How to Trade EMini Futures

Post on: 10 Июнь, 2015 No Comment

How to Trade E-Mini Futures

How do you trade e-mini futures? You trade them the same way that you trade all futures contracts, in the technical sense. Hedge funds and the investors at large institutions trade the larger, full-fledged versions of the e-minis. This goes for index funds, too. So, e-mini index futures would also be based on indicators like the Dow Jones Industrial Average, the NASDAQ 100, the S&P 500, and the Russell 2000. You trade e-mini futures contracts, whether they are index futures or commodities, from your home via the Internet, just as you would do with full-fledged futures contracts.

The big difference is that e-minis dont require the large margin accounts that full-fledged futures do. E-mini futures are about one-fifth the size of their full fledged futures counterparts. E-minis are the perfect way for regular Joe investors to get in on the exciting and potentially lucrative action of day trading futures contracts.

But the second part of the question of how to trade e-mini futures involves the approach you should take-that is, the mental approach. What mentality should you have about them? What should be your attitude? What should be your motivation? Lets look at that.

First, enough cannot be said about the advantages of those low margin accounts for e-mini futures. Day trading stocks or full-fledged futures contracts has become just too expensive for many everyday traders because of margin requirements which may run into the many thousands of or tens of thousands of dollars. According to emini brokers, a trader can open an e-mini account with as little as $5,000.

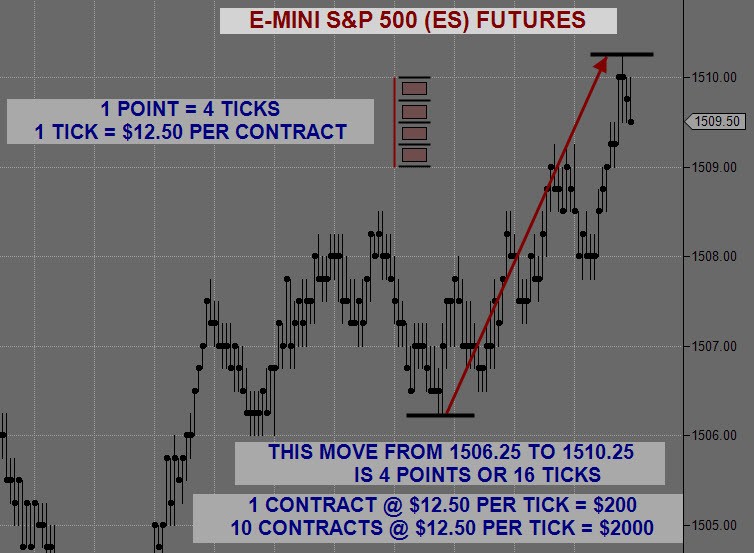

Leveraging is another prime motivating factor for the e-mini day trader. E-mini futures, for the price that they go for and for those low margin requirements, probably offer the greatest leveraging power of any investment. Trading oil stocks or even oil options, for example, cannot compete with the relatively large amount of moves that could be seen on just a few minutes movement with an e-mini oil futures contract. Roughly speaking, a five-point price movement with an e-mini equals a 200-point day with an individual stock purchase of the same underlying asset. Of course, this also means theres greater risk, but if you follow a disciplined system one could learn how to attempt to minimize risks and losses while seeking maximum profit potential.

In fact, e-mini futures trading is a simple market to follow. However, finding consistency is an ever-changing business mastered by few.