How to use Parabolic SAR

Post on: 16 Июнь, 2015 No Comment

How to use Parabolic SAR

Introduction to the parabolic SAR

In the world of short sales, experiences are defined by the merchant the ability to predict a move in the price of financial assets. There are many different indicators used to predict the future direction of funds, but few have proved as useful and easy to interpret as parabolic SAR. In this article we will look at the basics of this indicator and show you how you can incorporate into your trading strategy.

Indicator

The parabolic SAR is a technical indicator used by many traders to determine the direction of the momentum and the advantage point in time when this point has a higher than normal probability of switching directions. Sometimes known as stop and reversal system parabolic SAR was developed by a famous technician Wells Wilder, creator of the relative strength index, which is shown as a series of dots placed above or below the price of the asset table. (To learn more about Wilder’s other indicator, read Introduction resonators: the relative strength index.)

One of the most important aspects to consider is that the positioning of points used by traders to generate transaction signals depending on where the item is compared to the cost of the asset. Item placed below cost is considered bullish signal, causing traders to expect momentum to remain in the upward direction. Conversely, point placed above prices are used to illustrate that the bears are in control and that the momentum is likely to remain down. (For further reading, see How to use Parabolic SAR to trade?)

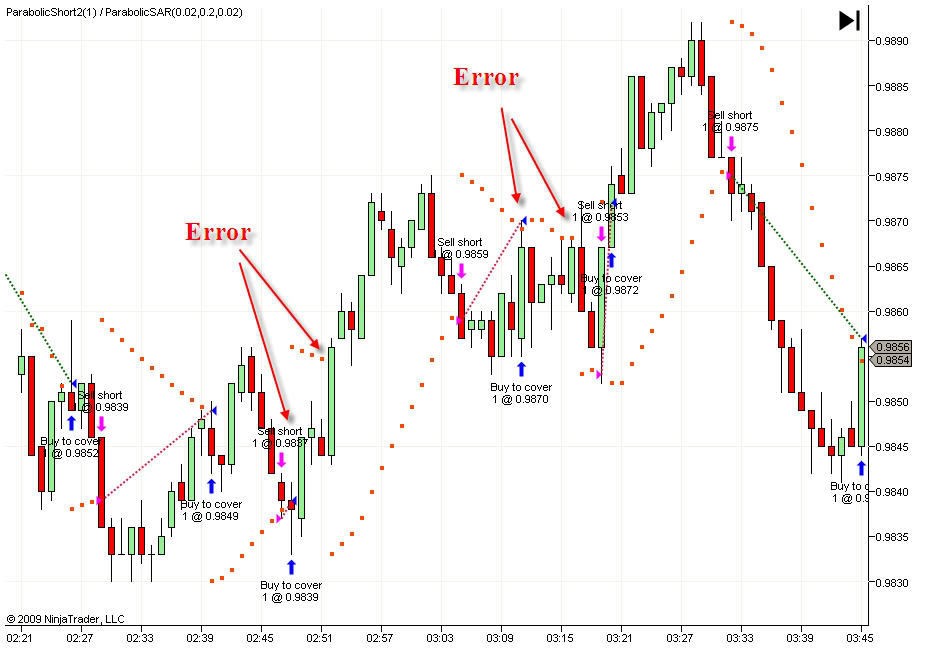

The first entry point of Parabolic SAR buy side occurs when the recent high price of this question is broken, it is at this point that Parabolic SAR is the latest low price. As the stock price increases, the points will increase as well, first slowly, then picking up speed and accelerating with the trend. This acceleration system allows investors to see the Parabolic SAR trend develop and establish itself. The Parabolic SAR is starting to move a little faster as the trend develops and points will soon catch the price action on the issue. As can be seen in Figure 1, the indicator works extremely well when stocks are trending, but it can lead to many false signals when the Parabolic SAR price moves sideways or choppy trading in the market.

Parabolic SAR and short sales

The parabolic SAR is extremely important, because it is one of the easiest methods available for setting the strategic position of the stop-loss order. As you become more familiar with technical indicators, you will find that the parabolic SAR has built quite a reputation for its positive role in helping many traders lock the paper profits that are realized in a trending environment. You can also see that professional traders who short the market will use this indicator to determine the time to cover their short positions. (For more, see Trailing-Stop Techniques.)

It is important to note that this indicator is very mechanical and will always assume that a trader holding a Parabolic SAR long or short position. Parabolic SAR ability to respond to changing conditions removes all human emotions and allows the merchant to be disciplined. On the other hand, the disadvantage of using this indicator can also be seen in Figure 1. Notice how the signals can lead to many false records during periods of consolidation. It is whipsawed in and out of trades can often be extremely frustrating, even for successful traders.

shows a Parabolic SAR pattern of American Express (NYSE: AXP) from the last part of 2008. The trader can see no real way to get into a long position as a strong downtrend continues. This is shown by the dominance of set points over cost.

Parabolic SAR: It stands United

Given the mechanical properties of Parabolic SAR, it is not surprising that it is a favorite among traders develop their own strategies. In trade, it is better to have several indicators confirm the specific signal rather than rely solely on one specific indicator, so most traders will choose to compliment the parabolic SAR trading signals with other indicators such as stochastics, moving On average, candlestick patterns etc.

For example, changing the price points under the above is very convincing when the price is trading below long term moving average when it happens when the price is above the moving average. Given the price remains below long term moving average suggests that sellers are in control of direction and the recent turnaround may be the beginning of another wave lower. Also considered a stronger signal each time an additional indicator that confirms the same trend. For Parabolic SAR example, American Express dive again as in Figure 3, notice that the parabolic SAR indicator caused a sell signal (black arrows) every time we approached, the resistance of its 50-day moving average (green line). Parabolic SAR Traders also will consider the stochastic oscillator crossed below its signal line around the same time as the parabolic SAR signals (shown by red circles). At the same time sell signals are then used as a confirmation of a move lower. (For related reading of combining strategies, see MACD And Stochastic. Double-Cross Strategy)

Parabolic SAR Bottom Line

The parabolic SAR is a pretty good tool for traders looking for a method of studying strategic direction of the stock or share of a stop-loss order. As shown above, this indicator shows extremely important in trending environments, but can often lead to many false signals during periods of consolidation. This indicator is simple to implement in any strategy, but like all indicators, it is usually best if used in combination with other indicators to ensure that all information is considered. (For further reading, see our Technical Analysis Tutorial.)