How to Sell on an ExDividend Date

Post on: 16 Март, 2015 No Comment

Instructions

Select stocks for trading using the dividend capture strategy. The stocks should pay regular, relatively high dividends. The list should have staggered dividend dates. The more dividends you can earn during the year, the higher your net profit will be. Most stocks pay dividends four times a year. With dividend capture, you may be able to collect eight or more dividends from different stocks.

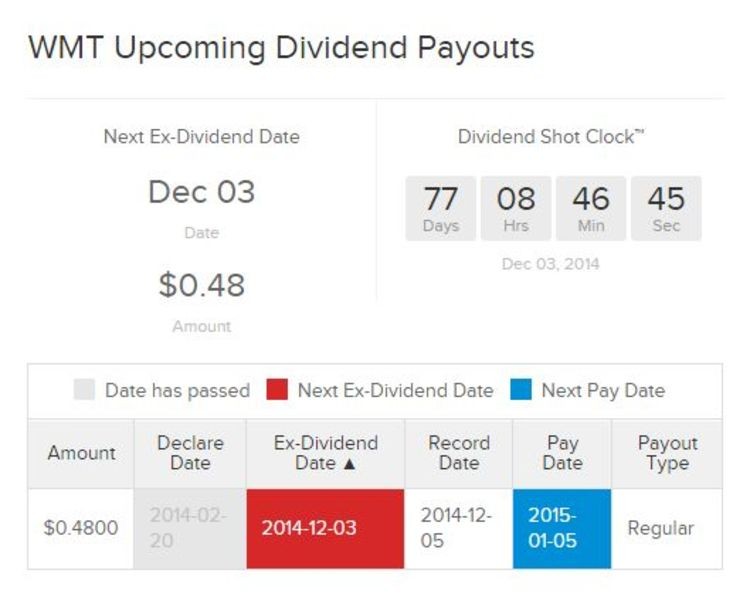

Calculate the ex-dividend date when you have notification of a pending dividend payment. The ex-dividend date will be two business days before the record date for the dividend. Investors who buy shares on or after the ex-dividend date will not receive the dividend.

References

More Like This

What Happens if You Sell a Stock Before the Dividend Day?

You May Also Like

If an investor owns a stock on the ex-dividend date, the investor is entitled to receive the dividend and it will be.

Selling stock after the ex-dividend date is part of a stock trading strategy referred to as dividend capture. Most dividend-paying stocks make.

Some corporations elect to share their profits with shareholders in the form of dividends. The board of directors decides whether a company.

On the ex-dividend date, the share price of the dividend-paying stock will decline by the amount of the dividend. For example.

There are several dates of importance concerning the sale of stock on the ex-dividend day. This important trade date determines the last.

An investor can consult multiple sources that provide a list of stock prices as well as dividend dates. Some newspapers publish stock.

Buying stock before the ex-dividend date is easy as long as basic rules are followed. The day count is important so that.

An ex-dividend stock trades on or after the ex-dividend date (ex-date). At this moment, the person owning the stock on the ex-dividend.

. ex-dividend date, date of record and payable date. What Happens if You Sell Stock After the Dividend Date but Before.

The ex-dividend date is the day two days before the dividend-record date of a company's stock. Only shareholders who own shares on.

Each dividend a company pays is announced in a dividend declaration by the corporation board of directors. The dividend announcement will included.

The stock market strategy called dividend capture is focused on buying and selling shares of stock around the ex-dividend date. The goal.

The term ex-dividend describes a very. the buyer is not entitled to that dividend but anybody that owns the stock up.