How To Use The Top Yahoo! Finance Tools Investopedia

Post on: 11 Июнь, 2015 No Comment

The tools finance professionals use to screen securities, gather statistics and analyze market intelligence are invaluable. Unfortunately they can be so expensive that the individual investor typically cannot access them; that’s where Yahoo! Finance can help. Yahoo has a set of tools that rival the professional ones so that individuals will not be at a disadvantage. To use these tools there is an enormous amount of data to go through, so weve provided a guide to help steer users to the top tools for investors.

Ranking of Top Tools

1. Stock Research Center : This tool is the most comprehensive, go-to page on Yahoo! Finance for investors. From here, investors can click on links to get information related to company earnings (dates, surprises, etc.), analysts’ research (company research, upgrade/downgrades, sector analysis), company reports (annual, quarterly, all SEC filings), financial calendars (stock splits, IPOs, M&A, economic data) and research tools (screeners, historical or real time quotes) for stocks, bonds, mutual funds and options.

Lets walk through the steps to get started. First you select the Market Data link on the left side of the home page, then you scroll down 3/4 of the way till you see the More Market Stats box on the right, then select the Stock Research Center.

Once that page loads, you can select from among all the categories. For example, if seeing which companies are reporting earnings today, select Company Earnings then Earnings Dates. Or if you are looking for price trends, select the link for Historical Quotes to get prices for a specific time frame.

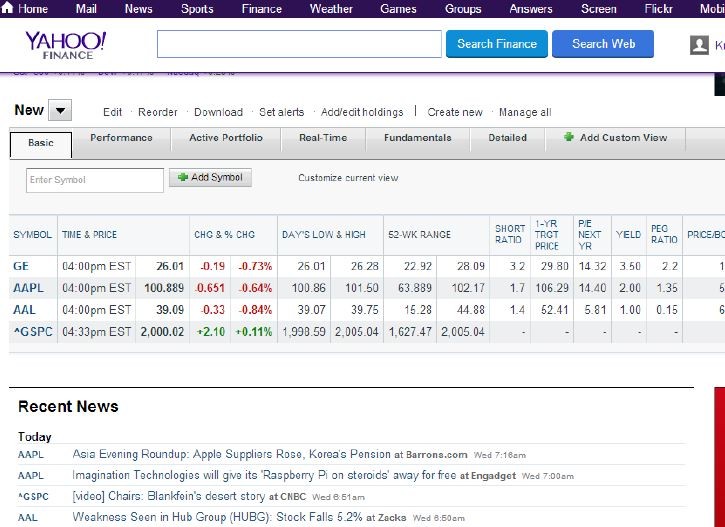

2. My Portfolio (NOTE: You have to have a Yahoo account to access this, as it requires you to log it): After utilizing all the resources provided in the Stock Research Center, My Portfolio is perhaps the next most useful tool. It allows investors to track portfolios or securities of interest, customize the screen view, choose fields based on investor interest, such as valuation metrics, estimates and price movements, among others. It even allows investors to input the number of shares purchased and the purchase price to track gains or losses. Not only can investors maintain current information, Yahoo! Finance turns that list of tickers into the news feeds for users, tailoring which news stories the user receives based on the tickers in the portfolios. Finally the tool allows users to sync up with other sites to their actual portfolios.

Lets go through an example. The following stocks are in a portfolio: American Airlines (AAL ), General Electric (GE ) and Apple (AAPL ). To Track these names, first select My Portfolio on the left side of the home page. From the My Portfolio page select Create New.

The page opens to allow input of a portfolio name, ticker symbols, market indices and allows for the selection of which stock characteristics are of interest to view (it is automatically set to default). This screen also allows linkage to brokerage accounts.

As you can see the output screen provides an easy way to track all investments in the portfolio and at the bottom in the Recent News section, the news stories are directly related to the stocks in the portfolio.

3. Market Data. This section covers every asset class and provides a quick glance of the current market from performance of various indices, to stock movers, to an index decliner/advancer heat map giving investors a complete overall picture of the trading day. To get to this page, select Market Data on the left side of the home page. (We did this previously when accessing the Stock Research Center).

The Bottom Line

Professional investment tools are typically out of reach of the individual investor, but by using the tools hosted by Yahoo! Finance, individuals can intelligently research and track securities.