How to Spot Institutional Buying and Selling

Post on: 9 Ноябрь, 2016 No Comment

by Daniel Peters

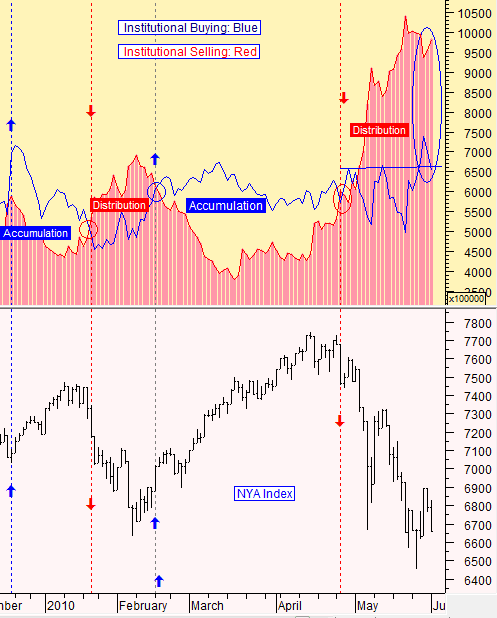

It makes sense to time stock purchases and sales with the ‘big money.’ These financial giants have heavy financial clout! Hitching a ride on their trading bumper will generally translate into dollars and cents.

Institutions are Accumulating Which Stocks?

Institutions need to keep their purchases quiet so as to quietly accumulate shares at the best possible price. One tactic to maintain a good share price is to buy shares on market down days. Or they may buy a certain amount of shares and then sell a portion to drive the price back down. Once they have accumulated the desired amount, the institution may quickly drive the price up with a large purchase to notify other investors that it is time to trade.

A reduced float with increased buying will lift the stock nicely. To find out which publicly traded companies institutions have been heavily investing into last month, investors can use the MoneyCentral link here.

Selecting the Right Stock

Illiquid and low capitalization stocks usually have increased volatility which raises risk. Among the stocks listed at MoneyCentral as having increased institutional support, traders should generally pick the ones with 100 million market capitalization or more. Also, many will choose to weed out the stocks that are below five dollars per share.

Following Institutional Trading with Precision Timing

If an investor simply bought shares based on the provided institutional ownership list, he may be disappointed. Buying wantonly even with good stock picks is not recommended because the profit boat may have already left the dock. Purchasing shares at inflated prices is not a wise strategy even when following the market giants.

These are simple Do Not Buy If rules:

• The boat may have left if the stock rocketed up 20% or more in the last few trading days.

• Share price should be within 20 to 25% of the 50 day moving average.

By using this link and entering in the desired stock from the MoneyCentral institutional ownership list, investors will be able to see if the share price is close to the 50 day moving average. The red line is the 50 day moving average and the blue lines represent a 20% envelope above and below the average. When the price is far above the upper blue line, a wise trader will wait for a better entry point.

Sell the Shares When This Happens

There are a few different signals to bail on a trade. These are some easy to follow exit rules:

• When the share price drops ten percent from his purchase point, the investor should sell.

• If net institutional selling occurs, the investor should likewise liquidate his position.

• For a profit point, the trader could have a trailing stop-loss of five to ten percent.

Trading With the Institutional Giants Strategy

The investor who follows institutional support can profit from having a heavy hitter on his side, without the liquidity problems large firms may have. The key is to pick the right stock early on, and expertly time the purchase and sell orders to maximize gains. As is true with all strategies, problems do occur, and having a stop-loss in place will keep wise investors trading for a very long time to come.