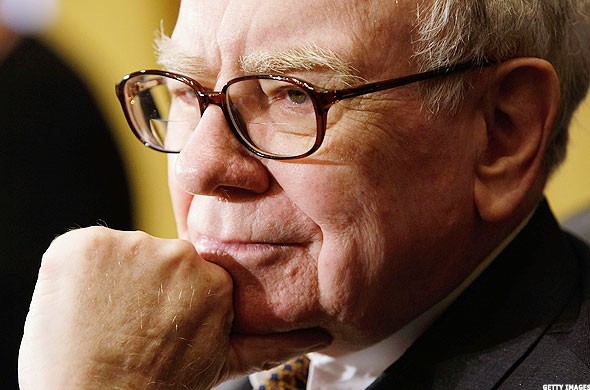

How to think like Warren Buffett Follow The Gain

Post on: 16 Март, 2015 No Comment

How to think like Warren Buffett

Its not like Warren Buffett has a crystal ball,infact the Berkshire Hathaway (NYSE: BRK.A) chairman and CEO would be quick to tell you he doesn’t know what the stock market is going to do tomorrow, next month or next year.

Although the man known as Americas greatest investor has said he doesnt believe youll make money trying to sell stocks on a daily or weekly basis, many investors closely follow Berkshires new investments, seeing them as a vote of confidence by Buffett.

But if Berkshire builds its stake in an agricultural equipment company such as Deere (NYSE: DE). should you buy it? Berkshire dumped shares in Exxon Mobil (NYSE: XOM) as oil prices plummeted. Should you have done the same?

Would I follow him? No. But would I read what he does? Absolutely, said New Jersey-based financial advisor Patricia Powell. His strategy is extremely long term.

The true value in investing like Buffett may not be achieved by trying to replicate the Berkshire portfolio, but instead, emulating his investment philosophy. Dont just pick stocks; choose businesses with strong balance sheets, experienced management and a long-term horizon.

The problem with many investors is they follow the herd mentality. When things are really looking dire is when you need to up your equity allocation, not when the market is overvalued, said Carolyn McClanahan, the founder of Life Planning Partners in Jacksonville, Florida. She says now is the time when investors need to protect their assets while taking some risk with equities.

Like Buffett, McClanahan said thinking long term is the key to growth for many investors.

Yet, the problem for the average investor is that something often derails their long-term strategy. A new bank survey found that one-third of Americans say they cant save more for retirement because they have just enough money for their day-to-day expenses.

In another survey of more than 2,000 Americans, TD Ameritrade found two-thirds of respondents had seen their long-term and retirement plans disrupted, most often due to a job loss or lower-paying job. The result: more than three-quarters of these disrupted Americans had to reduce their retirement savings by almost $300 a month on average. Before the disruption, they had been saving more than $500 a month on average.

It took those who are now back on track with their long-term retirement goals almost five years to get there, meaning they saved about $16,000 less than they otherwise would have.

So its not just that investors arent picking the right stocks; with less money being put away, many will have less opportunity to invest like Buffett.