How to Scan For Stocks on

Post on: 4 Июнь, 2015 No Comment

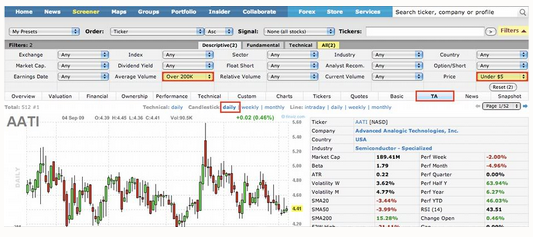

Stock scans are easy to write and absolutely essential to swing trading. You need to be able to find stocks with the exact setup that you are looking for. On this page, I am going to show you how to do it using StockCharts.com .

Note: You will need to sign up for the EXTRA! package at StockCharts.com if you want to create and save custom scans.

How to scan for TAZ setups

After you get an account set up with StockCharts.com. log in to the members area and scroll down to the middle right side of the screen where it says, Create New Scan.

After you click on that you will be taken to the scanning page. Scroll down to the bottom where it says, Advanced User Interface. Click that button.

Next you will see the scan expression box. Copy and paste the following scan into the scan expression box on StockCharts.com:

[type = stock] and [country = us] and[daily ema(60,daily volume) > 300000] and

[daily close > daily ema(30,daily close)]and

[daily close daily sma(200,daily close)]and

[weekly sma(10,weekly close) > weekly ema(30,weekly close)]and

[close >= 5]

After you have copied and pasted the scan it will look similar to this.

I’ve cut off some of the picture above so that it wasn’t too big but I think you can see how it will look. When you have finished, click on the Add/Modify the Current Scan link at the bottom.

A window will pop up, then save it using something descriptive. Since this scan looks for stocks on the long side that have pulled back into the TAZ we will name it TAZ-Long.

Now go back to the members area of StockCharts.com and select the scan from the drop down box.

After that click Run Scan. That’s it! You now have a whole list of TAZ stocks. Now all you have to do is go through these stocks and pick out the best looking setups and add them to your watch list.

[type = stock] and [country = us] and[daily ema(60,daily volume) > 300000] and

[daily low > yesterday’s daily low] and

[yesterday’s daily low > 2 days ago daily low] and

[SMA(10, close) daily SMA(10,daily close)]and

[daily close 20.0]and

[close >= 10]

What does this stock scan mean?

Can you tell what the components of the scan mean? In the first line we are looking for US stocks with average volume of at least 300,000. The next two lines we are finding stocks that have consecutive lower highs (or lows). Then you have the moving average lines in the scans that find stocks that have moved into the TAZ.

We then use the ADX Indicator to make sure we find stocks that are trending. The next line makes sure that the stock is in an uptrend on the weekly chart. Finally we pick stocks with a closing price of at least 5 dollars on the long side and at least 10 dollars on the short side (don’t trade penny stocks!).

TAZ moving average crossover scans

There is another scan that I use to identify stocks that are at the beginning of a trend. It is a moving average crossover scan. On the long side, it identifies stocks where the 10 MA has just crossed above the 30 EMA. On the short side, it identifies stocks where the 10 MA has just crossed below the 30 EMA

Here they are.

TAZ Cross Long Setups

[type = stock] and [country = us] and [daily sma(20,daily volume) > 300000] and

[daily sma(10,daily close) crosses daily ema(30,daily close)] and

TAZ Cross Short Setups

[type = stock] and [country = us] and [daily sma(20,daily volume) > 300000] and

[daily sma(10,daily close) = yesterday’s daily ema(30,daily close)]and

[close >= 10]

How to find the strongest stocks

Sometimes you might just want to find the strongest stocks that are trending up. This is useful for building a watch list. Here is the scan that I use: