How to trade penny stocks The Cody Word

Post on: 24 Июль, 2015 No Comment

By Cody Willard

In general, the rule to investing and trading penny stocks (any stock trading at less than $5 is typically considered a penny stock) is: Dont invest or trade penny stocks.

Because they usually have such small market caps and so few shares outstanding in the markets, they are easily moved higher for the short-term, often enabling insiders and their cronies to run up the stocks temporarily so that they can sell as many shares as they can while the stock is up. Lets talk more about this as theres always a ton of questions from everybody I know about such and such penny stock, and theres some easy flags to see when you should run from a particular penny stock.

A couple years ago, Id been invited by a friend to a ZZ Top concert at Beacon Theatre in NYC. My friend was friends with Billy Gibbons and Gibbons wife, who was into the markets and theyd invited me backstage to hang out after the show. We eventually ended up on ZZ Tops tour bus and in between me getting to pick a little bit on Billys 1960s Les Paul and talking about how much he loves the Inn of the Mountain Gods in Mescalero, NM, his wife and I were talking stocks. And then the conversation turned to a penny stock that she owned and I set the guitar down because I was pretty sure where this talk was about to go.

The stock she wanted to know about was a company that made water purification systems. At the end of the ticker was .OB, which means that it was either so small or had a rough enough history that it couldnt even get listed on a major exchange. Not all .OB stocks are trash, but most of them are, and thats a huge red flag already. This was before we had iPhones and I wasnt going to sit there and pull up the stock and research it for her on ZZ Tops tour bus anyway, so I told her Id email her some analysis.

Cross-posted from TradingWithCody.com . where I post all my personal trades and positions in real-time, an independent service not affiliated with Marketwatch.

A few months ago, I was at my dads farmhouse in Hondo Valley when a telephone company utility truck pulled down the drive. Our longtime neighbor hopped out and wanted to know if I had a minute to talk stocks. He wanted to know if I had any opinion about a particular penny stock that he had been told was ready to hop 10-fold. The company is involved in Internet streaming video compression. We were out on the farm so I told him Id take a look at it when I got back to the office and would shoot him an email. But again, hearing a casual investor/trader ask me about a penny stock was already a red flag for me.

Though the details of each of the above anecdotes are worlds apart a rock stars wife in NYC and a utility worker in rural NM, water purification and streaming video it was very easy for me to quickly determine that these were both screaming sells and that I wouldnt touch either stock with a ten foot pole.

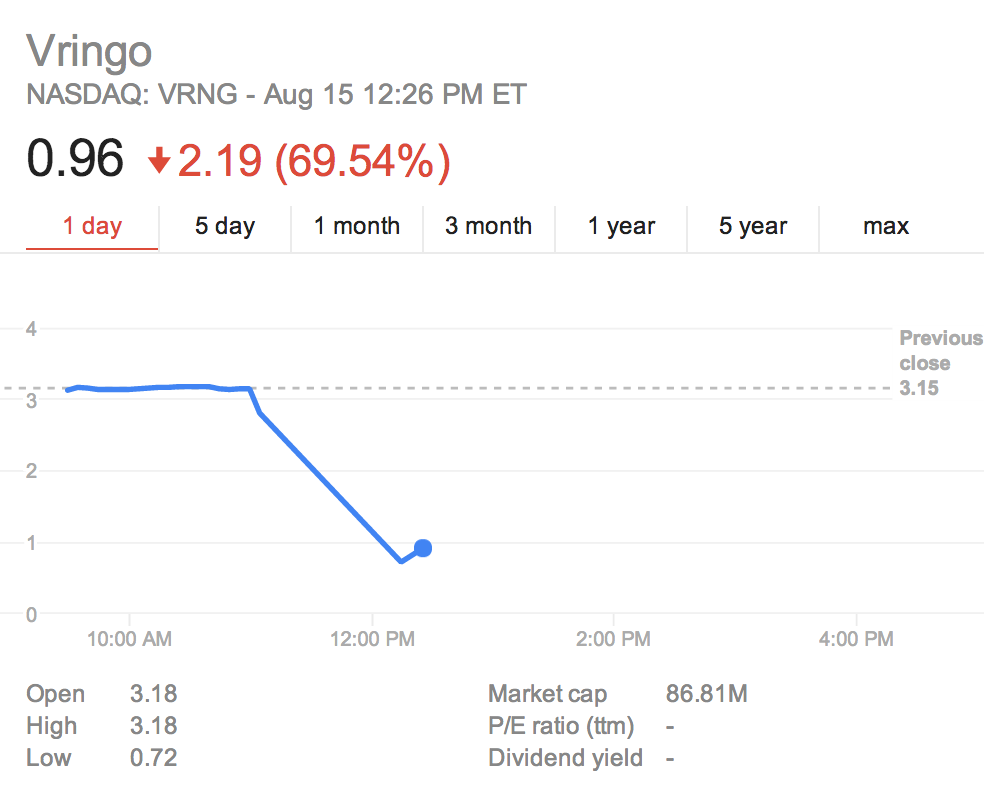

Both stocks collapsed after I warned my friends about them. In fact, the water stock has changed names and tickers since then and was trading under a dime at last look.

As for the other company, one red flag is a company that issues a plethora of news releases through popular financial sites, which this one did. Anyone, any company can buy a press release and Yahoo! Finance, MarketWatch and many the other news services will pick it up as part of their daily news feed. These releases may look like real stories but they are press releases and are labled as such. As press releases, they usually are syndicated through outfits like Marketwire, BusinessWire, GlobeNewswire, companies with wire in their names.

But, my neighbor asked, arent all those research reports saying that this stock and their technology are about to explode?

Sure, if those reports are from a reputable research shop. But are they? Have you ever heard of the companies issuing that research? And more to the point, are you sure that the company or its controlling shareholder didnt pay someone to write that research?

When you see press releases touting a research report touting a penny stock, I would run for the hills. I havent played the lottery once in my life, havent even contributed a dollar to the office funds when the jackpot is through the roof, but I would probably rather buy a lottery ticket than just about any small-cap (less than $250 million market cap) penny stock.

Heres an interview on my show from Fox Business that I did with a penny stock promoter from a few years ago:

I was intense, I know, but how many people like my friends in the anecdotes above have lost money when theyve bought a small-cap penny stock being promoted by someone being paid to promote it. Its hard enough making money in the market when your research resources arent biased. And few small-cap penny stock news releases and the research reports they tout are unbiased. My old pal Tim Sykes is making a career out of finding and shorting these kinds of promotional small-cap penny stocks. Thats probably the only way to make any money in penny stocks shorting them when theyre in the spiked promotional phase.

Be careful with your money. I have made a lot of money for a lot of people by buying revolutionary technology companies of any market cap size and shorting companies whose government-sponsored business models are failing. I dont know anybody whos made big money consistently ever in penny stocks. Dont even try.

Cody Willard writes Revolution Investing for MarketWatch and posts the trades from his personal account at TradingWithCody.com. At time of publication, Cody has no positions in the stocks mentioned.

The anti-Warren Buffett backlash Next

Time to panic about Apples parabolic chart