest rates to borrow — This is one of the best factors in the current situation, with loans available at 4%, perhaps even a bit less. When the cost of borrowing is low, it sets a lower bar for earnings from interest, dividends or capital gains to beat in order to make a profit.

- High yields on dividend stocks — There are many solid companies paying dividends over 3%, and some even in the 4-5% range. Against current borrowing rates that offers the promise of cash in- vs out-flow that can sustain payments on interest-only loans. Added to the benefit is that most dividends from Canadian companies are eligible for the enhanced dividend tax credit, which effectively means a very low marginal tax rate on that type of income. This improves the investor’s chances of making a net profit in a non-registered taxable account.

- Reasonable stock market valuation level — The indicators we discussed in Is the Stock Market Over- or Under-Valued? suggest that US and Canadian stock markets are at a level that promise modest returns of 4 — 8% over the next ten years.

Risks & Counter-Measures

Some of the major things that could go wrong include:

- Psychological stress and panic — No one wants the anxiety of a very large debt hanging overhead when facing a large market decline that could get worse. That leads those with experience in leveraged investing to suggest: 1) only going ahead when you have at least several years of investing under your belt, which gets you mentally and emotionally familiar with the frequent falls in the market; 2) starting out with a small loan and investment; 3) buying the investments progressively so that if the market goes down after the first purchase you feel less regret (a line of credit is well suited to this tactic since you borrow as you go).

Investment Candidates

First, we note that the maximum value from leveraged investing comes when the tax advantages are utilized, in particular the deductibility of interest expense and the lower tax rates on dividends and capital gains. The implication is that investing is best done within a non-registered taxable account. It also means that Canadian equity should make up the investment holdings.

Our take on the best combination at the moment includes:

- Passively managed index ETFs — The passive index management results in low turnover, which minimizes annual capital gains distributions and tax to pay. It also ensures diversification through multiple holdings, which eliminates the possibility of complete loss of capital through default and reduces the year-in-year-out volatility.

- Equity ETFs — Equity provides its return in the form of the desired dividends and capital gains. Over the long haul, equity has outperformed fixed income. We do not like some of the specialty dividend ETFs despite their enticing high distributions because often a sizable chunk of their distributions consists of Return of Capital, which causes problems with the deductibility of the loan interest (see MillionDollarJourney’s Key Tax Considerations on an Investment Loan ).

Some reasonable though less attractive possibilities:

- Pipeline and utility stocks — These are amongst the most stable in a business sense and as a result are so on the stock market too. All offer much better than average dividends (see our January 2011 post on these stocks)

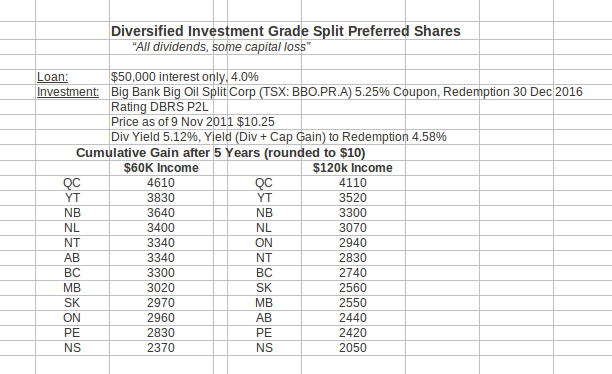

- Split Share Preferreds — Unlike most preferred shares, this type of preferred has a redemption date and price. The price and yield you buy at today is locked in to the redemption date if you hold till then. If interest rates rise in the meantime, the market price of such shares may decline temporarily but by the redemption date the market price must converge to the redemption price. The catches are that such shares still have some default risk and that redemption dates may be within only a few years so you would need to be renewing and reinvesting the holdings with capital gains taxes to settle up earlier than desired. See our detailed post on assessing Split Preferreds .

Interest Deductibility Tax and Book-keeping

The general principle is that interest on the investment loan may be deducted against the investor’s income (and not just investment income but against other income such employment earnings). However, the rules for carrying out the borrowing to the Canada Revenue Agency’s satisfaction to ensure the deduction is not denied can be quite tricky. Consider getting the guidance of an accountant! Amongst the tricky bits:

- Investment must be capable of earning income, though it may not actually do so. If it can only ever achieve capital gains, that will not qualify.

- Book-keeping is much easier if the investments purchased with the loan are in a separate account.

- Similarly for book-keeping ease, once income is received, take that money out of the account to keep the cost basis of the debt the same as the investment.

- Watch out when withdrawing funds from the account since the amount of eligible debt may change.

Next post, we will work through an example with the help of available online tools to see how the numbers work out and give a feel for how big the benefits could be.

Disclaimer. this post is my opinion only and should not be construed as investment advice. Readers should be aware that the above comparisons are not an investment recommendation. They rest on other sources, whose accuracy is not guaranteed and the article may not interpret such results correctly. Do your homework before making any decisions and consider consulting a professional advisor.