How to Use a Moving Average to Buy Sell Stock

Post on: 21 Июль, 2015 No Comment

Instructions

Among many free websites that track the stock markets’ moving averages are MarketWatch.com and MSN.com. Click on the drop-down menu for Upper Indicator, and you be given a choice of the SMA or EMA, the exponential moving average. The EMA is a weighted average that gives more importance to the most recent data and less to the earlier days in the sample. Either moving average is fine; there has never been any conclusive proof that one is better than the other.

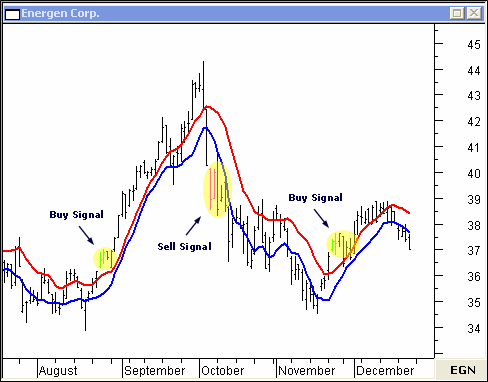

Use a cross-over system comprised of two moving averages of varying duration. This is a simple and commonly used system. For example, you can use the 9-day and 18-day moving averages, and when the 9-day crosses above the 18-day, this is a buy signal. When the 9-day crosses below the 18-day, that constitutes a sell signal. This is a short-term system that will usually keep you in trades for a few days or weeks. You can also use the 50- and 200-day moving averages for longer-term signals that will keep you in trades for a few weeks or months.

References

Resources

More Like This

How to Figure Direction in the FOREX Market

Indicators of When to Buy a Stock

How to Use Moving Averages

You May Also Like

A moving average is a method used to smooth data that have a high level of variance or volatility. The smoothed data.

If predicting the changes in the price of stocks and commodities were easy, everyone would be a market millionaire. As it is.

When trading securities, some investors use an indicator called the Donchian channel to measure price movements and volatility of a particular stock.

Whipsaws occur when data jumps over and below the moving average, giving many buy and sell signals without a real trend ever.

This indicator provides clear buy and sell signals. The histogram is plotted on a graph above and below a 0 line. When.

How to Use a Moving Average to Buy & Sell Stock. One of the easiest and most common technical indicators of stock.

Moving Average. Another simple sales forecasting technique is moving average. You can also use a weighted average to focus more on.

The moving average convergence divergence, or MACD, is one of many tools in the arsenal of a technical trader. Developed in 1979.

. point to buy and sell opportunities or. Moving Average Convergence Divergence. using standard deviations from a mean to evaluate.

Plot the moving averages on the chart by selecting them in the drop-down menus on the left-hand. About Stock Market Charts;.