How to Read a Corporate Balance Sheet DF DVN AZO DNB HCA Investing Daily

Post on: 3 Июнь, 2015 No Comment

By Jim Fink on June 18, 2013

Investors love story stocks companies operating in exciting industries on the forefront of innovation and disruptive new technologies. Internet stocks were all the rage in the late 1990s, but many crashed and burned when the sober reality of their current corporate financials clashed with stratospheric valuations based on dreams of future unlimited riches. Hot industry sectors today include social media. 3-D printing. big data. and alternative energy/clean tech .

But just as Internet companies Pets.com and Webvan.com turned out to be investment disasters despite the success of the Internet, so too will many companies in the todays new and exciting industries also fail despite the success of the industries as a whole. As Wharton finance professor Jeremy Siegel wrote in his 2005 classic investment book The Future for Investors. Why the Tried and the True Triumph Over the Bold and the New . stock bubbles caused by investor excitement over new technologies always end badly:

Although a disaster for investors, there is a silver lining to these euphoric episodes. They have marked, and perhaps encouraged, many of the advancements that have occurred in the last three hundred years, from the canals and railways to the automobile, the radio, the airplane, the computer, and the Internet.

But history proves that it is best to let others fund these innovations. Originality in no way guarantees profits. In fashion, you may want to buy what everybody else is buying. In the market, such impulses are a road to ruin.

Although some initial public offerings (IPOs) are great investment successes (e.g. Cisco Systems, Dell, Microsoft, Home Depot), the vast majority are disappointing because the issuers (i.e. sellers) decide when to go public and they rationally do so when their companies are experiencing peak profitability and/or when investor enthusiasm for an industry fad is at its highest.

Sellers are smarter than buyers. Consequently, buyers need to be educated. Knowledge is power and the best way to become knowledgeable is to read a companys financial statements. The Securities and Exchange Commission (SEC) requires all publicly-traded companies to publish quarterly financial statements so that investors have a fighting chance against the sellers.

Balance Sheet is Most Important of Three Financial Statements

The main three financial statements produced by publicly-traded corporations are:

- Balance sheet

- Income statement

- Statement of cash flows

All three are important in understanding a companys financial health, but the balance sheet is arguably the most important. Fund manager Richard Bernstein, who used to work at Merrill Lynch as its chief investment strategist, wrote a parting letter in March 2009 soon before he left the firm. The letter consisted of 10 market guidelines he had learned during his 20 years as a stock-market analyst. Number 6 on the list was:

Balance sheets are generally more important than income or cash-flow statements.

Fund manager Bruce Berkowitz also favors the balance sheet. stating (video timestamp 13:25 to 15:15):

There are less ways to cheat on a balance sheet than an income statement.

The reason that the balance sheet is more important is because it offers a reflection of the entire company a full body scan in medical terms. Although it is a snapshot of the companys condition at a particular point of time, it is a complete snapshot and represents the accumulation of total wealth over several years. Most investors look first at the income statement (i.e. earnings), but earnings are nothing more than the comparison of two balance sheets and calculating the change in the balance sheets shareholder equity (i.e. retained earnings) plus dividends paid. The total value of a companys shareholder equity (i.e. book value) is more important than one years change in that equity.

For example, Dean Foods (NYSE: DF) earned $3.33 per share last year whereas Devon Energy (NYSE: DVN) lost $4.85 per share. Based on their income statements, a share of Dean Foods must be more valuable than a share of Devon Energy, right? Wrong Dean Foods trades at $10.31 and Devon Energy is trading more than five times higher at $55.00. The reason is that Dean Foods has a book value per share of only $4.57, whereas Devon Energy has a book value per share of $48.54. A years worth of incremental wealth (earnings) is much less important than the wealth that a company has accumulated over its entire lifetime (book value).

Two Ways to Value a Company

Legendary value investor Seth Klarman, in his out-of-print classic Margin of Safety , wrote that there are two main ways (pp. 133-34) to value a publicly-traded company: (1) as a going-concern, in which case you perform a discounted cash flow analysis, or (2) as a liquidation, in which case you look at the balance sheet and calculate what would be left over for shareholders after all assets have been sold and all liabilities paid off.

