How to Use Fibonacci on Charts

Post on: 6 Июнь, 2015 No Comment

Instructions

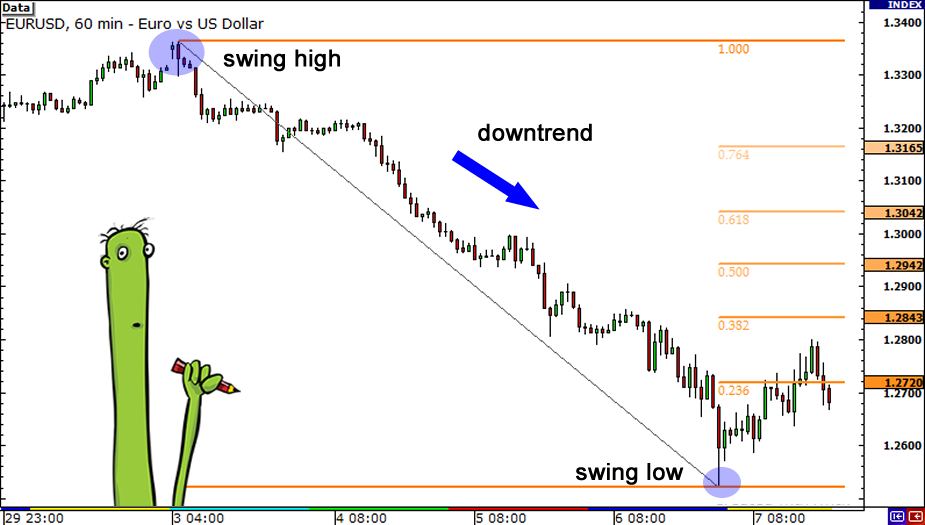

Use Fibonacci retracement ratios to predict stock entry points. Looking at a chart for a stock, identify a recent swing trade high and swing trade low range. Calculate the range by subtracting the low price from the high price; then multiply it by a Fibonacci ratio. According to website swing-trade-stocks.com, the most popular Fibonacci retracement ratios used for entry points are 23.6 percent, 38.2 percent, 50 percent and 61.8 percent. Take the resulting number and subtract it from the swing trade high. Draw lines on the chart to represent these prices; these signal points that a stock will often hit before retracing back to previous highs. Traders often enter a stock on the way down, as it hits one of these ratios, in hopes of realizing a profit if the stock retraces.

Place trailing stops using Fibonacci extensions. After a stock has hit a bottom and commences to retrace, begin to place trailing stops as it passes through the same Fibonacci ratios — 23.6 percent, 38.2 percent, 50 percent and 61.8 percent — to lock in profits.

Tips & Warnings

References

More Like This

How to Calculate Fibonacci Retracements

How to Use Fibonacci for Trade Options

How to Chart With Fibonacci

You May Also Like

Fibonacci theory is centered around the numbers 38.2, 50. Future surges in trends sometimes occur in. How to Calculate Fibonacci.

The Fibonacci sequence is a mathematical pattern often found in nature. The field of technical analysis of Forex (foreign exchange) price charts.

How to Use Fibonacci on Charts; Comments You May Also Like. How to Plot a Fibonacci on Currency Charts. First two.

Fibernocci de Pisa, in trying to find the solution to a math problem about rabbits, stumbled onto a sequence of numbers that.

How to Use the Fibonacci Time Zone. investors and other stock market players to try to predict events in the.

Create charts of a stock or index that you want to analyze using Fibonacci numbers. Practice applying Fibonacci ratios to stocks.

Determine stop loss and take profit levels. so there is no specific point of entry. If a trend is forming in.

Draw Fibonacci time zones on a stock. Decide in advance where your entry and exit points will be for. How.

Day traders seek to buy a security such as a stock or. How to Use Fibonacci for Trade Options. Fibonacci numbers were.

Support lines can be drawn on the chart at a price point where the stock has typically hit bottom and reverses.

Using fibonacci numbers to measure that pullback gives smart traders both good entry points and good points to measure where price is.

When a bearish fractal turning point appears at a high Fibonacci extreme. By only using highs and lows that are generated.