Howto switch brokers transfer assets (ACAT) and avoid fees

Post on: 26 Май, 2015 No Comment

So youve been thinking of switching your online broker. But how does this work? What happens to the stocks you hold? Do you have to sell and re-purchase them? Are there fees involved? Taxes?

How to transfer stocks from one broker to another?

If youve never switched a broker before, fear not. It isnt that complicated, though for the uninformed, you may be hit with exit fees by your existing broker. In this HOWTO Ill even show you how to minimize or avoid this. Exit fees vary from $50 to $95. Ouch!

In Kind or In Cash transfer?

When you switch brokers, you have the option of transferring your assets in-kind or in-cash and either partially or in full. The term for account transfer is called an ACAT transfer. ACAT stands for Automated Customer Account Transfer. And though the usage ACAT transfer is redundant (the T in ACAT stands for transfer), it has become customary to use the terms ACAT transfer together.

In kind transfer implies moving your stocks to the new broker. If you have 100 shares of AAPL with broker A and you did an in kind transfer to broker B, your 100 shared of AAPL are moved to broker B. This is typically what one would choose.

In cash is basically liquidating your assets and moving the cash out to your new broker. You normally dont want to do this. When you sell at a profit, youll be liable for capital gains tax.

A partial transfer is when you want to transfer a portion of your asset to the new broker. If you wish to move 75 shares of AAPL to broker B and keep the rest with Broker A, youd do a partial in kind ACAT transfer of AAPL.

The ACAT is normally initiated from the new broker not the existing broker.

Fees

Before your transfer your assets over, go over the fees with your existing broker. You should look for Account transfer fees or ACAT fees. Heres what you need to know.

- There are no fees for incoming ACAT

- Most brokers charge for outgoing ACAT

- Some brokers dont charge for partial ACAT but there will be a charge for a full ACAT

- In addition to ACAT, brokers might also charge an account close out fee

- As far as I know, Scottrade and Vanguard dont charge ACAT fees

How to avoid or minimize ACAT fees

When you switch brokers youd normally do a full in kind ACAT. And chances are that youd be hit with a $50 fee on your way out by your existing broker.

MoneyCone Tip: In order to avoid this fee, dont do a full ACAT, instead do a partial ACAT, leave one share of the asset, liquidate it and take the cash out. Most brokers dont charge for partial ACAT. So taking the AAPL example:

- Youd initiate a partial ACAT transfer out of 99 shares of AAPL to broker B

- Once the transfer is complete, do another partial transfer of 1 share of AAPL to broker B and keep some cash in broker A

- If this goes through as well, transfer the money out of broker A to your bank and close your broker A account

- The third step may or may not work depending upon the broker. You still can eliminate the fee by selling that one share of AAPL, take the proceeds out as an ACH transfer to your bank (not to your new broker!). That way even if you have capital gains, this is greatly reduced. 1 share instead of 100.

- This will work only if your existing broker doesnt charge for partial ACAT. Most dont, but do check.

MoneyCone Tip: Never do a in cash ACAT. If you must, do this instead: liquidate your assets (sell all stock!), do an ACH transfer of the cash to your bank and close the account. No ACAT fees.

MoneyCone Tip: Move any cash with your current broker to your bank as an ACH and and then to your new broker instead of doing an ACAT to your new broker.

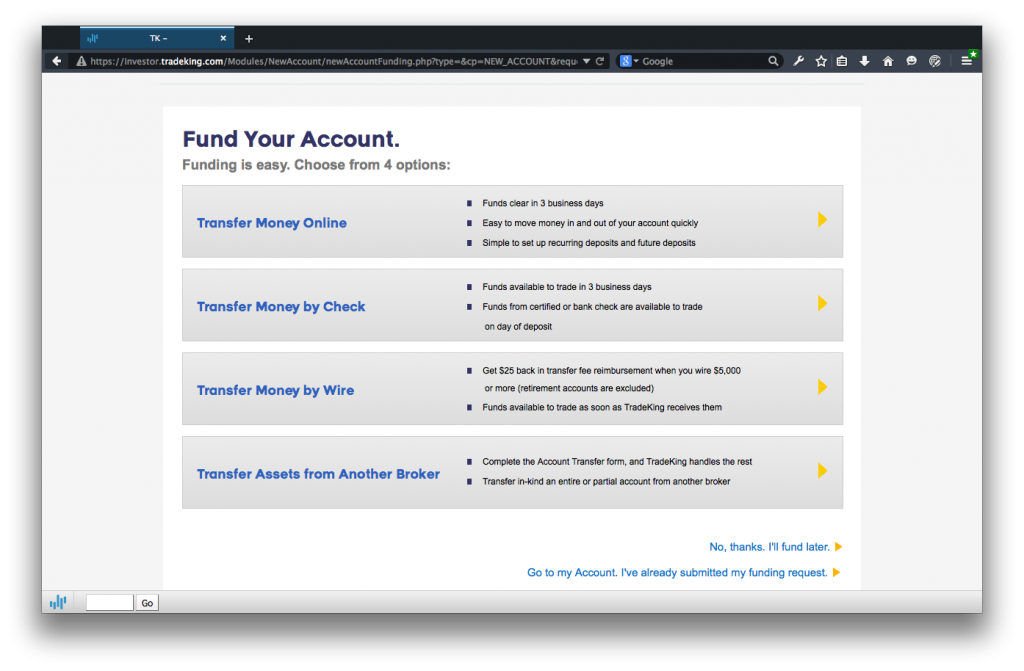

For your convenience, heres a list of ACAT fees charged by brokers.