How to Use Schwab Stock Tools

Post on: 16 Март, 2015 No Comment

Key Points

- Looking for an easier way to help manage your stock portfolio? Find out how to use Schwab Equity Ratings, the Equity Scorecard, the Portfolio Checkup, Schwab Stock Lists and the Stock Screener. Helpful information for stock investors.

Interested in being more proactive with your stock portfolio but don’t know where to start? Here’s a five-step guide to managing your stock portfolio and using our stock tools. Our goal is to help you keep on top of the often time-consuming tasks of rebalancing and finding new stock ideas. You should also read our guide for investors, Managing a Portfolio Using Schwab Equity Ratings 1. If you own foreign stocks, you should also read our Managing an International Stock Portfolio 1 guide.

As we take you through our most popular stock tools, you can click on the links to access them.

Step 1: Get the big picture

This step is designed to give you an overview of the current economic environment and shift your thoughts into a higher, investment-oriented gear. Once you’re thinking along these lines, your decisions can be more informed and thoughtful.

- First, at least once a week, get a macro perspective on what’s happening with the economy and the markets. This is not only important, it’s easy. Check out recently published commentary on the markets and the economy from Liz Ann Sonders, Schwab’s Chief Investment Strategist; Brad Sorensen, Schwab’s Director of Market and Sector Analysis; Michelle Gibley, Director of International Research, and others.

- Second, get an idea of the outlook for individual sectors of the stock market by reviewing Brad Sorensen’s Schwab Sector Views. Since the rebalancing process and the search for new stocks may involve decisions about which sectors to focus on or avoid, print out Brad’s most recent Sector Views article for later use.

Step 2: Review your portfolio

Your next weekly step should be to take a look at your current portfolio. Since Schwab Equity Ratings are recomputed each weekend, your goals are to see if the Ratings of your portfolio’s holdings have changed and to possibly make any decisions based on those new Ratings.

- Start at the Accounts > Positions tab. This page displays the current Schwab Equity Ratings of the stocks in your accounts. Print out the list of your portfolio’s holdings and make a note of any stocks rated C, D, F, NR, or NC. 2

- If a stock’s rating is C, NR (Not Rated), or NC (Not Covered), click on the letter grade of the stock to display the Equity Scorecard. If the stock is NR, you’ll see a brief explanation of the reason why the stock is not rated.

- If a stock’s rating has fallen to D or F since last week, consider selling it. Your decision may be influenced by tax considerations. D- and F-rated stocks should be sell candidates, tax considerations permitting.

- The usual reason for an NC rating is that the stock’s market capitalization has fallen below the lower limit of the Schwab Equity Ratings universe of the largest 3,200 stocks (ranked by market capitalization). You may want to consider selling an NC-rated stock, since you no longer have the Schwab Equity Rating available to help guide your decision.

- For C-rated stocks, check the Equity Scorecard and click on the link to the Schwab Equity Rating Report. Check the stock’s Schwab Industry Rating in the Sector/Industry section on the right side of the first page. If the industry is rated D or F, consider selling the stock. Schwab research has indicated that C-rated stocks with percentile ranks below 50 and Schwab Industry Ratings of D or F are expected to underperform during the following 12 months, relative to the average stock.

Step 3: Find any gaps in your portfolio

Once you’ve made your sell decisions (if any), you can see if your portfolio is still aligned with your objectives and risk tolerance. Since your goal should be to maintain a well-diversified portfolio that’s consistent with your investment objectives and your tolerance for risk, it’s important to determine whether your portfolio meets those criteria.

- Go the Schwab Portfolio Checkup to review your Schwab portfolio (and any other portfolios not held at Schwab). If you haven’t used the Schwab Portfolio Checkup before, click Get Started. Or if you’ve already used this tool before, move down to the bottom of the window and click on Analyze Portfolio to see if there’s anywhere that you’re off target.

- If you’re missing stocks in a particular sector(s), if you’re considering tilting your portfolio toward or away from one or more sectors, or if your overall stock exposure is below the level suggested for your risk tolerance, you may need some stock ideas. The first two conditions may benefit from the Schwab Sector Views recommendations. For example, if you’re missing stocks in a specific sector, but the outlook for that sector is underperform, you may want to stay away from this group of stocks. On the other hand, sectors with outperform outlooks may be promising.

Step 4: Get stock ideas

Now you should fill in the holes, if any, by looking for potential buy candidates. Schwab has two easy-to-use tools available for generating stock ideas: our Stock Lists and the Schwab Stock Screener. Of course, you can always research an individual stock by going to the Research tab and entering a ticker symbol. But the Stock Lists and Stock Screener can be faster and more efficient.