Remember from accounting class:

Assets = Shareholder Equity + Liabilities

A balance sheet has two columns and can be thought of as the sources and uses of capital. The left-hand column consists of the companys assets which are the uses of capital. The right-hand column consists of shareholder equity (capital invested by owners of the company) and liabilities (capital owed to non-owners that must be paid back at some point) which are the two sources of capital. The total dollar amount of each column must equal the other column because each source of capital is used for something (even if it is just cash savings).

Shareholder equity also known as book value should always be examined when evaluating the value of a companys common stock in a liquidation valuation. If the stock price is below the book value per share, the stock is typically considered undervalued. A stock price above book value can also be undervalued if future cash flows/earnings are significant enough, however. But a bird in hand (book value) is more certain and consequently worth more than birds in the bush (potential but unrealized future cash flows).

When performing a discounted cash flow (DCF) analysis in a going-concern valuation, the largest component of a companys value is the terminal value the calculated value of all discounted future cash flows a company is expected to generate in perpetuity after it has fully matured and reached a stable growth rate in line with the general economy. The terminal value is always a large proportion of total value (slide no. 48) because perpetuity is a long time compared to a 10-year model. Theoretically, the current stock price should equal the present value of all future cash flows which is larger than the terminal value but the terminal value can be larger than the stock price if the stock is currently undervalued (i.e. the market is inefficient).

Do not add current book value in the DCF valuation because the DCF analysis assumes that the company is a going concern forever and assets will never be liquidated. However, because the company could unexpectedly fail sometime in the future and the future cash flows may not materialize, it still is a good idea to consider current book value when investing in a stock.

Keep in mind that book value is based on accounting cost, not current market value, so if assets have appreciated in value since their purchase, book value will understate true value. This explains why stock prices often are higher than book value per share. Due to the concept of conservatism, accounting rules do not allow companies to increase asset values if their current market value is higher, but companies are required to reduce asset values if current market value is lower (through impairment charges). Consequently, when a stock is trading below book value especially tangible book value (excluding intangible assets like goodwill, patents, and trademarks), it is a pretty good indication of undervaluation.

Two Ways to Assess Bankruptcy Risk

Liquidity measures a companys ability to survive in the short term by paying back current liabilities on time. Assets are either current (likely to be converted to cash within 12 months) or non-current (not likely to be converted to cash within 12 months). Similarly, liabilities are either current (likely to be paid in cash within 12 months) or non-current. In general, companies are stronger and safer if they have more of their assets current and more of their liabilities non-current. An important balance-sheet metric is the current ratio, which measures the amount of current assets divided by the amount of current liabilities. Strong companies typically have a current ratio of 2 or greater. Even more conservative short-term metrics of liquidity are the quick ratio which includes all current assets except prepaid expenses and inventory (inventory often cannot be sold or must be marked down) and the cash ratio which includes only cash and cash equivalents like marketable securities (excluding prepaid expenses, inventory and accounts receivable/credit sales). Quick ratios should be at least 1.0 and cash ratios should be at least 0.5 .

Solvency measures a companys ability to survive in the long term and compares shareholder equity versus total debt. What debt-to-equity ratio is considered safe varies by industry, but generally debt should be no higher than 50% of equity which equates to 33% of total capital (debt plus equity). This ratio doesnt include any consideration of a companys cash-flow generation ability and is therefore a conservative measure of survivability. The thinking is that even if a company doesnt generate any cash flow to service debt interest, if shareholder equity is sufficient to buy back all of the debt that has been issued then the company will not go bankrupt. Furthermore, some debt contains financial covenants that require the debtor to pay back the debt in full if they are violated. If accelerated repayment of both interest and principal is triggered, merely having enough cash flow to cover interest payments will be insufficient to avoid bankruptcy.

