How To Use Dividends For Retirement Income

Post on: 27 Май, 2015 No Comment

Dividend Income Can Provide An Increasing Stream of Retirement Income

Let’s Start With the Basics

To know how to use dividends, you have to understand what they are. When you buy a stock, you become an owner of the company, and as the company makes a profit, you will participate in that profit in one of two ways:

- The company will pay a dividend, which you will receive. A dividend is simply the company paying some of what it earned out to you — the shareholder.

- The company will use their profits to further grow the business, and, if all goes well, you should subsequently see your stock rise in value.

If the company pays a dividend, you will see it announced on a “per share” basis. For example, in 2010 Coca-Cola Co announced a .44 cent per share dividend. This means for every share of Coca-Cola you own, you will receive an additional .44 cents.

Frequency of Dividend Payments

Dividends are normally paid quarterly, so in the case above, for every share of Coca-Cola that you owned you would receive $1.16 of dividend income per year.

To be entitled to the dividend from a stock, you must own the stock on its ex-dividend date. Below is information about the ex-dividend date and other dates you need to know about:

- Declaration date – the date the company declares their next dividend and when it will be payable.

To learn more about dividend dates and how a stock price can be affected the day a dividend is paid see Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends .

When you own mutual funds that own dividend paying stocks, the mutual fund will collect the dividends for you and pay them out to you according to their rules, usually either quarterly or monthly.

How is the Money Paid to You?

In some cases the dividend will be sent to you in the form of a check, or deposited into your account in cash. In other cases, you may participate in a dividend re-investment plan, in which case your dividend is used to buy more shares of stock.

In the case of a mutual fund, the dividends can either be paid to you or reinvested; if reinvested they will buy more shares of the fund.

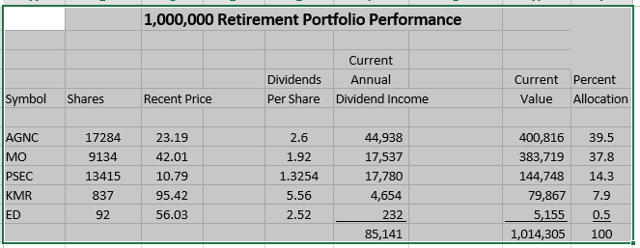

Dividends for Retirement Income

Dividends can be a good source of increasing retirement income. If you look at the dividend payout history for Coca-Cola you see the dividend has steadily increased since 1962. This would have provided a source of retirement income that would have increased over the years to help your income keep pace with inflation.

To find stocks with a history of increasing dividends, look at the Dividend Aristocrats. or use one of my five favorite high dividend stock websites. which pre-screen high dividend stocks for you.

Rather than picking your own dividend paying stocks you can use a dividend income fund which will own many dividend paying stocks, collect the dividends and pay them out to you. I have created a list of 5 Dividend Index Funds. and in the right proportion any of them can make a great addition to a retirement income portfolio.

Caution: What you don’t want to do is screen for stocks solely based on dividends. Often stocks have a high yield because the company is in trouble. The stock price may have dropped quite a bit and so when you look at the dividend yield based on the most recent dividend paid (which is always looking at the past) it will look high. A company can lower its dividend any time; which also results in the stock price dropping. Don’t invest solely based on dividends. If you don’t know how to screen for stocks, then stick with a fund that does the work for you.