Schwab Stock Lists

Each week, Schwab updates 15 stock lists: 10 sector lists, four style lists, and the Schwab Composite List, made up of the three most highly rated stocks in each sector. These lists can provide a quick list of potential buy candidates that could warrant further research. Whether you find a stock through the Schwab Stock Lists, the Schwab Stock Screener, or your own research, we suggest you follow our guide, Managing a Portfolio With Schwab Equity Ratings 1 .

- The composite list is a great place to start. It’s made up of three A- and B-rated stocks from each sector, so there’s no need to hunt through symbol after symbol. Just click on a ticker symbol to start your research.

- To see other lists, put your cursor on the word Composite to display a drop-down list. You’ll see Sector , Large Cap. and Small Cap .

- To see the sector lists, click on Sector and put your cursor on the word Energy to display the Sector drop-down list. Each sector list contains the five best-rated stocks in that sector. See the list of sectors in the graphic below.

To see the style lists, put your cursor on the word Composite and choose Large Cap or Small Cap from the drop-down list. Then, put your cursor on Large Cap Growth or Small Cap Growth on the other drop-down list to choose between the Growth or Value lists. The style lists provide 10 stocks in each of four style categories: large-cap growth, large-cap value, small-cap growth, and small-cap value.

Schwab Stock Lists

Source: Schwab.com, as of October 19, 2012.

The Schwab Stock Screener

You can find stocks that meet a set of criteria, such as specific sectors, price performance, or financial and valuation metrics, by using the Schwab Stock Screener .

The Schwab Stock Screener provides seven categories of screening items in the Choose Criteria window (Basic Criteria, Analyst Ratings, and so on). To select a criterion within any category, click on the plus sign by the category name or click on the category name itself.

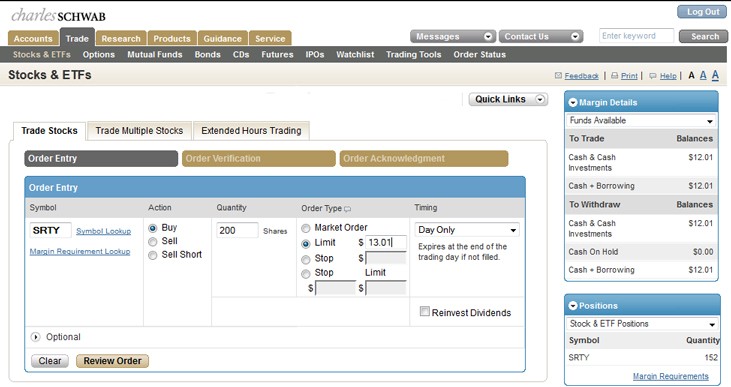

For example, Schwab Equity Ratings and Schwab Equity Ratings Percentile Ranks are found under Analyst Ratings. Click the name of the criterion you want and specify the values to be used in the field to the right of the list. For example, the graphic below shows a screen for stocks with Schwab Equity Ratings percentile ranks between 1 and 10 (which includes A- and high B-ranked stocks) and the results as of October 12, 2012. Click on View Matches to see the list of stocks, then print the list or export it to Microsoft Excel by clicking the Export link (note that each download is limited to 1,000 stocks).

Screen for stocks with Percentile Ranks from 1 through 10

Source: Schwab.com, as of October 19, 2012.

Step 5: Stay on the alert

Since significant news about a stock can occur at any time, the final step is to set up an Alert to notify you by email if certain conditions occur (for example, news releases that impact the stock, price conditions, and so on). In the top-level menu, click on Service. then click on Alert Preferences and select Securities Alerts. Enter a ticker symbol and then move down the page to the Set Alerts section. Click on Expand All to view the alert conditions available and make the selections you want, then move to the bottom of the page and click on Save Alert Settings .

Bottom line

Managing your stock portfolio is a critical part of investment success. A quick and simple process will hopefully make portfolio decisions easier and more objective, and allow you to spend more time on higher-level issues like your investment objectives and your asset allocation. Here’s to your investment success!

1. These guides can be accessed by logging on to Schwab.com and selecting the Research tab and the Stocks sub-tab. You’ll see links to both documents under Learn More from the Schwab Center for Financial Research.

2. As of December 2013, Schwab Equity Ratings International grades are not shown for your foreign stocks. When available, these ratings will be displayed in the Positions report. Work is in progress to make them available.