A less-conservative solvency ratio measures a companys ability to cover debt interest expense with cash flow: the EBITDA-to-Total-Interest-Expense ratio. EBITDA stands for earnings before interest, taxes, depreciation, and amortization and is a measure of cash flow (albeit one that ignores taxes, working capital changes, and capital expenditures ). Generally, an EBITDA ratio of greater than 2.5 times interest expense is needed for safety. The 2.5 level may seem excessively high, but it takes into account the fact that debt payments are fixed and certain, whereas EBITDA is variable and uncertain. Consequently, you want a cushion in case business conditions temporarily deteriorate and EBITDA declines.

Negative Shareholder Equity Companies Can Have Value, Too!

There are many examples of publicly-traded companies with negative shareholder equity that retain value. For example, the natural cosmetics company Bare Escentuals was laden with significant debt at its 2006 IPO and had a negative book value from 2006 through 2008 and yet had enough cash-flow generating capacity to dig itself out of a hole and score an $18.20 per share takeover offer from Japanese company Shiseido (OTC Markets: SSDOY) in 2010. Current examples of negative-book-value firms include solid companies like AutoZone (NYSE: AZO). Dun & Bradstreet (NYSE: DNB). HCA Holdings (NYSE: HCA). and Dominos Pizza (NYSE: DPZ). In these cases, the negative equity was self-imposed based on significant share buyback activity (treasury stock is subtracted from shareholder equity) or incurring debt to pay cash dividends.

In conclusion, the balance sheet provides two separate types of useful investment information. First, by looking at a companys book value per share one can get a sense for whether the current stock price is expensive or cheap. Second, by calculating some liquidity and solvency ratios using assets, liabilities, debt, and shareholder equity, one can assess the riskiness of a company and the probability that it will go bankrupt if business conditions deteriorate and future cash flows are less than expected.

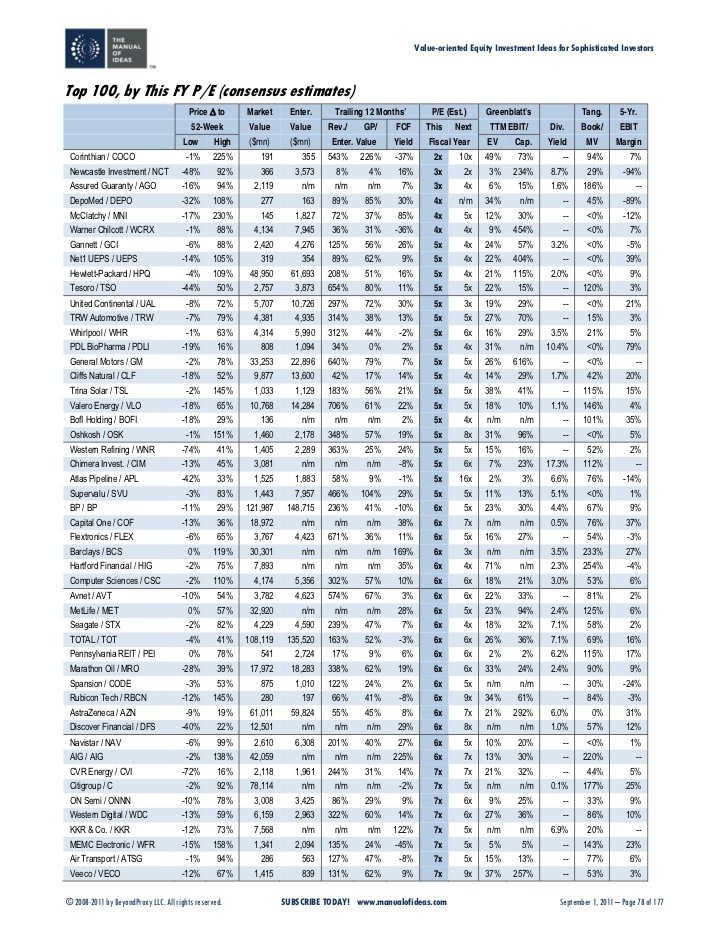

Stock Screens

Using my trusty Bloomberg terminal, I screened for small and mid-cap stocks that have strong and weak balance sheets. Stocks with strong balance sheets are low-risk and may be good candidates to buy, whereas stocks with weak balance sheets are high-risk and may be good candidates to avoid or short.