How to start contributing to a Roth IRA

Post on: 1 Август, 2015 No Comment

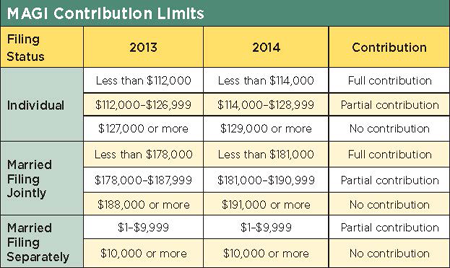

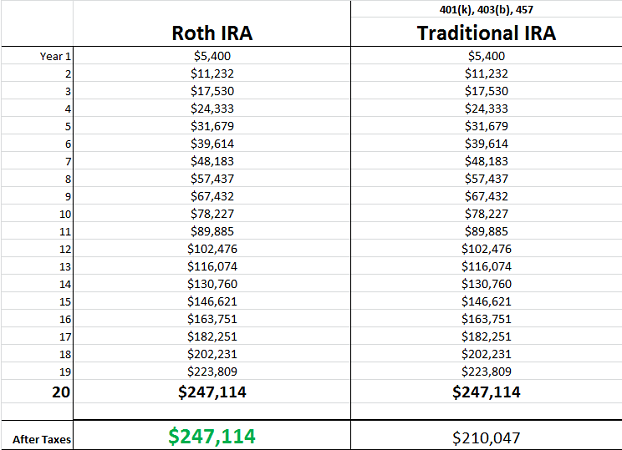

Out of all my investments, the Roth IRA is my favorite account. Why? It is because I won’t have to pay any tax on the gains in this account. I don’t plan to withdraw until I’m 60 and not having to pay any tax or penalty at that point is a plus. See the end of the post for the qualification flow chart. Additionally, if we really need some money due to an emergency, I can withdraw the contribution with no penalty. The Roth IRA will also give us more tax strategy options when we finally withdraw from our retirement funds. We can avoid the higher tax bracket by mixing the withdrawals from regular and Roth IRA.

I was assuming that everyone knew how to contribute to a Roth IRA, but recently I found out that some of our readers would like more information. So today I’m going to go over how to start contributing to a Roth IRA.

Save up some money

Before investing in an IRA, you should have enough money to cover an emergency. Most experts recommend enough funds to cover 3-6 months of expenses, but even $1,000 would be helpful. Once you have an emergency fund. then you can save up some cash to put toward the Roth IRA. You probably would want to save up at least $500 to invest in the Roth IRA before opening a new account.

*Note: you can only invest earned income in the Roth IRA.

Decide where to open a Roth IRA account

Most financial institutions offer some kind of Roth IRA. Big banks like BofA offer CD and Money Market IRA options. These are very safe, but the rates are quite low. Personally, I don’t see the point of investing in these accounts. The big advantage of the Roth IRA is you won’t have to pay tax on the gain. If you are only making 1% (current rate) a year from your investment, the tax saving will be very small. I think it’s better to take a bit more risk and invest in the stock market with a brokerage especially if you are young and have over 20 years before retirement.

How to open an account at a brokerage

You can open an account at any brokerage, but I recommend a low fee online brokerage. I use Firstrade because their fees are low. I have been pretty happy with them so I don’t feel the need to change brokerages. Their customer service is also quite good. I have been able to get help on the phone whenever I need it. New investors should pay close attention to the mutual fund transaction fee when opening a new brokerage account. The mutual fund transaction fee is usually quite a bit higher than the stock transaction fee. For example, Ameritrade charges $49.99 to trade no load mutual funds. Firstrade charges only $9.95. It is still one of the lowest mutual fund transaction fees I’ve seen.

Fees at Firstrade

- Stocks and ETFs: $6.95

- Mutual funds: $9.95 for No-Load funds

Opening an account

You will need to gather the following information to open a new account.

- Social Security Number or Taxpayer ID Number

- Employers Name and Address

- Date of Birth

- Bank account and routing number (if funding electronically via ACH)

- For IRAs: Name, address, social security number, date of birth of beneficiary(ies)

Now you are ready to open a Roth IRA. Here is the first page of the application.

Select Roth IRA. I would skip Options for now. You can always add any later if you’d like. The easiest way to fund your account is through electronic funds transfer. After this, just fill out the forms. It should take around 10-15 minutes to do so.

Funding your account

You can set up auto deduction while filling out the forms or you can do it later as well. I like to transfer the maximum contribution amount ($5,500 for 2013) early in the year and invest it when there is a small pull back. For many young people, this is a lot of money to invest at once. It might be easier to set up an automatic deduction and invest only $200 per month to start.

What to invest in

For beginners, I recommend investing in low fee mutual funds or ETFs. If you add to your investment consistently over a long period of time, you should be able to make a good profit. Firstrade has a list of 10 commission-free ETFs that you can start with. If you can only add $200/month to your investment, these are great because you don’t have to pay the usual $6.95 commission to trade.

One simple strategy is to put the initial amount in IVV, IShares S&P 500 Index fund, and keep adding to it every month. Once you learn more about the stock market, you can trade these in for no fee and buy something else.

How to trade Stocks/ETFs at Firstrade

You can log on to Firstrade and click on the Trading tab up top. Then click on Stocks/ETFs right below the Trading tab. Once you are there can can buy or sell stocks and ETFs. In this example below, I asked to buy 2 shares of IVV at the price of $147.77. I can hit the preview button to see how much money it would cost or just hit the send order button to send the order.

Why I love the Roth IRA

Let’s summarize why I love the Roth IRA.

- No tax on the capital gain

- I can withdraw the contribution at any time with no penalty

- More tax options

If you don’t have a Roth IRA account yet, you should make it a priority to open one. The Roth IRA is a great deal for young folks because over 30-40 years, the earnings can easily grow larger than the original contribution. Why pay tax on these earnings if you don’t have to? Let me know if I can answer any questions. I hope this is helpful for some readers. You can see more retirement advice for young folks here.

Here is the distribution flow chart from the IRS if you want to learn more about withdrawal.

Distribution flow chart