How Will The Subprime Mess Impact You

Post on: 11 Июнь, 2015 No Comment

Although the direct cost of the subprime crisis will likely be modest in the scope of the economy, the spillover effects are concerning. Shocks to financial markets appear to have begun a reversal in the ease of obtaining credit, a change in investors’ perceptions of risk and a continuation of housing market declines.

Therefore, as this situation continues, it is important to ask how the subprime meltdown might affect you. Read on as we examine this question.

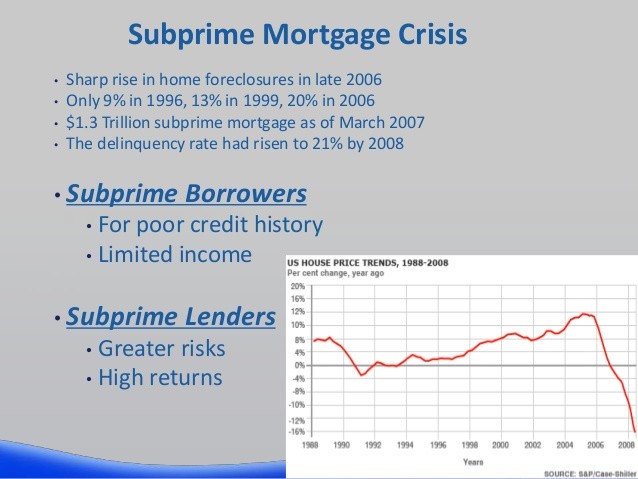

Size of the Subprime Market

To get an idea of the total direct impact of the subprime lending crisis, we will take a look at its size and make an estimate of the overall loss. (For background reading on what happened, see The Fuel That Fed The Subprime Meltdown .)

According to a July 2007 report by AMP Capital Investors, the total value of all subprime loans is approximately $1.4 trillion, of which only about one-third of outstanding loans could reasonably be expected to default. Even if a loan defaults, it isn’t a total loss as the bank can sell the home.

If we assume that in the event of a default, a home can still be sold off, on average, for two-thirds of its original value, the total losses on subprime loans shouldn’t go much higher than $150 billion.

Clearly, subprime losses are only a fraction of overall economic activity. The U.S. economy produced around $13 trillion in gross domestic product (GDP) during 2006, and according to January 2007 data from the World Federation of Exchanges, the total value of all stocks in the world is about $50 trillion. So, what this tells us is that even in a worst-case scenario, the pain in the subprime market alone may not have a major impact on the overall economy.

However, it isn’t just about the losses from loan defaults that investors and other market participants are worried about. It is the potential spillover effects of the subprime mess that could have a much greater impact on the overall economy — it even brings up talks of the dreaded possibility of recession.

Impact on Borrowers

A major impact stemming from the subprime meltdown has been the reduction in available funds for borrowers. The group most affected by this reduction is lower quality borrowers. Subprime lending has dried up as a result of both the collapse of lenders and the reduction in desire to lend to this group. (To learn more, read Subprime Lending: Helping Hand Or Underhanded? )

With the recent meltdown in subprime markets, investors are now more aware of the credit risk inherent in these types of investments. As such, they will require a higher rate of return to compensate for the additional, perceived risk. This translates into higher interest costs for lower quality borrowers and a higher cost of home ownership.

Additionally, many lenders have suffered severely for making these types of loans. Numerous firms have gone of out business or had their stock prices pummeled by frantic investors. Firms that are already in the business of making low quality loans will likely be much more stringent in their underwriting standards. Moreover, they may also seek to diversify their portfolio of loans to include more high-quality borrowers. (To learn more, read Dissecting The Bear Stearns Hedge Fund Collapse and The Rise And Demise Of New Century Financial .)

Furthermore, firms that are not currently in the business of making low quality loans will be much less likely to enter into this business for fear of financial losses and investor reprisal on their stock price. These factors will almost certainly work together to decrease the supply of loans to low-quality borrowers, thereby diminishing the pace of growth in home ownership and hurting the housing market.

What this means to borrowers - The next time you go to the bank for a loan or a mortgage it will likely be more difficult to get and more costly.

Housing Prices

As lower quality borrowers lose their homes or find it more difficult to purchase them, this also puts downward pressure on real estate prices, all but closing the spigot of home-equity withdrawals. (For more insight, read Home-Equity Loans: The Costs .)

Basically, the reduction of easy credit in the market leads to fewer people being able to get a mortgage to purchase a home. The lower the number of people who are able to purchase a home, the lower the demand for homes. As a result, prices are likely to fall. (For related reading, see Profit As Your Home’s Price Changes .)

Not only will the reduction in credit reduce home prices from the demand side, supply is also increasing, as foreclosures hit all-time highs. In the event of a mortgage foreclosure, the collateralized property is given back to the bank, which is forced to sell it if it wants to recoup its money. As these properties are put on the market, supply increases, which leads to pricing pressure in the market. (For more on this, see Economics Basics: Demand and Supply .)

These factors only have the potential to weaken the already reeling housing market, which can hurt those looking to sell and especially those who are looking for home equity loans .