How to Screen for Mutual Funds

Post on: 25 Апрель, 2015 No Comment

Screening for Mutual Funds

The last time I looked, the overall market, as measured by the S&P 500 index was still up slightly for the year.

But that news would be of little consolation to holders of MGM Mirage, Continental Airlines or Callaway Golf. As of last Wednesday, these, along with more than 160 other stocks, had dropped at least 50 % so far this year.

By contrast, 7,893 of the 10,161 domestic stock mutual funds tracked by Morningstar (www.morningstar.com ) had racked up returns ahead of the S&P 500 so far this year.

Those figures illustrate the advantage of owning mutual funds. Most funds hold dozens, if not hundreds of stocks, so you get automatic diversification. One or two disasters don’t move the needle on the entire portfolio by much.

Here’s a screen for pinpointing worthwhile mutual fund candidates. If you’re not familiar with the term, screens are programs you can use to search out funds meeting your selection criteria. I’ll use Morningstar’s free and user-friendly fund screener to demonstrate the process. From Morningstar’s homepage, select Funds and then click on Fund Screener (Tools menu).

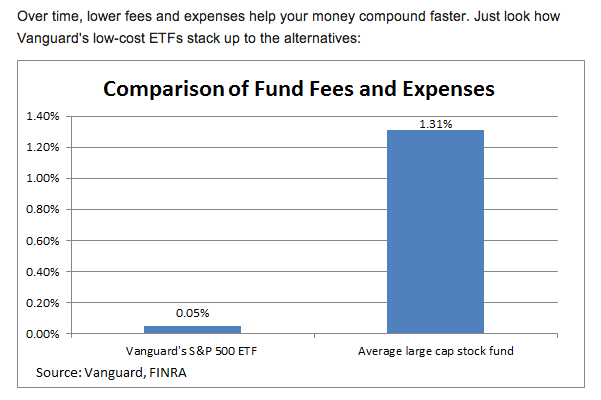

Say No to Loads

Start by selecting “No-load funds only” from the “Load Funds” dropdown menu. Loads are sales commissions used to compensate financial advisors who select mutual funds for their clients. The professionals deserve to be paid for their work, but there’s no point in paying the fee if you are selecting funds on your own.

Required First Purchase

Next, use the “Minimum Initial Purchase” menu to specify $3,000. That means your first purchase of each fund must be at least $3,000. Usually after your first purchase, you can add to holdings in a fund in much smaller increments. Other choices range from $500 to $10,000. Pick the amount that suits your needs.

Star Rating

The ideal mutual fund would deliver market-beating returns with minimal price swings, which is termed “volatility.” Most analysts equate volatility to risk.

Morningstar’s Star rating compares a fund’s historical returns to its historical volatility. The ratings run from one to five stars, where five is best. The funds with the highest return vs. volatility ratio in each category (e.g. value, technology, energy) earn five stars. While a five-star rating doesn’t guarantee future performance, it’s a good starting point.