How to Use StopLosses on SmallCap Stocks Cabot Investing

Post on: 8 Июль, 2015 No Comment

How to Use Stop-Losses on Small-Cap Stocks

Small-Cap Stocks Require Special Handling

Beware Market Makers

Since 1925, small-cap stocks have posted more wins than any other asset class2% to 5% a year more than their counterparts, mid-caps or large-capsan advantage that compounds quickly.

Thats surely a strong case for owning small-cap stocks. But before you buy, its important to understand that small company stocks act differentlyand therefore must be handled differentlyfrom other stocks.

One area in which small-cap stocks require special handling is in stop losses.

As a general rule I recommend stop-losses to protect my earned profits in a small-cap stock position. But because small-cap stocks act differently from most other types of stocks, there are additional considerations.

Generally, small-cap stocks demonstrate much greater price volatility than mid-cap or large-cap stocksfluctuations of 15% or more are typical (and they dont need specific company or news events to trigger the volatility). Its therefore important to keep the stop-loss in your head, not as an order to your broker.

Let me give you an example of how using a stop-loss could have turned out to be a painful financial experience for me:

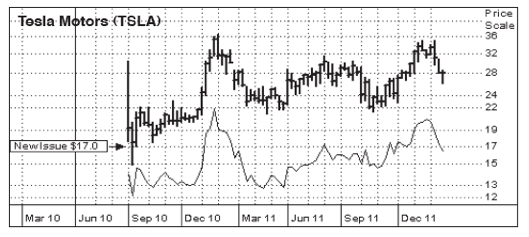

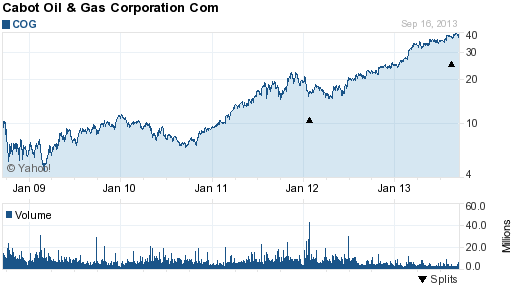

Over a decade ago, when I was invested in Monster Beverage (MNST), formerly Hansen Natural, the stock fell out of the sky. A single 600 sell-side transaction (at the time, about 15% of the average daily volume) sent the share price down 35% and I was instantly looking at a paper loss of $15,000. If Id had a stop-loss in place, I’d have missed out on the best investment of my lifetime, as Hansen went on to give its early investors returns in excess of 30,000%.

The lesson here is that an investor can get paid very well for stomaching the motion sickness that comes from owning small-cap stocks, but you absolutely need to keep on your toes.

If you always wanted to test-drive our Cabot Small-Cap Confidential advisory, today is the day.

We’re recommending a breakthrough $20 biotech stock that our research shows could hit $40 in the next 12 months—with 20% to 30% gains coming in the next 30 days.

The stock’s share price is already up 116% and looks to be rising faster than the 974% we made in Monster Beverage a few years back.

In fact, I so strongly believe that this new recommendation could ultimately become our next Monster Beverage, I want to give you the name of this company free along with a money-back trial subscription to Cabot Small-Cap Confidential.

You’ll get not only the full story on this fast moving biotech stock but also on 15 more game-changers that could hand you money-doubling profits and then someover the next 12 months.

Another potential downside to small-cap stop-losses is that they reveal your plans to the market makers.

A market maker is a broker-dealer firm that accepts the risk of holding a certain number of shares of a particular security in order to facilitate trading in that security. Each market maker competes for customers orders by displaying buy and sell quotations for a guaranteed number of shares. Once an order is received, the market maker immediately sells from its own inventory or seeks an offsetting order. This process takes seconds.

Market makers know when we place a sell order, so they can take out our stops by a penny in order to add the stock to their accounts.

To avoid this from happening, I recommend mental stop-losses, rather than actual stop-loss orders.

So right about now youre asking when stop-losses make sense.

I think a stop-loss is in order when you want to preserve the hard-earned gains you’ve achieved in a stock but you arent yet ready to book them.

Step one is to determine the lowest rate of return youre willing to accept on the stock. Use the stop-loss as your own personal profit guideline. I usually stick with a return of 35%.

The rationale is that you want a stop-loss thats low enough that it would be triggered only if demand for the company’s product has seriously deteriorated (you dont want to get tossed out of a stock because the price wavered in a sour stock market).

If you are confident that the company and its markets are sound, you may want to lower your stop-loss.

But when the stock is acting poorly despite your optimism and prospects for the company, you may want to raise the stop-loss to a level that makes you comfortable.

Your guide to small-cap investing.

Thomas Garrity

Editor, Cabot Small-Cap Confidential

P.S. Ill never forget the day I sold Medifast for a 16,290% gain and my readers saw a $5,000 investment soar to $814,000!

Or the day I sold Green Mountain Coffee Roasters for a 9,211% gain; Bally Technologies for a 5,975% profit; Southwestern Technologies for a 5,776% profit; or any of our many double, triple and 10-bagger plays.

I know youll feel 10-feet tall and bulletproof too, when you get in on the ground floor of my next Medifast! Thats why Ive made it as easy as possible for our loyal Cabot readers to give Small-Cap Confidential a try.