How to tell if we re in a bull or bear market

Post on: 31 Май, 2015 No Comment

Tuesdays sell off has the bulls worried. Major U.S. indexes fell about 1.5 percent. Ten of the past 12 trading sessions saw swings of 100 points or more in the Dow Jones Industrial Average.

The list of worries ranges from the strengthening dollars harm to U.S. earnings, the end of quantitative easing, Europes weakening economy and the International Monetary Funds reduced forecast for global growth. I am far less certain that those headlines are anything more than the excuses for the selloff, rather than the cause.

Perhaps more significant than the headlines are these facts:

• This bull market is now more than 5 1/2 years old;

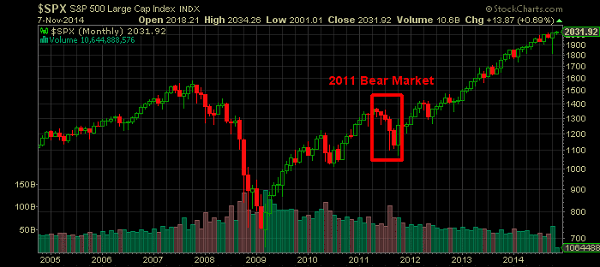

• The Standard & Poors 500 Index hasnt had a 10 percent pullback since October 2011;

• Small-cap stocks as measured by the Russell 2000 have fallen below their 200-day moving average for the first time since November 2012;

• Almost half of Nasdaq stocks are down 20 percent from their one-year highs, meaning they are already in a bear market;

• U.S. markets are down 3 percent from all-time highs;

What might this mean in coming months?

As I noted almost a year ago, “one of the best ways to identify a market that is exhausted is to look for divergences between Breadth (i.e. the number of advancing equities versus the number of declining ones) and Price (i.e. new highs). That is a concept that Paul Desmond of Lowry Research has researched and written about many times over the years.”

Healthy markets are deep and broad, with participation by small- and mid-cap stocks as well as big caps. That wide-ranging breadth we saw last year has narrowed a good deal. This is a significant warning sign that the bull market is getting tired, and may be coming to its natural end.

So far, each side in the bull-bear debate has been quick to declare victory. Doug Kass of Seabreeze Partners has been calling this “The Ali Blah Blah Top,” suggesting that the Chinese tech company’s monster initial public offering is a signal that markets have gotten too frothy. He notes that he won’t be initiating any new long positions “unless share prices drop meaningfully.”

The flip side of the argument comes from bulls such as Holland & Co. Chairman Michael Holland. He suggests that the easy part of the bull market, driven in part by the Federal Reserve, is ending: “The training wheels are coming off, the lack of volatility is ending, the ‘New Normal’ is ending, and the ‘True Normal’ is returning to markets.”

The tricky part of all this is how quickly fortunes can reverse. What looks like a strong bull market on the surface, but with weak internals, can easily slip into a 10 percent correction. And sell-offs that look like the start of something ugly can exhaust themselves, drawing in fresh buyers and under-invested money managers.

What I find so surprising is just how much angst this retreat from all-time highs has caused. The S&P 500 index peaked at 2,019.26. As of yesterday’s close of 1,935.10, it was down less than 100 points, or about 4.2 percent. For shorter-term traders, the weakening internals were already the source of anxiety.

However, I would suggest that investors who have a longer time horizon put this into broader context. Last year’s torrid gains were too much, too fast. The 30 percent gain in the S&P 500 was hot, but the real fire was in the small-cap indexes. The Russell 2000 was up 37 percent, while the Russell Growth Index was up a blistering 42 percent. This seems more like a few years gains, not one.

I suspect that 2014 may be a year of consolidation and digestion, as markets in 2013 got way ahead of both the economy and earnings.