How To Trade Breakout Stocks

Post on: 18 Май, 2015 No Comment

What Are Break Out stocks

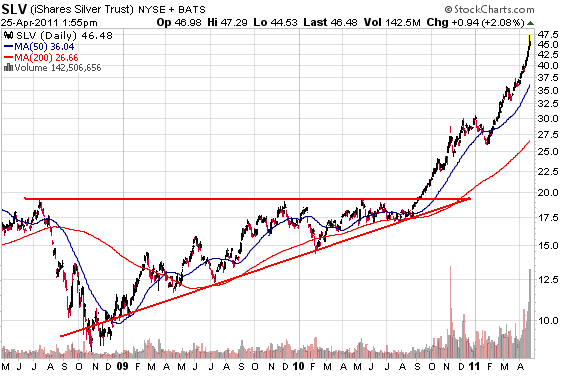

Break out stocks are the stocks that are making new highs, break out the previous resistance, or break the trend line. For short term traders, the breakout could be 5 minutes, a few days or a few weeks. For long term investors, the breakout could take a year or even many years. For example, if a stock is trading in the range of $7-$10 for the past 8 months and then all of a sudden, the stock is trading above $10, that’s a breakout.

Here are some breakout stocks.

Why are break out stocks profitable

Breakout patterns are profitable because there are a lot of technical traders out there. They are waiting anxiously at these break out prices. Many traders will have their limit orders ready to buy a stock when the stock makes a breakout. When these limit orders get executed, the stock goes further up because the demand is higher than usual. If a stock has been trading in the range for a very long time and it makes a breakout, the breakout is usually stronger and more profitable.

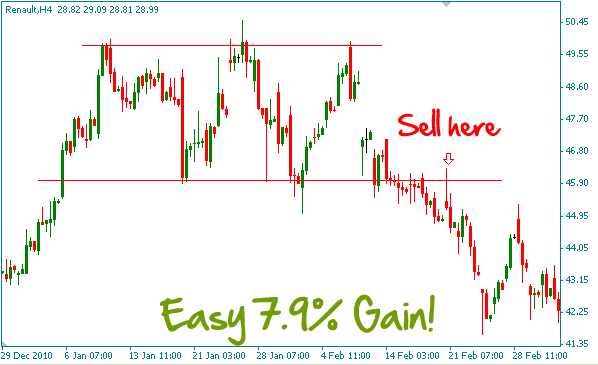

False Breakouts

While breakout patterns are extremely profitable, you must be aware of false breakout. Often, a stock would breakout of a resistance, pull back to the breakout price, and then drop below it. When that happens, you must get of the trade and cut your loss quickly. False breakouts often happen when the volume is low during breakout prices. In other words, not many traders are ready to buy this stock. Even worse, the breakout could be manipulated by market makers. Therefore, you want to make sure that the volume is higher than usual when a breakout takes place. If you look at the above charts, VRNG and ENOC, the trading volume is much higher during the breakout price than normal, that indicates strength.

Penny Breakout Stocks

Breakout works for penny stock as well as for blue chip stocks. Penny stock breakouts are high risk high reward while blue chip stocks are low risk low reward. A penny stock can easily double, triple or even quadruple in a short period of time, but it would never happen to blue chip stocks. At the same time, a penny stock can easily go bankrupt because they are cheap for a reason. When you swing trade, you must keep in mind that you are trading, not investing. You want quick profit and if the trade don’t work out, cut your loss quickly. Never fall in love with a stock as one fail trade can ruin your whole portfolio.

How To Find Breakout Stocks

There are a few ways that you can find these breakout stocks. You can manually search for these stocks, but that will take forever. You can also use our breakout stock screener to search for gapup stocks with high volume. Other ways to use our stock screener to find breakout stocks are the following.

1. The Volume Increase Stock Scan — allows you to search for stocks that are making moves in volume. It has a set of parameters that you can use such as volume is 100% greater than 5 day average.

2. Gap Up Stock Screener — allows you to search for gap up stocks. You can even set the gap up percentage for your filter parameter.

3. ADX Screener — the ADX allows you to search for stocks that are trending. The higher the number, the stronger the trend. The ADX indicator does not care whether the stock is in a down trend or uptrend.