How To Use Trailing Stops

Post on: 29 Июнь, 2015 No Comment

March 27, 2013

What is a trailing stop?

Technical Definition — A stop loss order set at a percentage level below the market price for a long stock position. The trailing stop price is adjusted as the price fluctuates.

Practical Definition This mechanism allows you to do three things:

- It allows you to let profits run without selling your position too soon.

- Allows you to cut your losses early to prevent catastrophic loss to your portfolio.

- Literally takes all the emotion out of investing, which prevents you from making a drastic mistake.

How A Trailing Stop Is Used

As always I like to simplify things as much as possible. Theres absolutely no need for big words or financial jargon. A trailing stop is a very straightforward and simple thing to implement in your portfolio today .

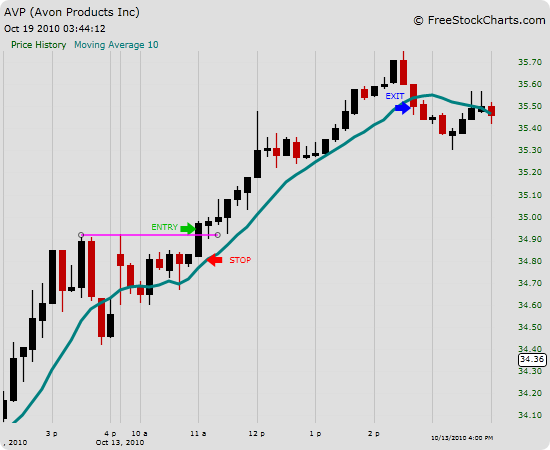

To use a trailing stop you will predetermine a percentage below your entry price that you are willing to lose. This could be 10%, 15% or 25% whatever you determine this will be your pack up your bags and move on price point. In other words, if the price falls below this price point it will set off an automatic trigger to sell. However, we all hope that the price of the stock moves upwards and when/if it does your trailing stop moves upwards as well.

Confused? Dont worry lets take a look at some examples.

In July of 2007 Sally conducted some initial research on Microsoft (MSFT) and concluded that the stock was a Dividend King and loved the idea of owning shares for the long term. She busted her tail working overtime for 2 months so she could invest the extra money into MSFT. When it was all said in done Sally was able to purchase shares of Microsoft for $26/share.

Not too shabby! She set a predetermined trailing stop of 25% which put her initial stop price at $19.50. Having this information Sally knew no matter what happened if Microsoft fell below $19.50 she would sell automatically. Yes she would lose money, a little bit of pride and probably some self confidence as well but she would preserve whatever capital she had left in order to invest in another stock position.

Remember, Sally must still monitor this position on a regular basis in order to adjust her trailing stop appropriately. In November of 2007 there was a spike in Microsofts share price all the way up to approximately $32/share.

Sally had been monitoring this move and therefore had to readjust her 25% trailing stop loss. Since the share price was now $32/share her new stop price was $24. Unfortunately for Sally in July of 2008 the share price of MSFT closed below $24/share which triggered an automatic sell of her entire position. This resulted in a 7.6% loss on her position.

This definitely isnt what anyone hopes for but it is inevitable in investing and in all honesty will happen more often than youd like. But lets take one more look at how Microsoft performed after Sally was stopped out.

Wow! Looks like Sally got out at the right time. She purchased her shares for $26 and MSFT ended up trading as low as $14 during the financial collapse. That was almost half the value of her current position. Now I know individuals from the buy and hold camp will argue that if she simply held onto her shares while purchasing more she would be above break even and at a profit. While I understand their argument I personally subscribe to the I cant tell the future camp. I would much rather cut my losses and take my preserved capital somewhere else that can work more efficiently. For example, Sally would have sold for a 7.6% loss but would have had that capital available to invest in large blue chip stocks trading at fire sale prices during the financial collapse.

How I Use Trailing Stops

Like everything else in this world, blanket statements/advice often lead to disaster and I believe the same holds true for trailing stops. I know their has been a lot of deep data research on what percentage is the most profitable but here is how I determine what percentage my trailing stop will be:

10% Trailing Stop I consider this a fairly tight trailing stop. I use this for speculative or highly volatile stock positions such as gold/silver stocks, etc.

15% Trailing Stop This is my conservative trailing stop. I implement this positions that have experienced a significant gain in a short amount of time and I want to lock in profits or for small to mid cap stocks.

25% Trailing Stop I use this trailing stop about 80% of the time. The majority of my investing portfolio is focused on long term holdings at extreme values therefore I am willing to let these positions breathe during corrections.

The number one thing that all investors should acknowledge and remember is that its far easier to determine how and when to purchase a stock but much harder to determine when to sell. Trailing stops eliminates this guessing game and ensures you are profitable or at the very least preserve your investing capital.

**UPDATE**

My apologies but a couple of you have pointed out a very important piece of advice that I forgot to include. You absolutely DO NOT want to enter your trailing stops into the market for these reasons:

- All of the big boys on Wall Street will be able to see your order and could potentially trigger it.

- You can potentially forget you entered the order.

It is better to keep a mental note of your stops and sell your position the next day if it is triggered.

Do you use trailing stops? If so what percentage works for you?